- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Do Diverging Analyst Ratings Hint at Shifting Competitive Dynamics for Comstock Resources (CRK)?

Reviewed by Sasha Jovanovic

- Piper Sandler recently reaffirmed an "Underweight" rating on Comstock Resources and updated its outlook after the company’s latest quarterly report, followed by analyst actions from UBS and Clear Street that presented differing viewpoints on the company’s prospects.

- This diverse range of analyst perspectives is influencing how investors assess Comstock Resources’ operational trends and future potential within the evolving natural gas sector.

- To explore how these updated analyst views may affect Comstock Resources’ risk profile and longer-term assumptions, let’s examine their implications for the investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Comstock Resources Investment Narrative Recap

To own shares of Comstock Resources, you need to believe that its concentrated Haynesville shale footprint, coupled with ongoing efficiency gains, will translate into sustained high-margin growth even when production volumes face headwinds. The recent analyst reactions, including Piper Sandler’s reaffirmed Underweight and mixed targets from other firms, mostly reinforce market caution but don’t materially shift the near-term catalyst: whether the company can stabilize and grow production after recent declines; the principal risk remains exposure to regional gas price swings given its lack of geographic diversity.

Among several recent company updates, Comstock’s third-quarter earnings report stands out. It showed a strong rebound in revenue and net income compared to last year, but these improved financials followed another quarter of year-over-year production declines, putting added focus on its ability to offset volume slippage through cost management and new drilling efficiencies.

In contrast, investors should also consider how heavy reliance on Haynesville production sets up…

Read the full narrative on Comstock Resources (it's free!)

Comstock Resources' outlook anticipates $2.5 billion in revenue and $733.2 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 14.6% and a $805.8 million increase in earnings from the current level of -$72.6 million.

Uncover how Comstock Resources' forecasts yield a $18.82 fair value, a 22% downside to its current price.

Exploring Other Perspectives

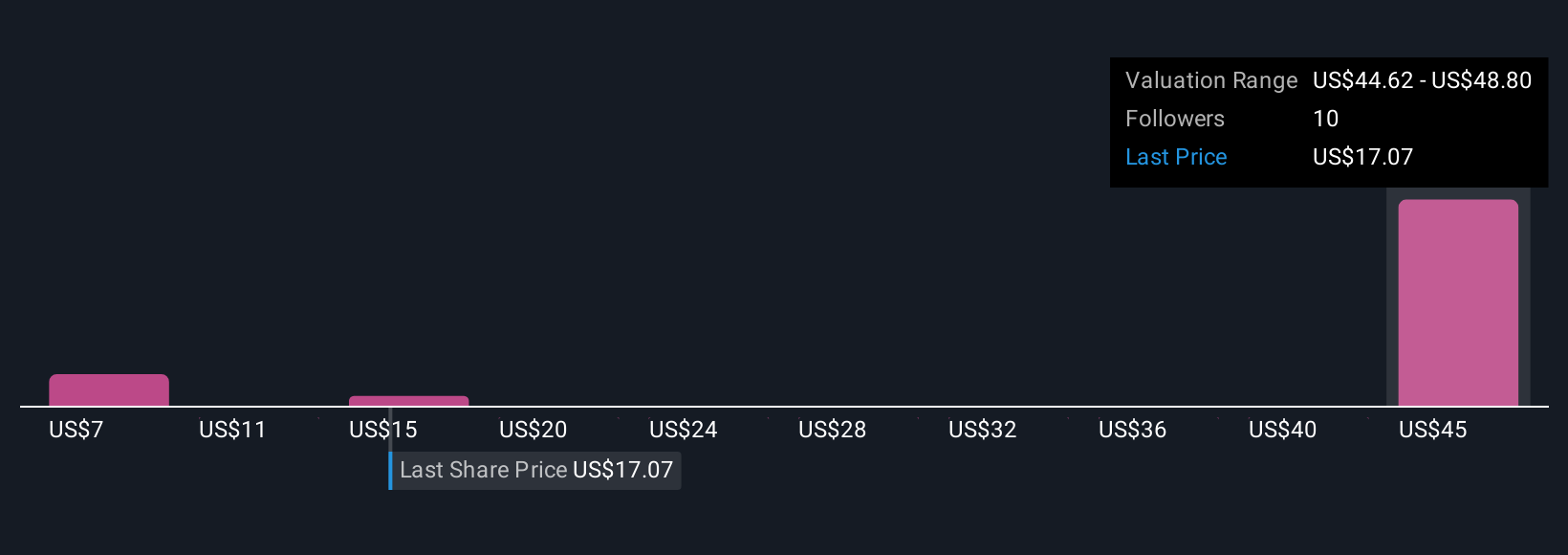

Fair value estimates from five members of the Simply Wall St Community range from US$6.97 to US$22.59 per share. Many see promise in Comstock’s expanding Western Haynesville assets, but opinions vary as production concentration raises questions about resilience if local market pressures intensify.

Explore 5 other fair value estimates on Comstock Resources - why the stock might be worth as much as $22.59!

Build Your Own Comstock Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comstock Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Comstock Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comstock Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives