- United States

- /

- Oil and Gas

- /

- NYSE:DVN

Devon Energy (NYSE:DVN) Reports Revenue Increase To US$4,452 Million In Q1 2025 Earnings

Reviewed by Simply Wall St

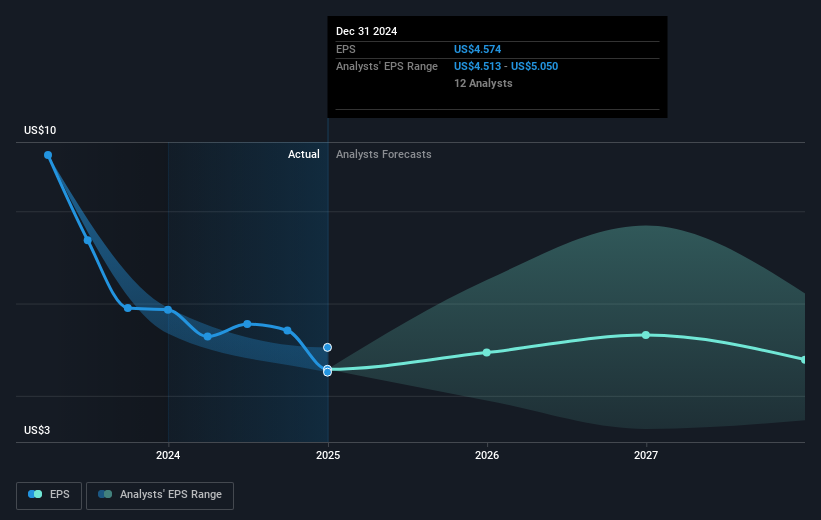

Devon Energy (NYSE:DVN) recently showcased an 18% price increase in its shares over the past month, attributed to a mix of corporate and market factors. The company reported its Q1 2025 earnings, highlighting a revenue boost to $4,452 million, although net income and EPS saw declines. Simultaneously, their active buyback program continued with the repurchase of 8.5 million shares. While these internal developments offer insight, they unfolded amidst a generally upward market trend, suggesting that Devon's positive price movement aligns with broader market dynamics, punctuated by optimism from the 5% rise in market indices over the past week.

Outshine the giants: these 29 early-stage AI stocks could fund your retirement.

The recent 18% increase in Devon Energy's share price suggests positive investor sentiment, possibly bolstered by the company's ongoing buyback program and recent revenue boost to US$4.45 billion. These corporate actions and market trends hint at strengthened investor confidence, albeit tempered by declines in net income and EPS. Over the past five years, Devon Energy has achieved a substantial total return of 264.81%, highlighting the company's ability to deliver significant shareholder value over an extended period.

In comparison over the last year, Devon Energy has underperformed both the US Oil and Gas industry and the broader US Market, which saw respective returns of 5.1% decline and 10.6% increase. This recent performance may prompt investors to scrutinize its long-term growth strategies, particularly in the context of its price of US$30.59, which is below the consensus analyst price target of US$42.90, indicating substantial potential upside.

The expansion of simul-frac technology and cost-cutting measures could lead to operational improvements and bolster future revenue and earnings forecasts. Nevertheless, uncertainties surrounding commodity pricing and efficiency gains pose risks. Analysts expect revenues to grow modestly, while the expectation of stable earnings at US$2.9 billion indicates limited earnings expansion in the near term. The gap between the current price and the analyst target suggests that any success in optimizing operations may significantly influence future valuations.

Review our growth performance report to gain insights into Devon Energy's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DVN

Devon Energy

An independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives