- United States

- /

- Oil and Gas

- /

- NYSE:DKL

Rethinking Delek Logistics After Joint Venture and Five Year 153% Share Price Surge

Reviewed by Bailey Pemberton

- Wondering if Delek Logistics Partners is trading at a fair price, or if there is a hidden bargain waiting to be uncovered? You are not alone. Valuing this stock can be trickier than it first appears, especially given its industry position and historical growth.

- Shares have climbed 28.4% over the past year and delivered a remarkable 153.0% gain over five years, signaling that investors may see strong potential or are responding to shifting risk profiles.

- In recent months, Delek Logistics Partners has made headlines for its strategic expansion through infrastructure investments and a newly announced joint venture. Both of these moves have been well received by the market. These developments may shed light on why the stock has been gaining momentum and may reframe the outlook for future growth opportunities.

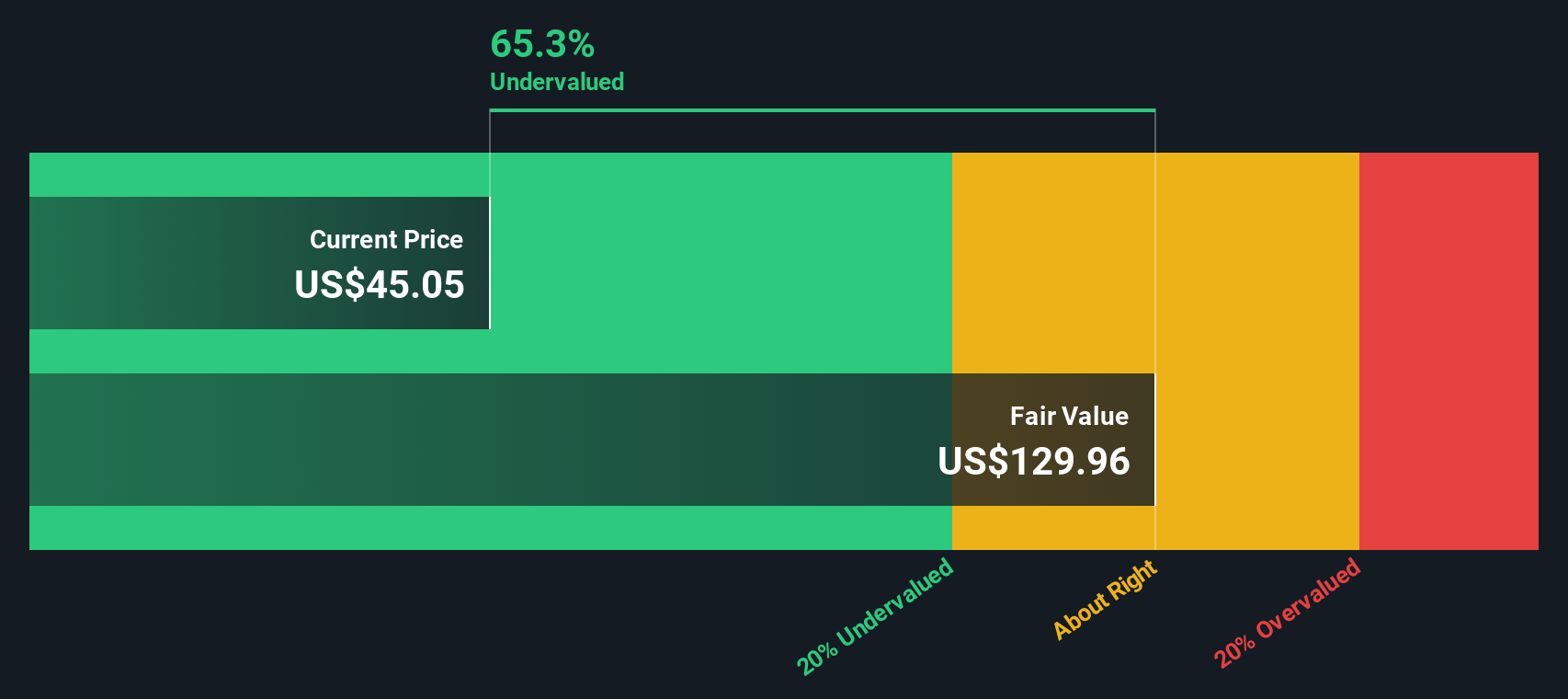

- According to our valuation checks, Delek Logistics Partners scores 3 out of 6 for being undervalued across key metrics. In the next section, we will take a closer look at the valuation methods behind that score. Plus, stick around for an even more insightful way to assess value at the end of the article.

Approach 1: Delek Logistics Partners Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting those back to today's values. This method helps investors focus on a business's fundamental ability to generate cash rather than short-term market swings.

For Delek Logistics Partners, the latest reported Free Cash Flow stands at $67.9 million. Analysts forecast that annual cash flows will continue to grow steadily, reaching $283.8 million by 2027. Extending this outlook further, extrapolated estimates suggest Free Cash Flow could rise to approximately $542.2 million in 2035. All these values refer to US dollars.

Based on these projections and discounting them to present day, the DCF model produces an intrinsic value for Delek Logistics Partners of $163.07 per share. This figure is 71.6% higher than the current trading price, indicating that the stock may be deeply undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Delek Logistics Partners is undervalued by 71.6%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Delek Logistics Partners Price vs Earnings

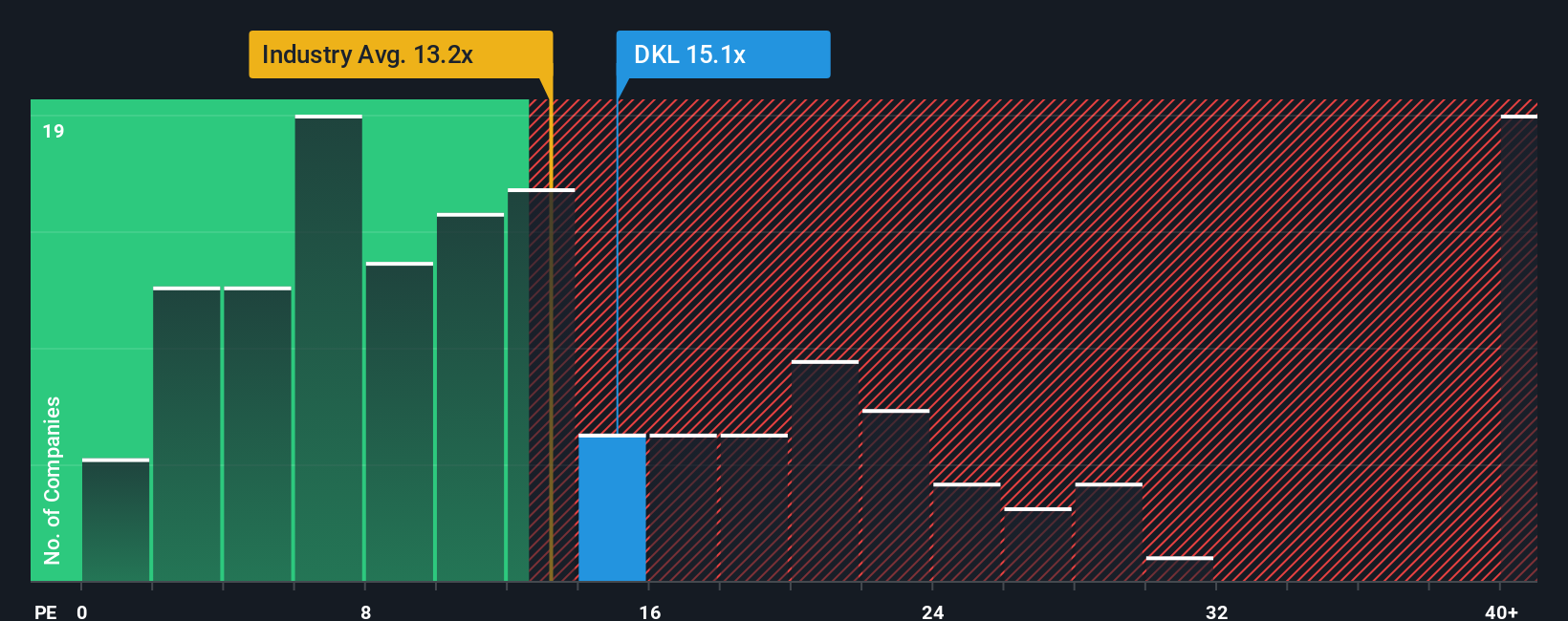

The price-to-earnings (PE) ratio is widely considered the go-to valuation metric for profitable companies like Delek Logistics Partners, as it captures how much investors are willing to pay for each dollar of current earnings. It serves as a quick indicator of market sentiment and allows straightforward comparison to peers and the broader industry.

However, what constitutes a “normal” or “fair” PE ratio depends on a company’s growth prospects and risk profile. Rapidly growing companies or those with lower risk typically command higher PE ratios, while more mature or riskier businesses tend to trade at lower multiples.

Currently, Delek Logistics Partners is trading at 15.1x earnings. For context, the Oil and Gas industry average sits at 13.3x, and the peer average is 9.6x. This indicates that Delek is trading at a premium to both. These simple comparisons do not always account for differences in growth outlook, profitability, or balance sheet strength.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. Calculated at 18.9x for Delek Logistics Partners, the Fair Ratio takes into account the company’s projected earnings growth, risk factors, profit margins, industry dynamics, and market capitalization. Unlike traditional benchmarks, the Fair Ratio provides a more nuanced view of value by reflecting the specific characteristics that matter most to long-term investors.

Comparing the Fair Ratio of 18.9x to the company’s actual PE of 15.1x shows that Delek Logistics Partners is currently trading below what Simply Wall St considers a fair value based on all relevant factors. This suggests shares may be undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Delek Logistics Partners Narrative

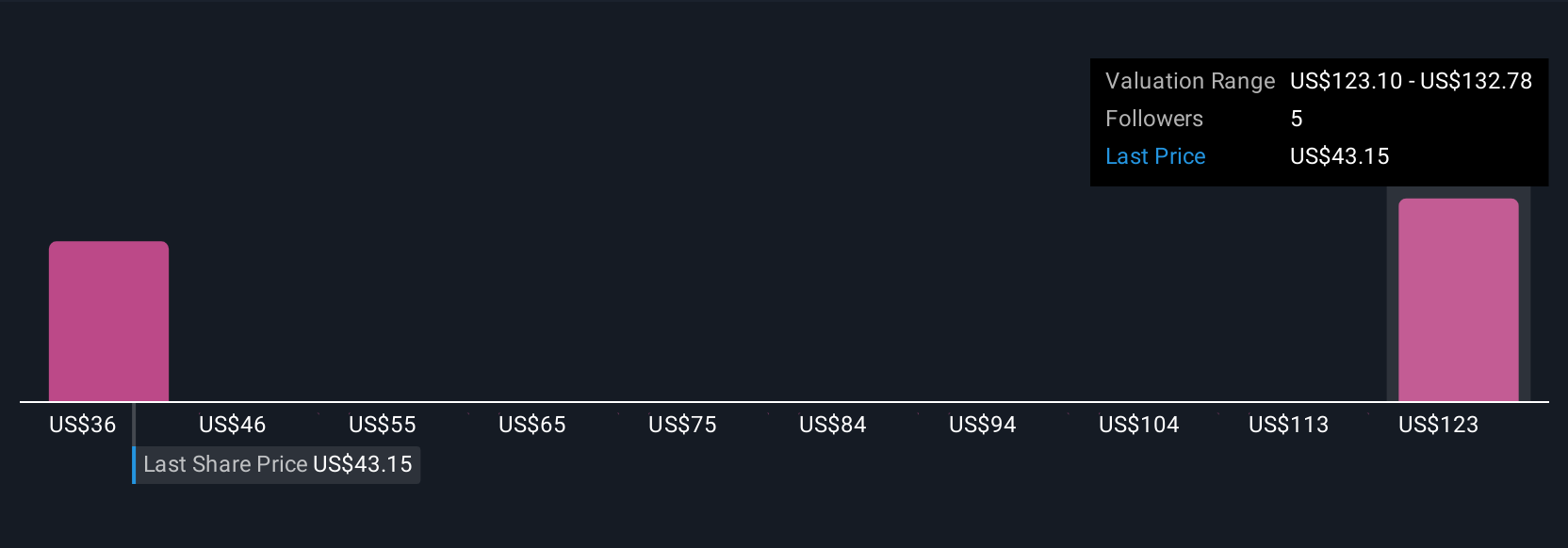

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your unique story or perspective on a company, paired directly to your numbers such as your estimates for future revenue, margins, and your view of what the fair value should be.

Narratives are powerful tools used by millions of investors on Simply Wall St’s Community page, making it easy to explain how a company’s story connects to a financial forecast and, ultimately, a fair value. By constructing a Narrative, you turn real-world insights about Delek Logistics Partners, including its new ventures, risks, and competitive moves, into concrete numbers and forecasts that inform your investing decisions.

Best of all, Narratives remain dynamic; they are automatically updated when new earnings, news, or industry developments emerge. This helps you stay proactive rather than reactive.

When you compare your own Fair Value calculation from your Narrative to the current share price, you can more clearly decide if you think it is time to buy, hold, or sell. For example, recent Narratives from investors put Delek Logistics Partners’ fair value estimates between $36.00 and $47.00 per share, providing a transparent look at how different perspectives can drive various investing conclusions.

Do you think there's more to the story for Delek Logistics Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKL

Delek Logistics Partners

Provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success