- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Comstock Resources, Inc. (NYSE:CRK) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Despite an already strong run, Comstock Resources, Inc. (NYSE:CRK) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 106% in the last year.

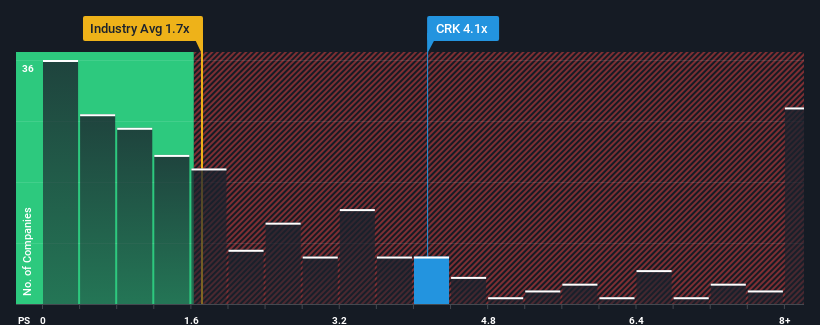

After such a large jump in price, given around half the companies in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider Comstock Resources as a stock to avoid entirely with its 4.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Comstock Resources

How Has Comstock Resources Performed Recently?

Recent times haven't been great for Comstock Resources as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Comstock Resources' future stacks up against the industry? In that case, our free report is a great place to start.How Is Comstock Resources' Revenue Growth Trending?

In order to justify its P/S ratio, Comstock Resources would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. This means it has also seen a slide in revenue over the longer-term as revenue is down 12% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the eight analysts following the company. With the industry only predicted to deliver 9.2%, the company is positioned for a stronger revenue result.

With this information, we can see why Comstock Resources is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Shares in Comstock Resources have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Comstock Resources shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You need to take note of risks, for example - Comstock Resources has 3 warning signs (and 1 which is potentially serious) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives