- United States

- /

- Oil and Gas

- /

- NYSE:DTM

How DT Midstream’s Record Quarter and Raised 2025 Guidance Will Impact DTM Investors

Reviewed by Sasha Jovanovic

- DT Midstream, Inc. reported third-quarter 2025 net income of US$115 million, or US$1.13 per diluted share, surpassing analyst estimates and announcing higher full-year Adjusted EBITDA guidance following the successful expansion of key pipeline projects.

- The company's early, on-budget commissioning of the LEAP Phase 4 project and upsized Guardian Pipeline expansion highlight its focus on accelerating infrastructure development and responding to growing energy demand.

- Given the increased full-year guidance and successful project delivery, we'll examine how DT Midstream's updated outlook impacts its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

DT Midstream Investment Narrative Recap

To own DT Midstream, investors typically need confidence in sustained North American natural gas infrastructure demand, robust pipeline utilization, and visibility on long-term cash flows. The latest earnings beat and increased guidance reinforce positive near-term momentum, but the underlying risk remains: significant capital spending on pipeline expansions could become a drag if long-term demand unexpectedly weakens or decarbonization accelerates. For now, the outperformance does not materially change that the most pressing short-term catalyst is infrastructure project execution, while the risk of asset underutilization persists.

Among recent announcements, the on-budget, early completion of the LEAP Phase 4 expansion stands out as directly relevant to the investment story. This milestone reinforces DT Midstream's record of delivering on growth projects and bolsters management's updated confidence in raising its Adjusted EBITDA outlook, bringing nearer-term support to the key catalyst of project delivery and utilization gains.

Yet, despite stronger earnings, investors should still weigh the possibility that...

Read the full narrative on DT Midstream (it's free!)

DT Midstream's outlook anticipates $1.6 billion in revenue and $606.6 million in earnings by 2028. This is based on analysts expecting a 12.0% annual revenue growth rate and an earnings increase of $230.6 million from the current $376.0 million.

Uncover how DT Midstream's forecasts yield a $114.69 fair value, a 8% upside to its current price.

Exploring Other Perspectives

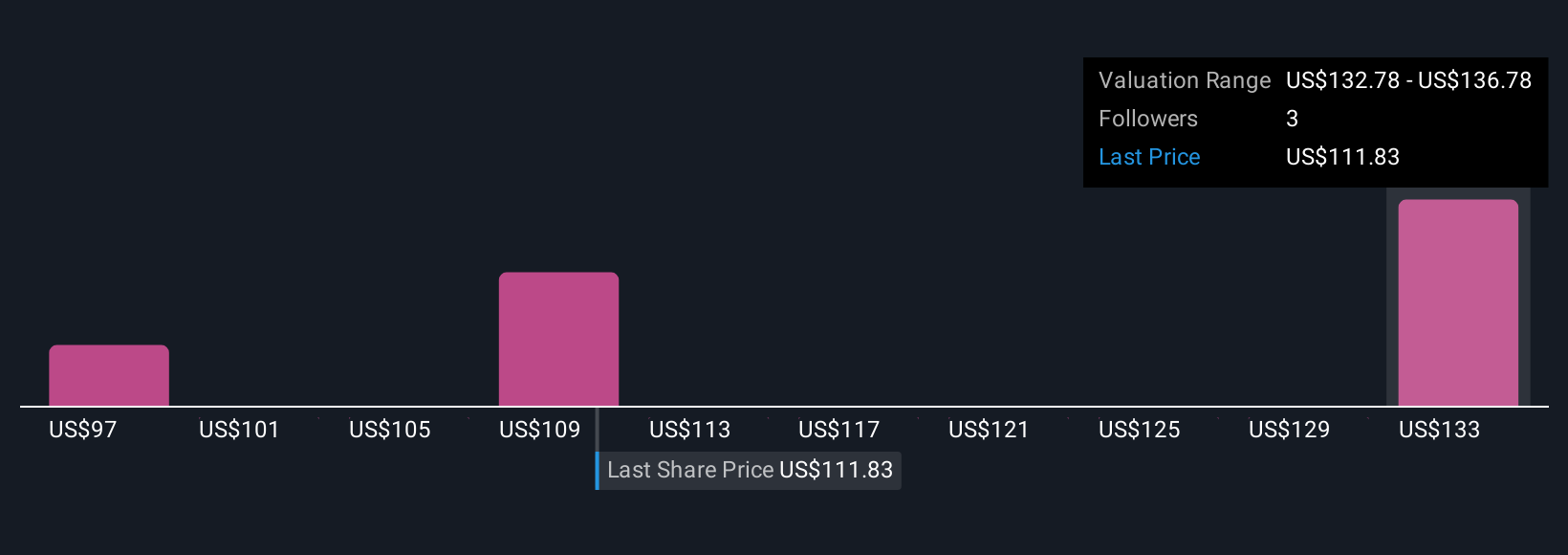

Community fair value estimates for DT Midstream range from US$96.75 to US$136.04 across three member forecasts, highlighting very different outlooks. While some see upside driven by project execution, others may focus on the risks tied to long-term demand, for a balanced view, read what the Simply Wall St Community believes and compare several perspectives for yourself.

Explore 3 other fair value estimates on DT Midstream - why the stock might be worth 9% less than the current price!

Build Your Own DT Midstream Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DT Midstream research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DT Midstream research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DT Midstream's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DTM

DT Midstream

Provides integrated natural gas services in the United States.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives