- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Is Crescent Energy’s 45.9% Drop in 2025 a Signal for Opportunity?

Reviewed by Bailey Pemberton

- Wondering if Crescent Energy is a hidden gem or a value trap? If you have even a bit of curiosity about whether its current price offers an opportunity, you are in the right place.

- The stock has seen some turbulence recently, sliding by 0.5% over the last week and dropping 11.0% in the past month. This adds to a hefty 45.9% decline year-to-date.

- This drop follows sector-wide volatility tied to shifting energy prices and was further amplified by analysts raising concerns around industry supply trends. Meanwhile, recent headlines have kept a spotlight on the company’s acquisition activities, fueling conversations about its long-term strategy and risk profile.

- Right now, Crescent Energy scores a 3 out of 6 on our valuation checks, suggesting some areas of potential undervaluation. Here is how that score is calculated using different valuation approaches. Stick around to the end to find out what may be an even better way to get to the heart of value.

Find out why Crescent Energy's -34.9% return over the last year is lagging behind its peers.

Approach 1: Crescent Energy Discounted Cash Flow (DCF) Analysis

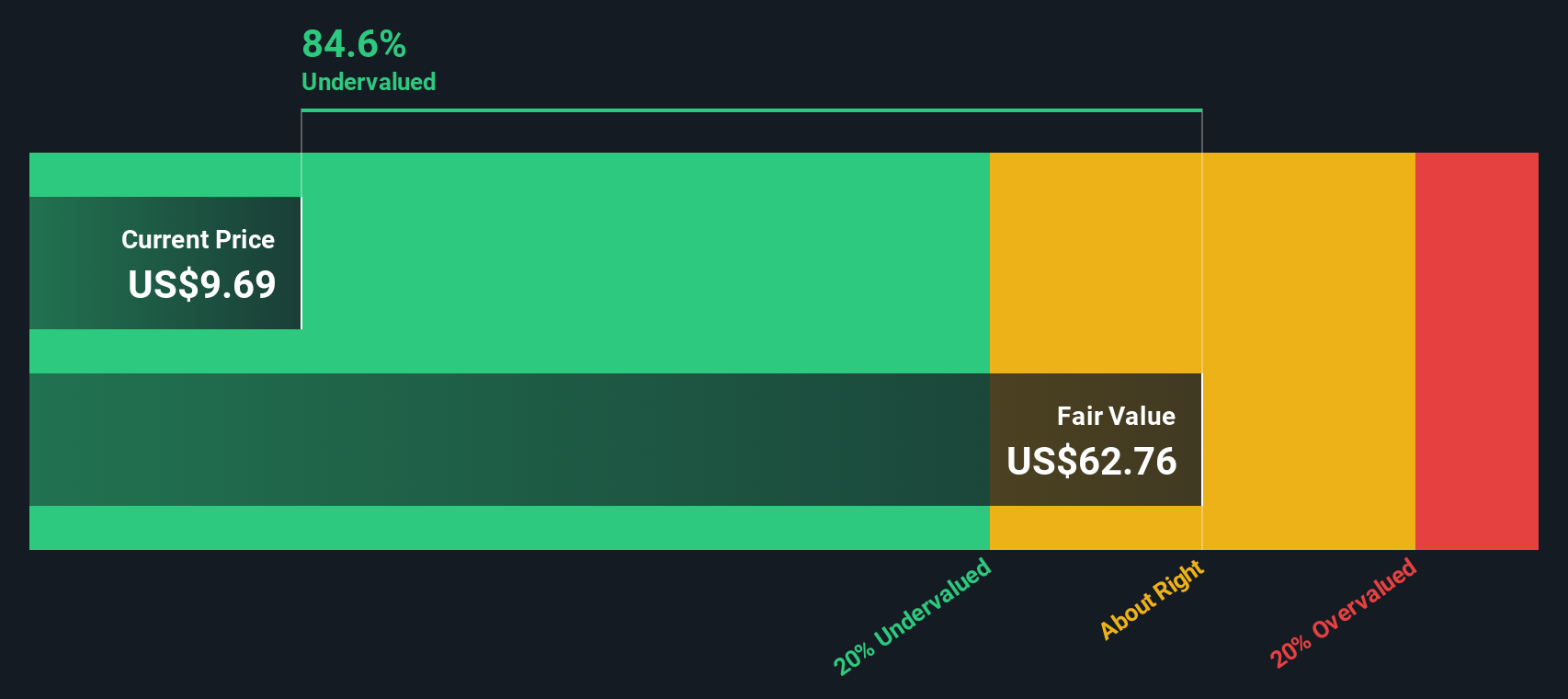

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors assess whether a stock is undervalued or overvalued based on its expected ability to generate cash into the future.

Crescent Energy’s most recent reported Free Cash Flow (FCF) sits at -$144 million. Looking ahead, analysts forecast substantial improvement, with projected annual FCF reaching $1.01 billion by 2029. It is worth noting that analyst estimates only extend five years. Further out projections, such as the $1.14 billion anticipated for 2035, are extrapolated based on trends by Simply Wall St.

Using these projections and applying a 2 Stage Free Cash Flow to Equity model, the estimated fair value per share is $67.40. This model currently suggests that Crescent Energy’s stock is trading at an 88.1% discount to its intrinsic value, indicating the stock is significantly undervalued compared to its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Crescent Energy is undervalued by 88.1%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Crescent Energy Price vs Earnings (PE Ratio)

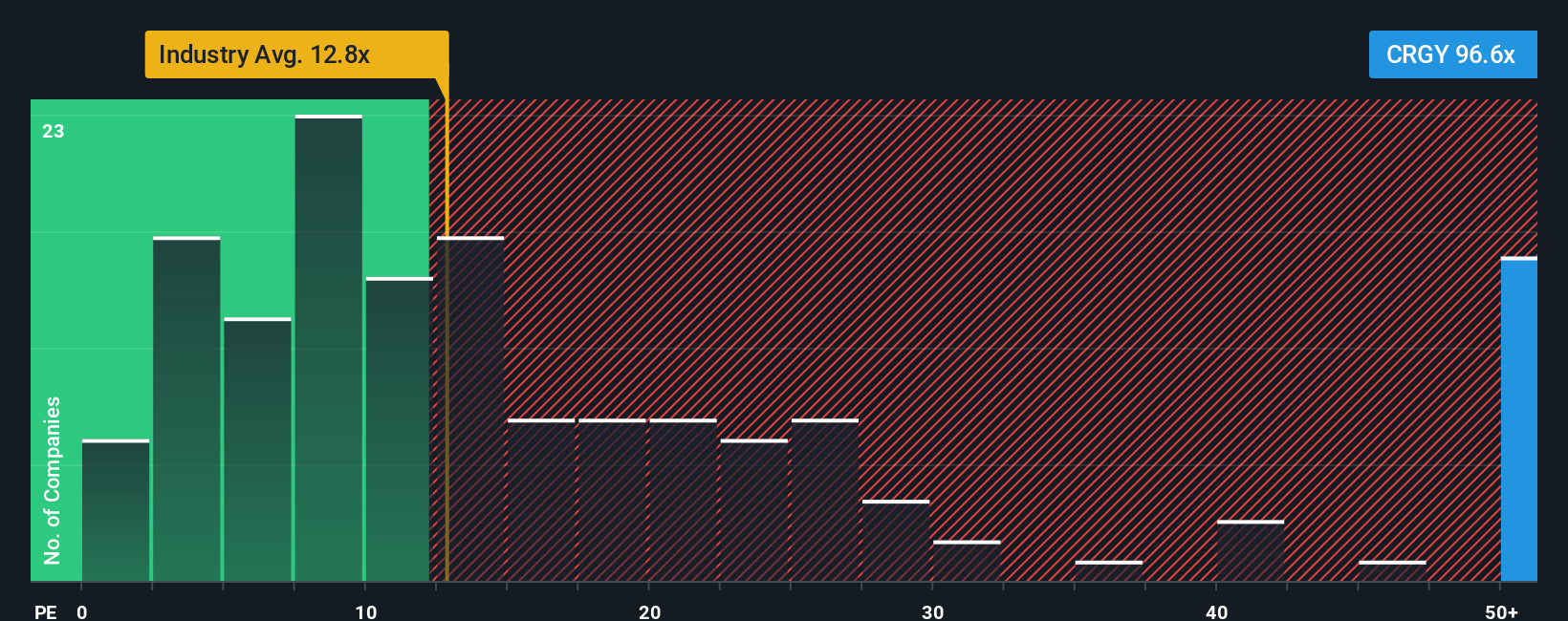

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies because it gives investors an idea of how much they are paying for each dollar of earnings. For situations where a company is generating positive net income, this metric offers a straightforward way to compare the market’s expectations for future performance.

The appropriate, or "fair", PE ratio for a company is influenced by its growth prospects, profitability, and the risks it faces. Generally, companies with faster earnings growth or more stable business models tend to justify higher PE ratios, while those with greater uncertainty or lower profitability see lower multiples.

Crescent Energy currently trades at a PE ratio of 87.1x. This is significantly higher than both the Oil and Gas industry average of 12.8x and the selected peer group, which average 4.1x. On the surface, this might suggest that the market is expecting considerable future earnings growth or sees meaningful differences in Crescent’s risk profile compared to its peers.

To provide a more nuanced perspective, Simply Wall St also calculates a "Fair Ratio" that incorporates expected growth, profit margins, risk factors, industry conditions, and even market capitalization. In this context, Crescent Energy's Fair Ratio is 21.8x, a level above its industry and peer averages but still considerably lower than the company’s actual PE.

Relying solely on peer or industry averages can lead to misleading conclusions, as those benchmarks may not reflect Crescent Energy's specific situation or future prospects. The Fair Ratio offers a tailored benchmark by accounting for the company’s actual business characteristics.

Comparing the Fair Ratio of 21.8x to the current PE of 87.1x, Crescent Energy appears to be overvalued relative to what would be expected for a company with its profile and fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

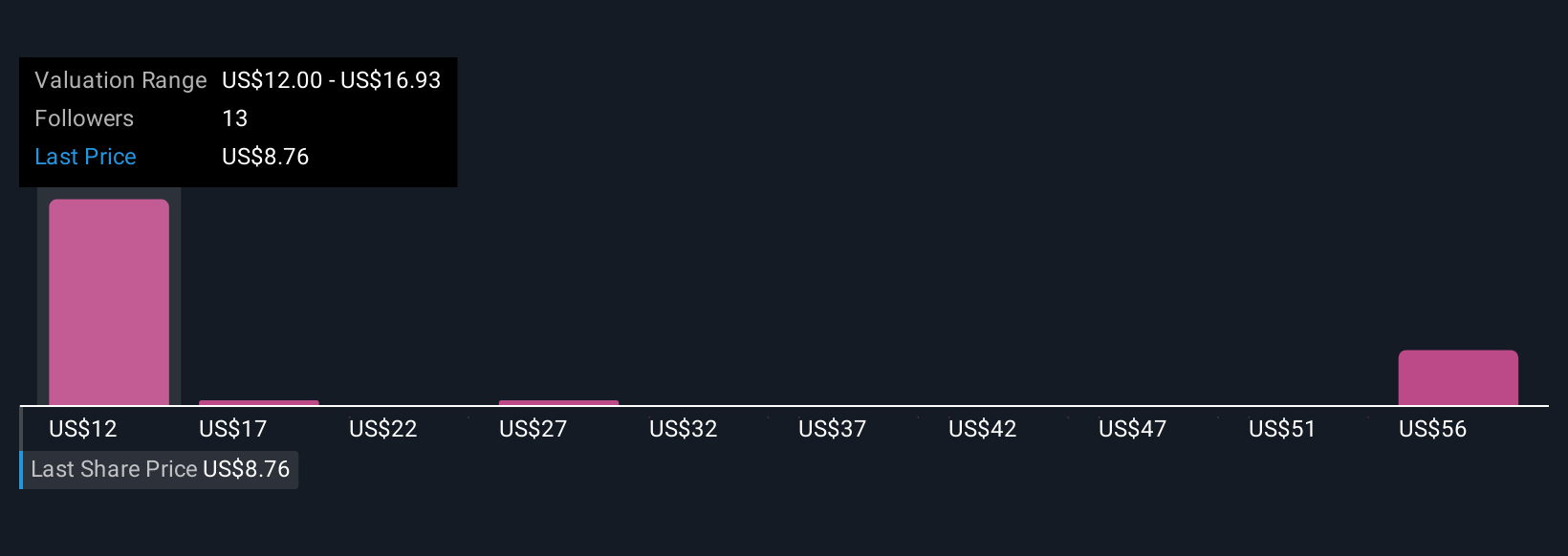

Upgrade Your Decision Making: Choose your Crescent Energy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story, your unique perspective about a company, built from your own assumptions about its future revenue, earnings, and margins, and what you believe its fair value should be. Narratives connect what is happening in the real world and within Crescent Energy to a specific financial forecast, and then distill it into a personalized fair value, allowing you to see whether the current share price offers an opportunity or signals caution.

On Simply Wall St, Narratives are an easy-to-use tool available for every company, including Crescent Energy, right within the Community page, and are utilized by millions of investors worldwide. They empower you to test "what if" scenarios, comparing your own assumptions or the consensus story with the current share price, to help make better decisions about when to buy or sell. What makes Narratives especially powerful is that they remain dynamic, automatically incorporating new news events or earnings releases so your view is always updated and relevant.

For instance, one investor's Narrative might see Crescent Energy as primed for long-term growth, projecting the highest analyst-reported fair value driven by stable global demand and operational efficiency. Another may build a more conservative story, focusing on sector volatility and downside risks, leading to a markedly lower fair value. Either way, Narratives let you link your beliefs to actual estimates so you can invest with clarity and conviction.

Do you think there's more to the story for Crescent Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives