- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Revenues Tell The Story For Comstock Resources, Inc. (NYSE:CRK) As Its Stock Soars 32%

Comstock Resources, Inc. (NYSE:CRK) shareholders are no doubt pleased to see that the share price has bounced 32% in the last month, although it is still struggling to make up recently lost ground. The last 30 days bring the annual gain to a very sharp 88%.

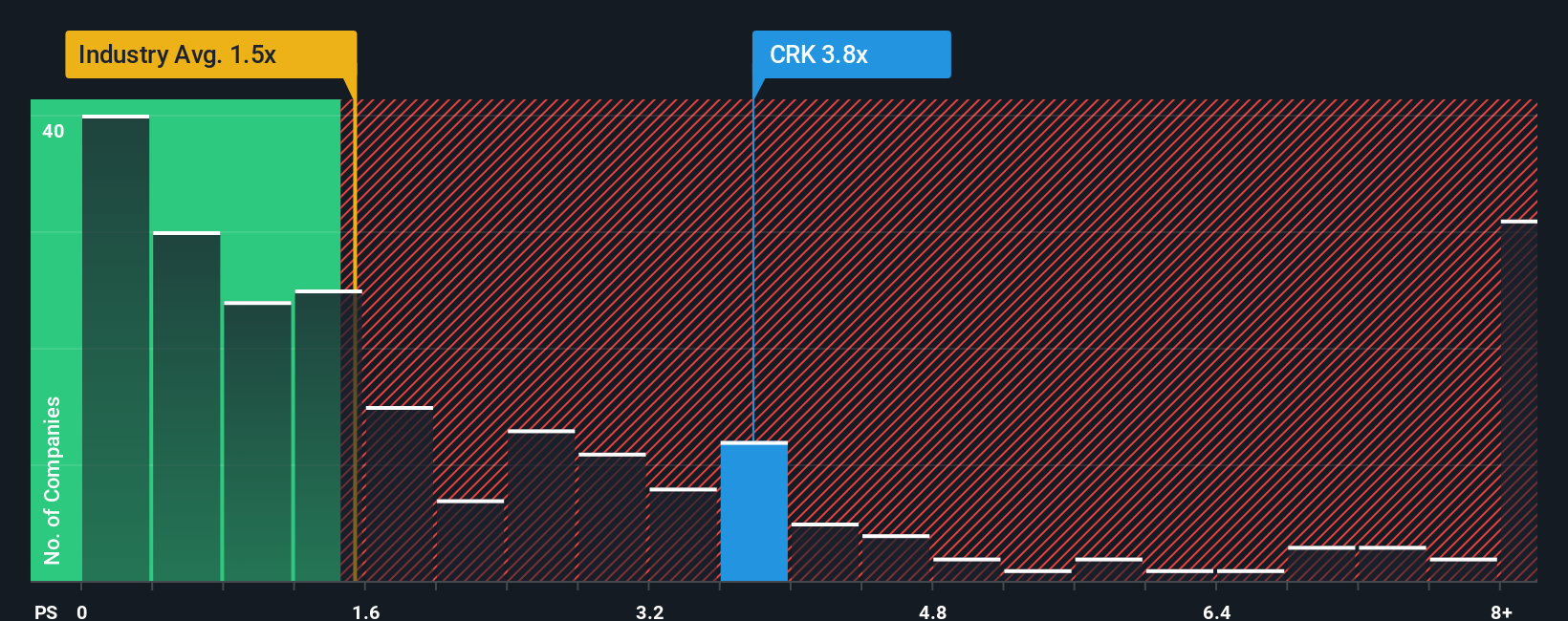

Following the firm bounce in price, when almost half of the companies in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Comstock Resources as a stock not worth researching with its 3.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Comstock Resources

What Does Comstock Resources' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Comstock Resources has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Comstock Resources' future stacks up against the industry? In that case, our free report is a great place to start.How Is Comstock Resources' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Comstock Resources' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Still, revenue has fallen 38% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 20% as estimated by the eight analysts watching the company. That's shaping up to be materially higher than the 4.8% growth forecast for the broader industry.

With this information, we can see why Comstock Resources is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Comstock Resources' P/S

The strong share price surge has lead to Comstock Resources' P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Comstock Resources maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Oil and Gas industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Comstock Resources, and understanding should be part of your investment process.

If you're unsure about the strength of Comstock Resources' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives