- United States

- /

- Oil and Gas

- /

- NYSE:CTRA

What Coterra Energy (CTRA)'s Upgraded UBS Outlook Signals About Its Capital Efficiency and Governance

Reviewed by Sasha Jovanovic

- In recent days, UBS raised its outlook on Coterra Energy following the company's updated 2026 guidance, citing enhanced capital efficiency and ongoing attention from activist investors regarding governance and capital allocation.

- This highlights how investor engagement and operational improvements are shaping perceptions of Coterra’s future value and corporate direction.

- Next, we will assess how UBS’s focus on improved capital efficiency could influence Coterra Energy’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Coterra Energy Investment Narrative Recap

To own Coterra Energy, an investor must accept both the potential of enhanced capital efficiency, recently highlighted by UBS’s upward revision, and the exposure to commodity price cycles, with the biggest near-term catalyst being sustained improvement in operational margin and the main risk centering on continued volatility in U.S. natural gas prices. The UBS news, while affirming improved efficiency and governance focus, does not fundamentally shift the short-term risk from weak and unstable gas markets, which continues to weigh on investor sentiment and Coterra’s outlook.

The company’s most recent quarterly earnings announcement stands out, underscoring higher revenue (US$1,817 million vs. US$1,359 million a year prior) and rising natural gas production. These operational gains provide helpful context for UBS's optimism, though the increased production also reinforces exposure to the primary risk of U.S. gas price softness, linking recent success directly back to the critical catalysts and risks shaping Coterra's performance.

However, investors should also consider the contrast between strong recent profit growth and the ongoing danger of prolonged low natural gas prices, because...

Read the full narrative on Coterra Energy (it's free!)

Coterra Energy is projected to reach $9.6 billion in revenue and $1.9 billion in earnings by 2028. This outlook reflects a 15.5% annual growth rate in revenue and a $0.3 billion increase in earnings from the current $1.6 billion level.

Uncover how Coterra Energy's forecasts yield a $31.96 fair value, a 24% upside to its current price.

Exploring Other Perspectives

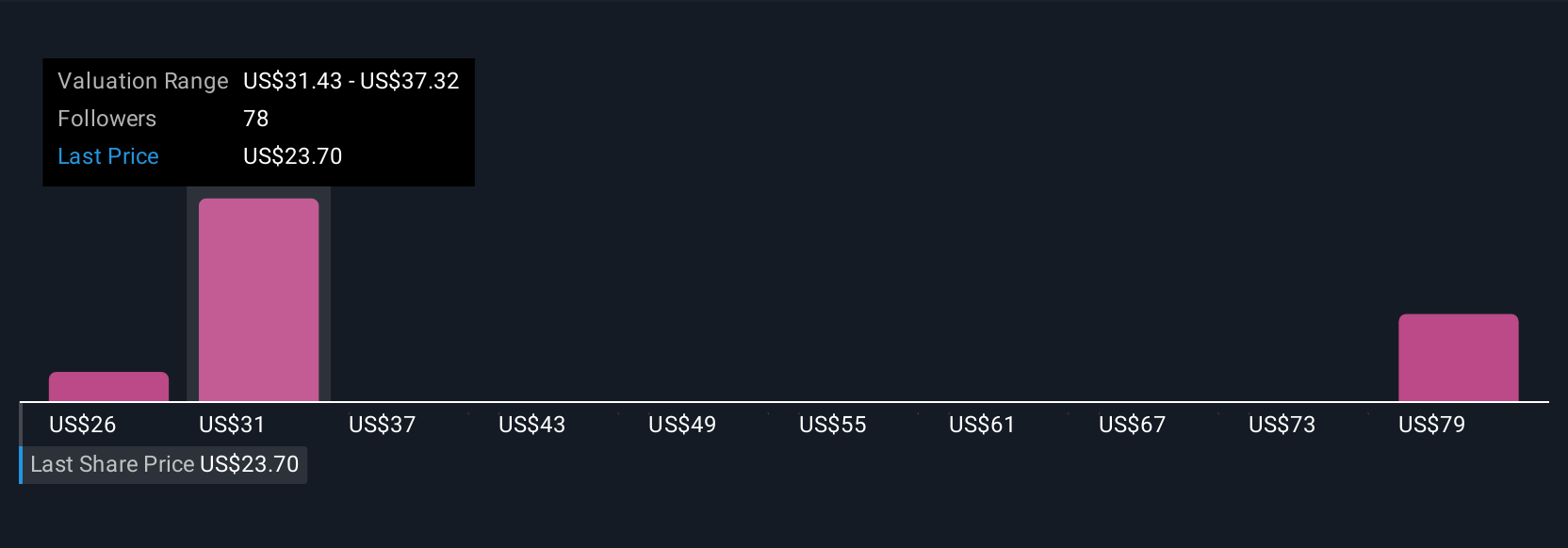

Six individual valuations from the Simply Wall St Community place Coterra’s fair value estimates between US$25.55 and US$76.61. Opinions vary, but with natural gas price risk shaping the near-term outlook, it pays to see how other investors are thinking about Coterra’s future prospects.

Explore 6 other fair value estimates on Coterra Energy - why the stock might be worth over 2x more than the current price!

Build Your Own Coterra Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coterra Energy research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coterra Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coterra Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRA

Coterra Energy

An independent oil and gas company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success