- United States

- /

- Oil and Gas

- /

- NYSE:EOG

EOG Resources (NYSE:EOG) Highlights Water Re-Use Initiative With TETRA Technologies

Reviewed by Simply Wall St

TETRA Technologies, Inc.'s recent pilot project with EOG Resources (NYSE:EOG) highlights its Oasis TDS desalination solution for re-using produced water from oil and gas wells. While this initiative underscores a commitment to sustainability, it may not have provided a counterweight to the broader market volatility driven by recent tariff adjustments and economic uncertainty. With the market remaining flat over the past 7 days and the Dow Jones experiencing bouts of volatility due to tariff-related developments, EOG's 12% weekly price dip aligns more with external market pressures rather than company-specific news.

Find companies with promising cash flow potential yet trading below their fair value.

TETRA Technologies' collaboration with EOG Resources on the Oasis TDS desalination solution may support the narrative of sustainability and operational efficiency improvements. While such initiatives align with EOG's focus on cost reduction and enhanced cash flow, the immediate impact on revenue and earnings forecasts remains indirect. Instead, these efforts might bolster EOG's overall operational strategy and competitiveness in key markets over time, even amid broader market volatility.

Over the past five years, EOG Resources has delivered a total shareholder return of 261.33%, showcasing resilience and growth despite a challenging environment. In the more recent one-year period, however, EOG underperformed both the US market and the oil and gas industry, which returned 0% and 18% declines, respectively. This discrepancy highlights short-term pressures likely linked to external factors rather than internal weaknesses.

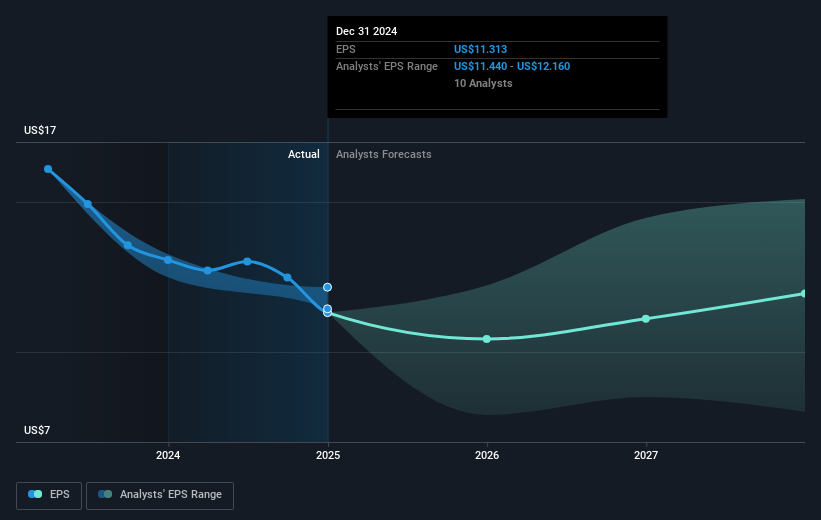

Today's share price of US$104.96 represents a substantial discount to the consensus analyst price target of US$139.30, suggesting potential upside as the market reassesses EOG's long-term outlook. However, analysts' forecasts assume gradual revenue and earnings shifts influenced by operational and market dynamics rather than immediate transformational changes. The continued strategic focus on international markets and infrastructure development remains pivotal in shaping future revenue growth and profitability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EOG Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EOG

EOG Resources

Explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas in producing basins in the United States, the Republic of Trinidad and Tobago, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion