- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Is Chevron’s Valuation Still Attractive Amid Steady Gains and Clean Energy Investments?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Chevron stock is truly a bargain or just riding the wave of energy sector hype, you are in the right place.

- Certainly, the stock’s recent movement has been steady, with just a -0.5% return over the last week and a year-to-date gain of 4.6%. These numbers often get value-focused investors' attention.

- There hasn’t been dramatic news shaking up Chevron lately, but the company has continued to draw headlines for its ongoing investments in cleaner energy initiatives, as well as updates on major international projects. These developments add important context to the stock’s recent performance and perception in the market.

- Right now, Chevron scores a 2 out of 6 on our valuation checks. This means it is undervalued in just a couple of key areas. We will break down what this means next, compare it to standard valuation methods, and finish up with a smarter approach to understanding value that might surprise you.

Chevron scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Chevron Discounted Cash Flow (DCF) Analysis

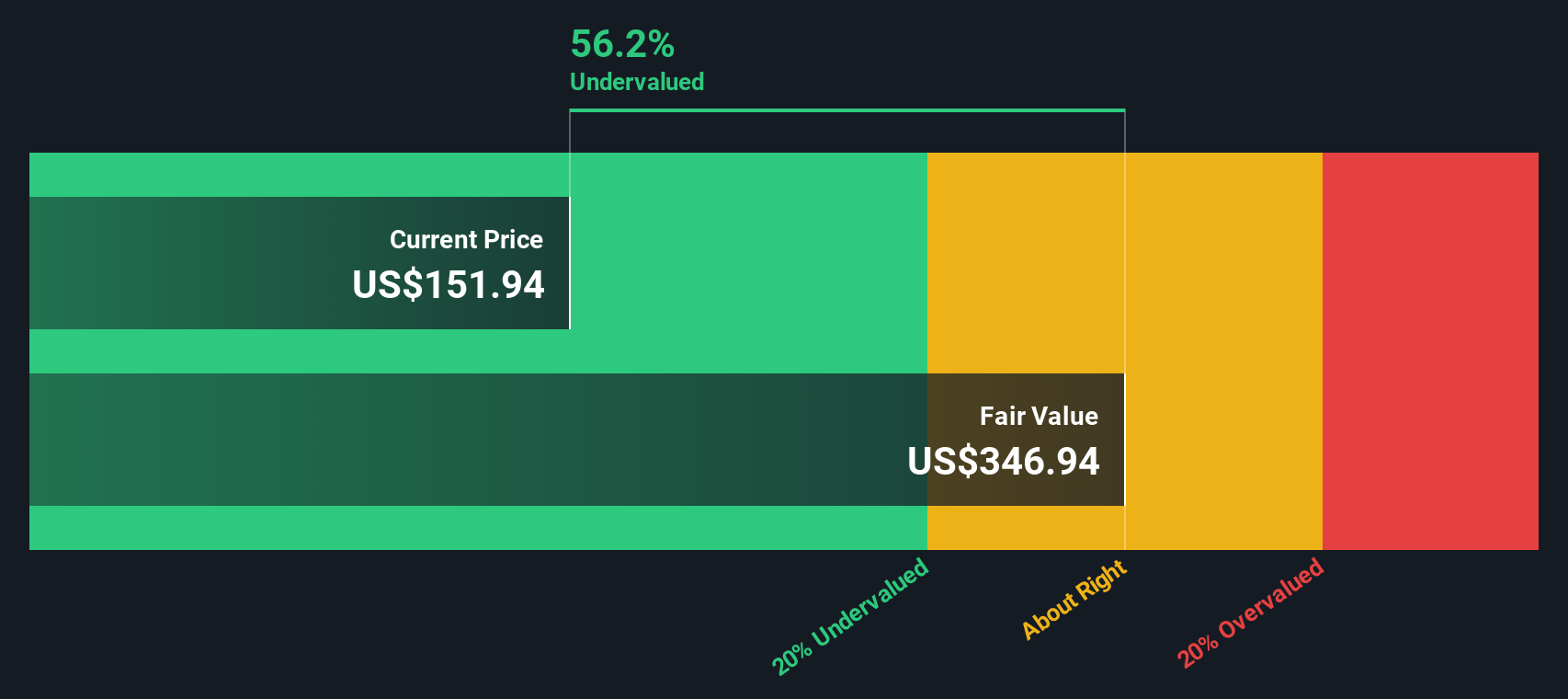

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to what they are worth today. For Chevron, this involves reviewing the $16.3 billion in Free Cash Flow (FCF) it generated most recently and forecasting how much cash the business could produce for shareholders over the coming years.

Analyst estimates suggest Chevron’s annual FCF will grow steadily, rising to about $27.2 billion by 2029. Looking further ahead, Simply Wall St extrapolates projections beyond the analyst horizon, expecting FCF to reach nearly $31.5 billion in 2035. These projections take into account both sector expectations and Chevron’s ongoing initiatives in cleaner energy and global ventures.

After discounting these cash flows to their present dollar value, the model calculates Chevron’s fair value at $319.95 per share. With Chevron’s shares currently trading at a price approximately 52.1% below this intrinsic value, the DCF model suggests the stock is significantly undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Chevron is undervalued by 52.1%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Chevron Price vs Earnings

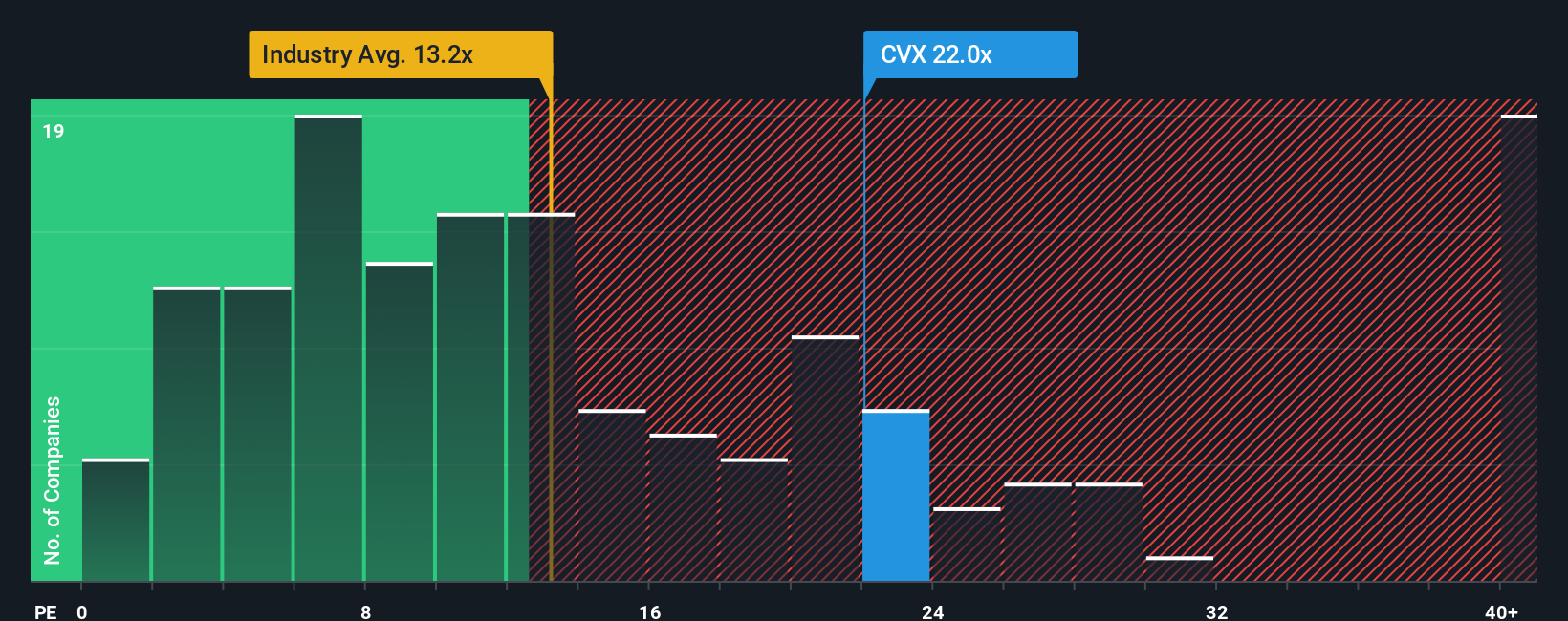

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Chevron because it gives investors a quick sense of how much they are paying for each dollar of earnings. This multiple is especially helpful for comparing companies within the same industry, as it balances out the effects of different profit levels.

Determining what a “normal” or “fair” PE ratio should be depends on expectations for future growth and the perceived risk attached to those earnings. Companies with strong growth prospects or lower risk often command a higher PE, while those with limited growth or higher risks tend to trade at lower multipliers.

Certainly, Chevron currently trades at a PE ratio of 24.4x, which is noticeably higher than the Oil and Gas industry average of 12.7x and its peer average of 20.0x. At first glance, this might suggest the stock is expensive compared to its sector.

However, Simply Wall St introduces the "Fair Ratio," a proprietary metric that goes beyond raw averages. It adjusts for Chevron's specific factors such as earnings growth, profit margins, market cap, and operational risk. For Chevron, the Fair Ratio is calculated at 23.5x, just a touch below its current PE. This tailored approach results in a more thoughtful estimate than simply comparing to peers or an industry average, which might overlook the strengths or unique risks of Chevron’s business.

With Chevron’s actual PE and Fair Ratio nearly aligned, the stock appears to be about right on this crucial metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Chevron Narrative

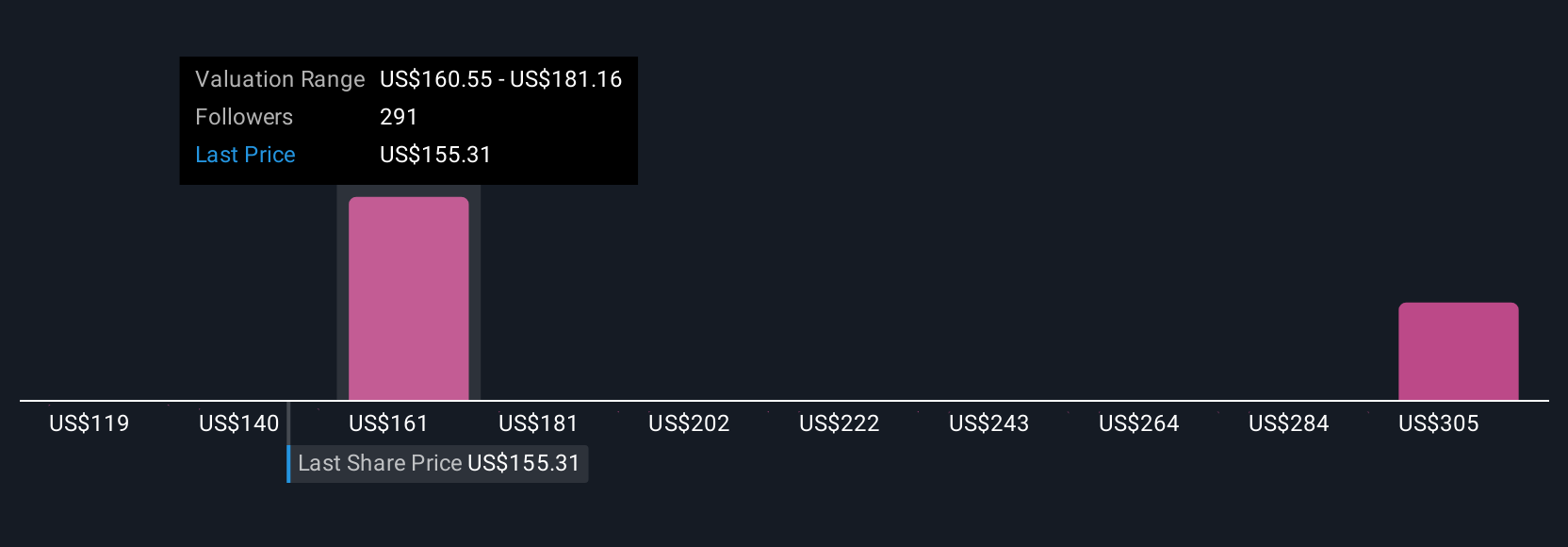

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a story you build around a company’s future by combining your beliefs about its business, industry shifts, and financial outlook to create your own estimate of fair value and prospects. Narratives help you connect Chevron’s story (such as its push for lower costs, cleaner energy, and operational excellence) with a financial forecast, and then to a fair value that reflects your personal view of the company.

On the Simply Wall St platform, Narratives are a simple, guided tool used by millions of investors on the Community page that make it easy to test your own perspective or see what others believe. By updating live as new news or earnings arrive, Narratives help you track how your view compares to market price, and decide if it might be the right time to buy, hold, or sell.

For example, one Chevron Narrative might focus on booming production, major acquisitions, and strong margin expansion, leading to a bullish price target of $197.0. Another Narrative, wary of energy transition risks and project setbacks, selects a more cautious target of $124.0. Narratives are an accessible way to map your conviction to concrete, real-time estimates, putting you firmly in the driver’s seat of your investment decisions.

Do you think there's more to the story for Chevron? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives