- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Comstock Resources, Inc. (NYSE:CRK) Shares Slammed 29% But Getting In Cheap Might Be Difficult Regardless

Comstock Resources, Inc. (NYSE:CRK) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 97% in the last year.

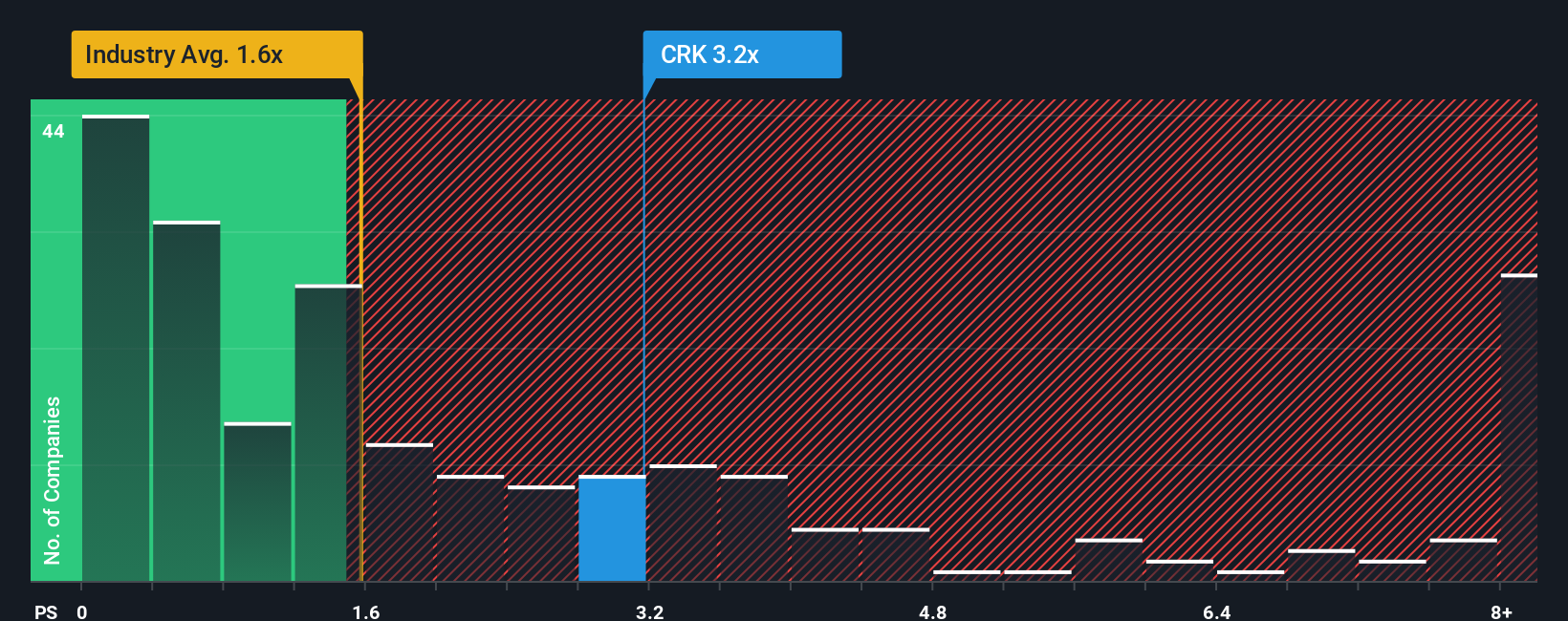

In spite of the heavy fall in price, given close to half the companies operating in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.6x, you may still consider Comstock Resources as a stock to potentially avoid with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Comstock Resources

How Comstock Resources Has Been Performing

With revenue growth that's superior to most other companies of late, Comstock Resources has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Comstock Resources will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Comstock Resources?

The only time you'd be truly comfortable seeing a P/S as high as Comstock Resources' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 38% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 24% over the next year. With the industry only predicted to deliver 6.6%, the company is positioned for a stronger revenue result.

With this information, we can see why Comstock Resources is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Despite the recent share price weakness, Comstock Resources' P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Comstock Resources maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Oil and Gas industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Comstock Resources is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives