- United States

- /

- Oil and Gas

- /

- NYSE:DKL

How Investors May Respond To Delek Logistics Partners (DKL) Posting Higher Q3 Profits and Earnings Per Share

Reviewed by Sasha Jovanovic

- Delek Logistics Partners reported its third quarter 2025 financial results, revealing sales and revenue of US$261.28 million and net income of US$45.56 million, both higher than the prior year period.

- This earnings announcement showed increased profitability, with basic and diluted earnings per share rising to US$0.85, reflecting operational momentum for the company.

- With quarterly net income and earnings per share both rising, we’ll explore what these improved results mean for Delek Logistics Partners’ investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Delek Logistics Partners Investment Narrative Recap

To be a shareholder in Delek Logistics Partners, you need confidence in the continuing demand for energy infrastructure in the Permian Basin and the company’s ability to grow earnings while managing leverage. The latest quarterly results signal positive operational momentum and improving profitability, but do not meaningfully change the ongoing short-term catalyst: bringing the Libby 2 gas plant and related assets up to full capacity. The key risk, heightened leverage from recent debt offerings, remains, with increased interest expenses requiring continued strong cash flow generation.

Of the company’s recent announcements, the ongoing increase in quarterly cash distributions stands out, as it speaks directly to the cash flow strength highlighted by this quarter’s results. With the Q3 dividend rising again, Delek Logistics continues its pattern of frequent payout increases, but this also underscores the importance of sustaining current earnings and volume trends if it hopes to maintain such distributions going forward. Yet, despite higher profits, investors should be alert to how interest cost pressures from new debt could...

Read the full narrative on Delek Logistics Partners (it's free!)

Delek Logistics Partners' outlook anticipates $1.1 billion in revenue and $289.6 million in earnings by 2028. This projection is based on a 6.1% annual revenue growth rate and reflects a $137.8 million increase in earnings from the current $151.8 million level.

Uncover how Delek Logistics Partners' forecasts yield a $43.75 fair value, a 4% downside to its current price.

Exploring Other Perspectives

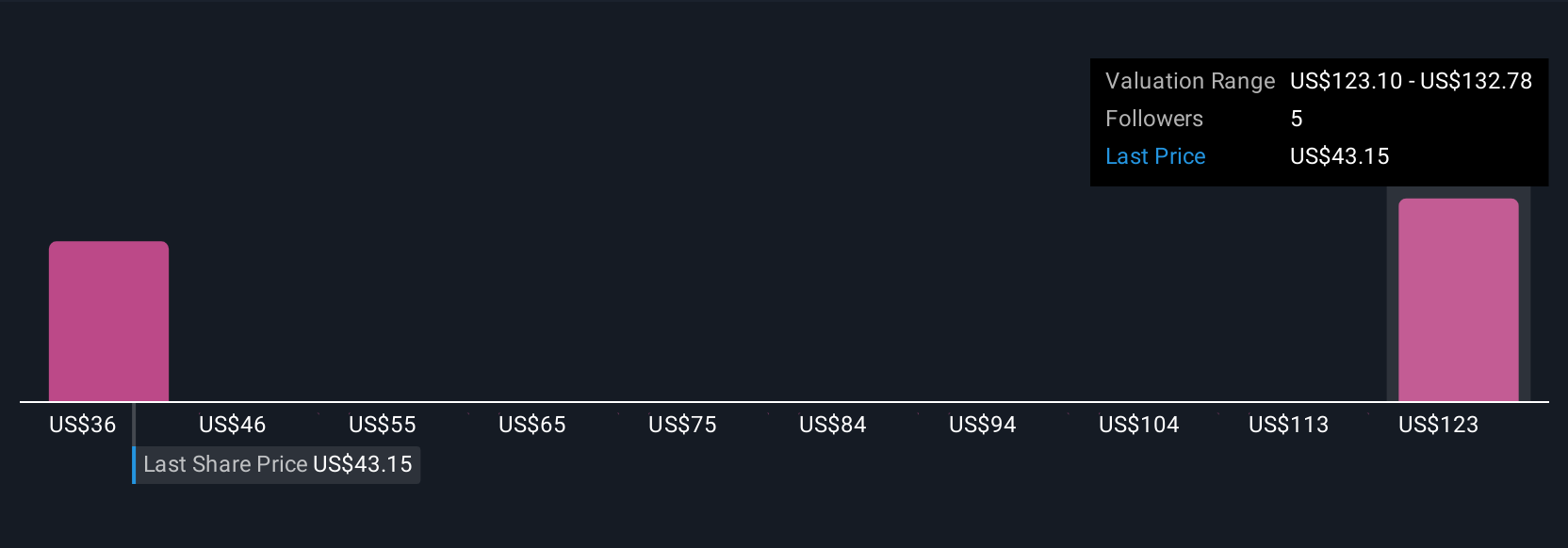

Three fair value estimates from the Simply Wall St Community span a wide range, from US$36 to over US$155 per share. Given this spread and the persistent risk from increased leverage, you can compare many viewpoints and see how differing expectations about asset utilization may shape performance.

Explore 3 other fair value estimates on Delek Logistics Partners - why the stock might be worth 21% less than the current price!

Build Your Own Delek Logistics Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delek Logistics Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Delek Logistics Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delek Logistics Partners' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKL

Delek Logistics Partners

Provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives