- United States

- /

- Oil and Gas

- /

- NYSE:DHT

Does Scorpio’s DHT (DHT) Stake Sale Reveal a New Strategic Focus in Fleet Expansion?

Reviewed by Sasha Jovanovic

- Scorpio Tankers recently sold over 2.3 million shares in DHT Holdings, reducing its stake while still retaining 1,169,568 shares, and announced plans to expand its fleet by building two additional VLCCs in South Korea with Hanwha Ocean Co. Ltd.

- This shift in DHT's shareholder structure, driven by Scorpio Tankers' divestment and reinvestment in its own fleet growth, may influence market perspectives on both companies' future directions.

- We'll explore how Scorpio Tankers' decision to reduce its DHT Holdings stake could impact the company's investment narrative and future outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

DHT Holdings Investment Narrative Recap

To be a shareholder in DHT Holdings, you must believe in ongoing demand for seaborne crude transport amid global energy shifts, while staying mindful of spot market volatility and dividend constraints. Scorpio Tankers’ recent sale of DHT shares alters the major shareholder mix, but does not materially affect the main near-term catalysts of consistent vessel utilization or the biggest risk from earnings volatility linked to the spot market. This shift is unlikely to impact the next quarter's earnings stability.

Among DHT’s latest developments, the $64 million revolving credit facility to finance the DHT Nokota acquisition stands out. It reinforces the company’s ongoing fleet renewal strategy, a key catalyst as modern, efficient vessels underpin stable earnings and help offset near-term industry risks linked to market rates and environmental compliance.

Yet, in contrast to these operational strengths, investors should watch for heightened earnings swings linked to spot market exposure and their impact if...

Read the full narrative on DHT Holdings (it's free!)

DHT Holdings' narrative projects $497.7 million in revenue and $281.4 million in earnings by 2028. This requires a 3.7% annual revenue decline and an earnings increase of $91 million from $190.4 million currently.

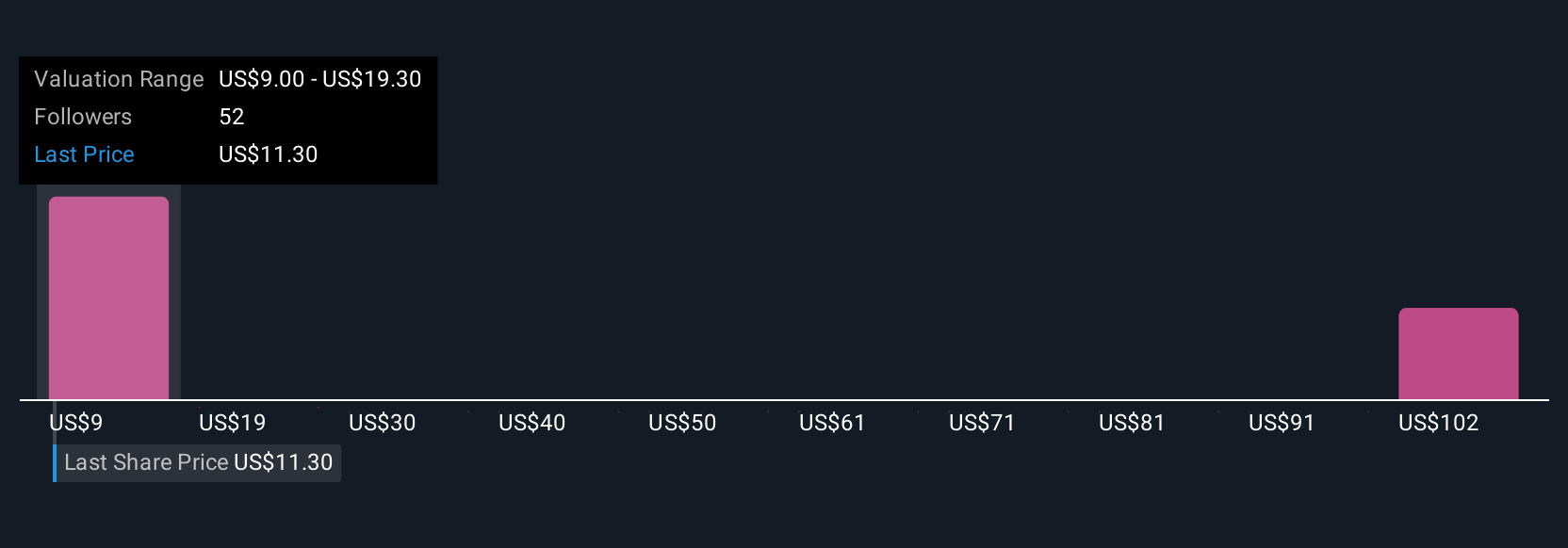

Uncover how DHT Holdings' forecasts yield a $15.20 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community valued DHT Holdings between US$13 and US$183 per share, reflecting sharply diverging expectations. With ongoing dividend payouts hitting retained earnings, these perspectives show how market participants weigh potential returns against possible constraints on future growth.

Explore 8 other fair value estimates on DHT Holdings - why the stock might be a potential multi-bagger!

Build Your Own DHT Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DHT Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DHT Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DHT Holdings' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHT

DHT Holdings

Through its subsidiaries, owns and operates crude oil tankers primarily in Monaco, Singapore, Norway, and India.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives