- United States

- /

- Oil and Gas

- /

- NYSE:DK

Has Delek US Holdings Outpaced Its Fundamentals After a 110% Stock Surge in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Delek US Holdings could be a hidden value opportunity, or if its stock has already outpaced its fundamentals? Let’s dig into what is driving attention to this energy company right now.

- The stock has seen a notable run, climbing 110.8% year-to-date and delivering a strong 113.6% return over the past year. However, it dipped slightly by 3.6% this past week.

- Delek’s recent momentum has caught headlines, with industry watchers pointing to strategic asset acquisitions and a push to expand its refining capacity as reasons behind its recent surge. Some analysts are also highlighting supply chain improvements and positive outlooks for the broader energy sector as important factors shaping investor sentiment.

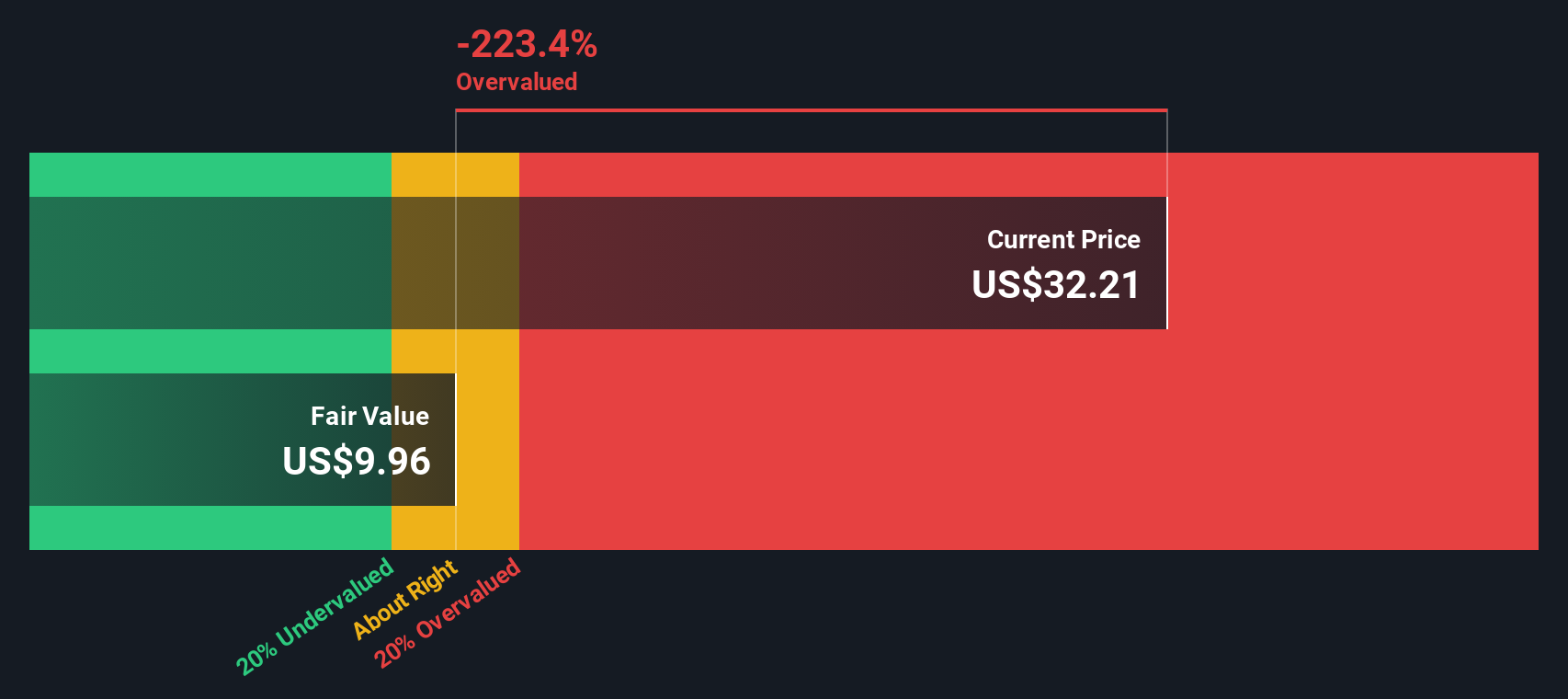

- On the valuation front, Delek US Holdings scores a 5 out of 6 on our valuation checklist. This signals that the stock passes most key value checks. Next, we will break down the valuation methods behind this score, and at the end of the article, reveal a smarter, holistic way to judge whether Delek is a true bargain.

Approach 1: Delek US Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This helps investors determine what the business might be worth now, based on forward-looking expectations.

For Delek US Holdings, the latest twelve months of Free Cash Flow (FCF) were negative, totaling -$485 million. However, analysts anticipate a sharp turnaround and forecast FCF to reach $297 million by 2027. Looking further, projections suggest FCF could climb as high as $1.9 billion by 2035. The initial five years rely on analyst estimates, while subsequent years are extrapolated based on observed trends.

Using this two-stage Free Cash Flow to Equity approach, the model calculates an intrinsic value of $368.69 per share. This represents an 89.5% discount compared to Delek’s current share price and implies the stock could be significantly undervalued if these cash flow improvements materialize.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Delek US Holdings is undervalued by 89.5%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

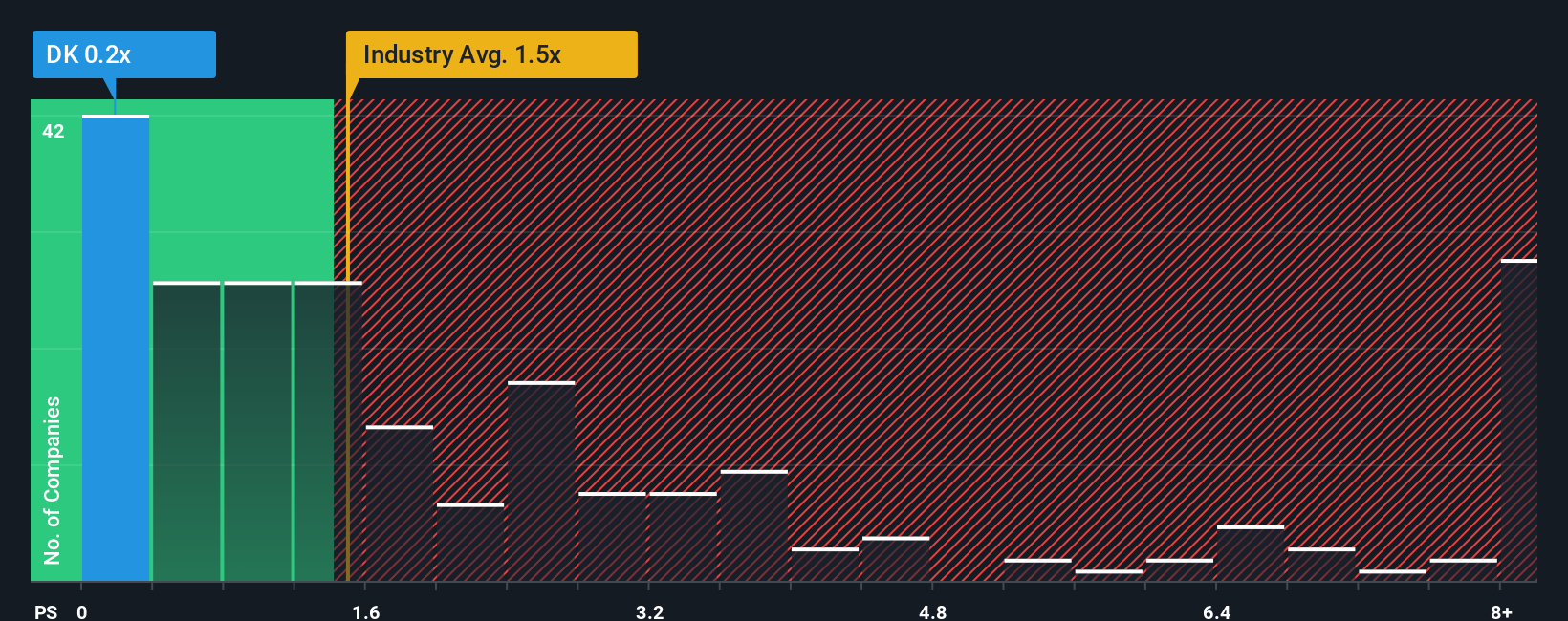

Approach 2: Delek US Holdings Price vs Sales

For companies in the energy sector, especially those with volatile or negative earnings, the Price-to-Sales (PS) ratio is a popular metric for valuation. It allows investors to compare how much the market values every dollar of a company’s sales, regardless of profitability. This is particularly useful when evaluating businesses where profits can fluctuate due to market cycles or investments in growth.

Growth expectations and company risk are key factors in deciding what counts as a “fair” or “normal” PS ratio. Companies anticipating rapid sales increases or those with strong profitability may merit a premium, while more cyclical or riskier businesses might trade at a discount. Typically, industry averages and peer benchmarks are the first points of comparison for these evaluations.

Delek US Holdings currently trades at a PS ratio of 0.22x, slightly below its peer average of 0.24x and significantly beneath the Oil and Gas industry average of 1.49x. Simply Wall St's proprietary Fair Ratio, calculated at 0.42x, further incorporates Delek’s sales growth outlook, margins, industry dynamics, company size, and risk profile. This approach is considered more reliable than a straight industry or peer comparison because it tailors the benchmark to the company’s unique circumstances and future prospects, rather than relying on a single standard for all companies.

When comparing Delek’s PS ratio of 0.22x to the calculated Fair Ratio of 0.42x, the stock appears quite undervalued by this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

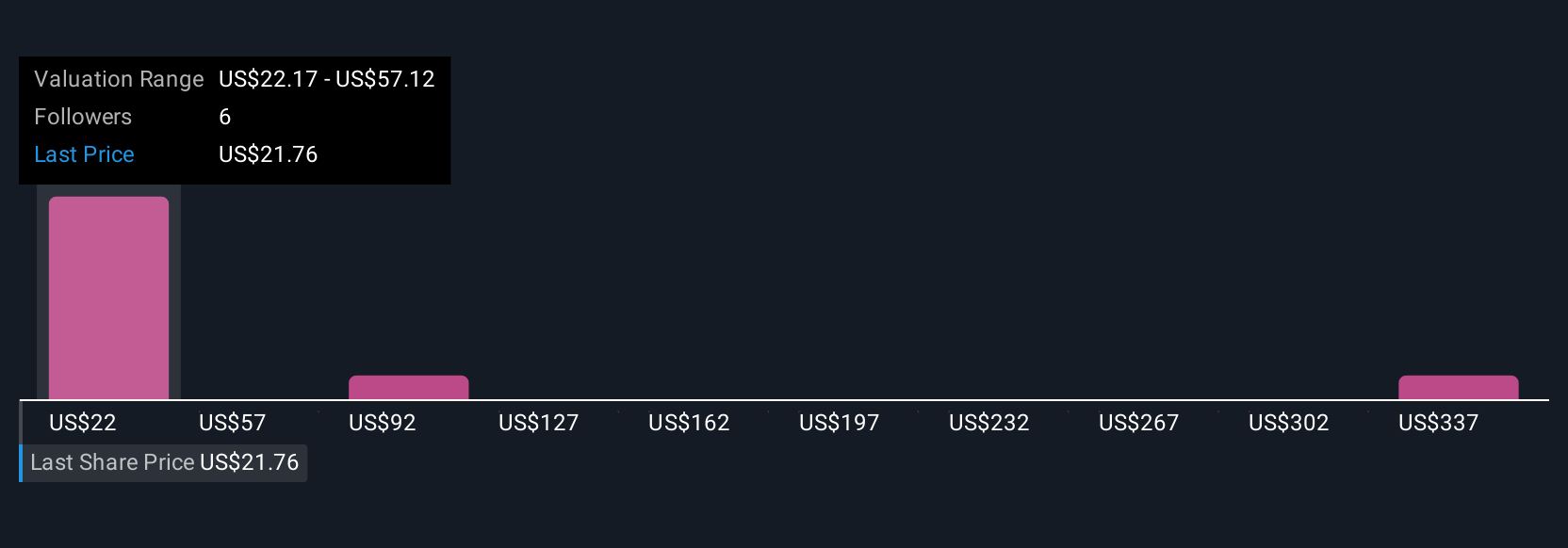

Upgrade Your Decision Making: Choose your Delek US Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story for a company; it’s where you outline your view on Delek US Holdings’ future by linking your assumptions about revenue, margins, or catalysts with a fair value estimate. Narratives bridge the gap between a company’s real-world outlook and its numbers by connecting your personal expectations, the financial forecast, and the resulting fair value in one place.

On Simply Wall St's Community page, millions of investors use Narratives as an easy, interactive tool to visualize and refine their investment logic. Narratives help you make informed decisions on when to buy or sell by continually comparing your Fair Value to the current price. They stay up-to-date and dynamically adjust whenever news or results change the investment thesis.

For example, investors tracking Delek US Holdings have set Narratives ranging from a bullish price target near $41 for those seeing improved margins and steady buybacks, to as low as $14 for those concerned about industry headwinds and lack of diversification. With Narratives, you can compare your outlook with others, or build your own, so your decisions always reflect the latest story as you see it.

Do you think there's more to the story for Delek US Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DK

Delek US Holdings

Engages in the integrated downstream energy business in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success