- United States

- /

- Oil and Gas

- /

- NYSE:DVN

Is Now the Right Time to Reassess Devon Energy After a 4.4% Share Price Jump?

Reviewed by Bailey Pemberton

If you have been eyeing Devon Energy’s stock, you are not alone in wondering whether now is the right moment to make a move. Over the past week, Devon’s share price jumped 4.4%, hinting at renewed optimism among investors. That is a stark turnaround from a month ago, when the stock was down 3.0%. While the one-year return of -13.0% might make some uneasy, it is hard to ignore a massive 413.1% gain over the past five years. Such swings show just how quickly sentiment and fortunes can shift in the energy sector.

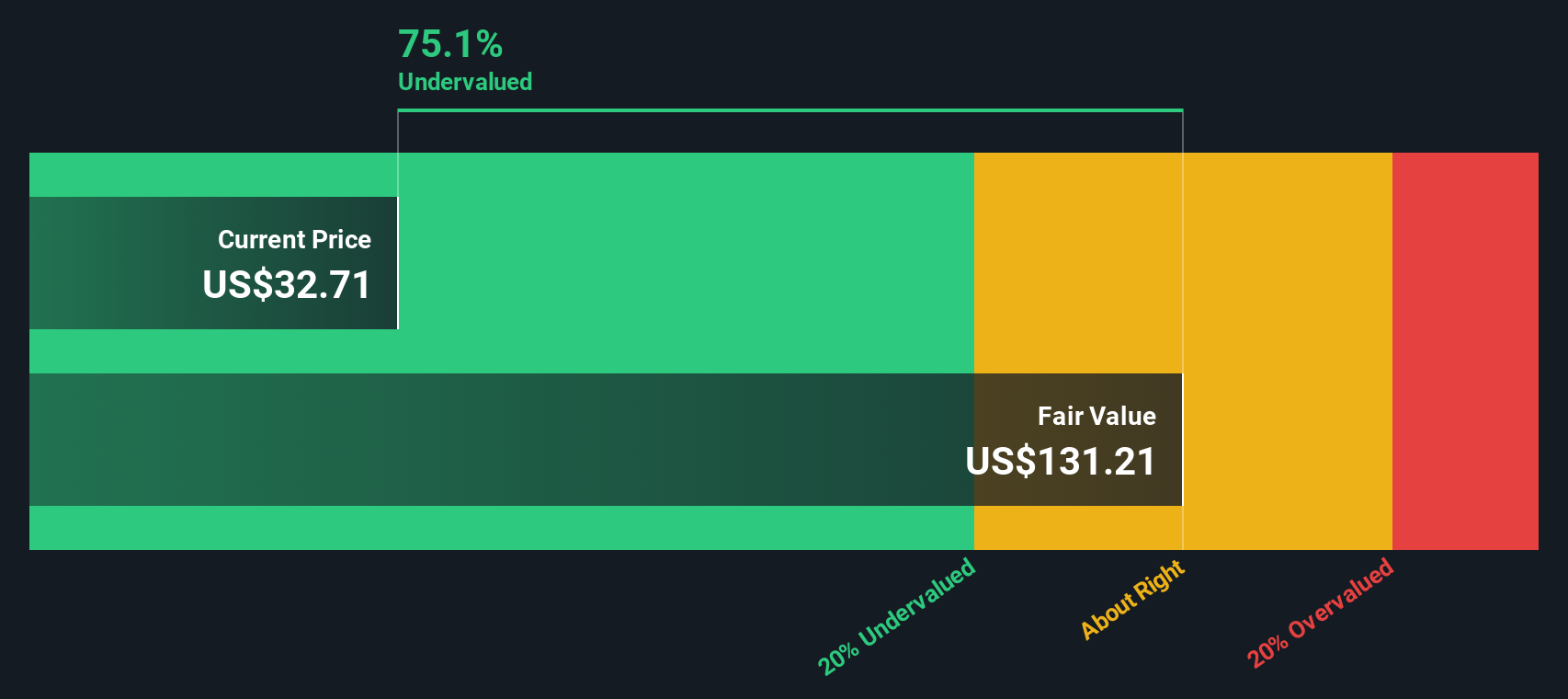

Recently, broader energy market factors like shifting crude oil prices and speculation about future supply have played a key role in Devon’s movement. As economic signals remain mixed, investors appear to be weighing both upside potential and long-term risks. This is partly why the company’s valuation score currently stands at 5 out of 6, which suggests Devon is undervalued in nearly every metric analysts care about.

But what does that score really tell us? In this article, we are going to break down its valuation from several different angles so you can make an informed decision. Before we finish, we will explore an even better approach to understanding what Devon Energy is truly worth in today’s market.

Why Devon Energy is lagging behind its peers

Approach 1: Devon Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and discounting them back to present value. This approach helps investors assess what a business is worth today, based on expected earnings over the coming years.

For Devon Energy, the latest reported Free Cash Flow sits at $926.9 Million. Analyst forecasts anticipate strong growth, with projected Free Cash Flow reaching $3.66 Billion by the end of 2029. Estimates up to five years out are based on analyst opinions, while projections further into the future are carefully extrapolated from current data.

Applying these projections, the computed intrinsic fair value per share using the DCF method is $125.39. Compared to the stock’s recent trading price, this model finds Devon Energy to be trading at a 73.3% discount, signaling a substantial undervaluation.

In summary, despite recent stock volatility, the DCF method highlights a strong case that Devon’s shares may be significantly undervalued given its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Devon Energy is undervalued by 73.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Devon Energy Price vs Earnings

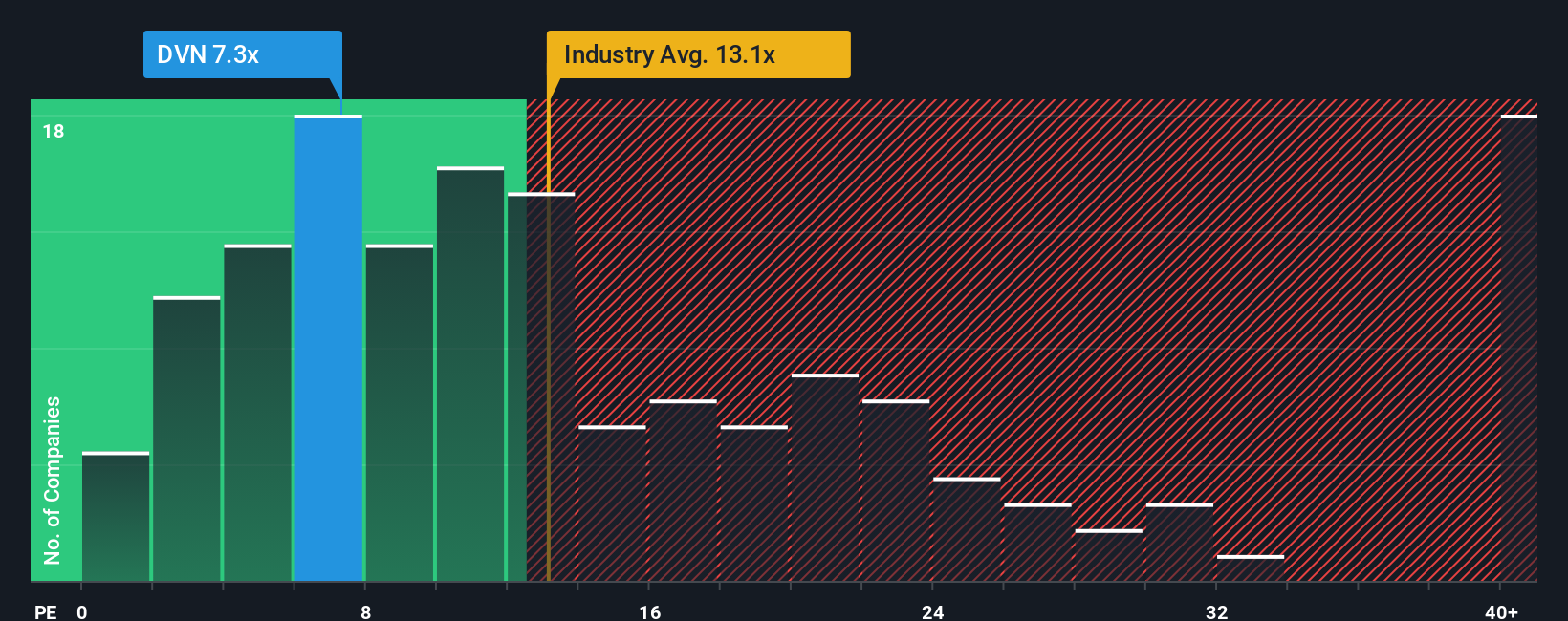

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies such as Devon Energy because it links a company’s share price to its earnings power. This gives investors a quick sense of what the market is willing to pay for current profits. Generally, higher growth prospects and lower risk justify a higher PE ratio. In contrast, lower growth or higher uncertainty indicate that a lower, more conservative multiple may be appropriate.

Devon Energy currently trades at a PE ratio of 7.5x, which is notably below the Oil and Gas industry average of 12.9x and the average for its peers at 23.4x. At first glance, this might suggest that the market is pricing Devon at a significant discount compared to its sector and close competitors.

Rather than relying solely on these wider benchmarks, Simply Wall St’s Fair Ratio offers a more nuanced comparison by considering the company’s unique profile, including earnings growth, profit margins, industry position, risk, and market cap. For Devon Energy, the Fair Ratio is calculated at 16.3x, which is significantly higher than its current PE. This approach delivers a clearer sense of fair value because it factors in more company-specific details and goes beyond simple peer and industry comparisons.

Since Devon’s current PE ratio is well below its Fair Ratio, it points to the stock being undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Devon Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your opportunity to connect the numbers to a bigger story; it is how you explain your own perspective about a company, your expectations for revenue, profit margins, future catalysts, and fair value, rooted in the company’s business developments and industry trends.

On Simply Wall St’s Community page, millions of investors are already using Narratives to link Devon Energy’s story and outlook to financial forecasts and fair value estimates in real time. Narratives let you decide when a stock is worth buying or selling by comparing your fair value to the current share price, and they are dynamically updated as new information (like earnings or news) emerges.

For example, some investors see Devon as a future outperformer due to its high-quality midstream moves and improving operational efficiency, supporting a bullish price target of $70.00 per share. Others remain cautious about risks like commodity price swings or regulatory pressures and set more conservative valuations, such as $33.00 per share. With Narratives, you can transparently map your own view and track how it stacks up against others, which makes building and adapting your investment thesis both easy and insightful.

Do you think there's more to the story for Devon Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVN

Devon Energy

An independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives