- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Expanded Credit Facility Might Change The Case For Investing In Crescent Energy (CRGY)

Reviewed by Sasha Jovanovic

- Earlier in October 2025, Crescent Energy announced the successful completion of its fall borrowing base redetermination, increasing its reserve-based revolving credit facility by 50% to US$3.9 billion, with the maturity extended to five years and a lower pricing grid.

- This expansion highlights Crescent’s strengthened lender support and delivers immediate cost synergies from the Vital Energy transaction, primarily through lower interest expenses and administrative efficiencies.

- We'll explore how Crescent’s significantly expanded borrowing base and extended debt maturity horizon influence its investment narrative and future outlook.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Crescent Energy Investment Narrative Recap

To own Crescent Energy, you need to believe that smart capital allocation and an expanded low-cost credit facility will drive accretive growth without materially increasing risk from integration or commodity swings. The recent boost to Crescent's borrowing base and extension of its debt maturity directly support its ability to pursue acquisitions, but with integration risk remaining the central short-term concern, the news does not shift this key catalyst or risk in a material way.

One recent company announcement worth highlighting is Crescent's ongoing share buyback program, with 4.8 million shares repurchased for over US$41 million so far. While the improved credit terms strengthen Crescent’s financial flexibility, the success of its buyback initiative is likely to depend on whether future asset integrations can deliver expected shareholder returns.

In contrast, investors should stay mindful of how ongoing dependence on acquisitions still leaves the company exposed to the risk that newly acquired assets might underperform and …

Read the full narrative on Crescent Energy (it's free!)

Crescent Energy's outlook anticipates $5.2 billion in revenue and $672.6 million in earnings by 2028. This is based on a 14.8% annual revenue growth rate and an increase in earnings of about $649.5 million from the current $23.1 million.

Uncover how Crescent Energy's forecasts yield a $14.78 fair value, a 81% upside to its current price.

Exploring Other Perspectives

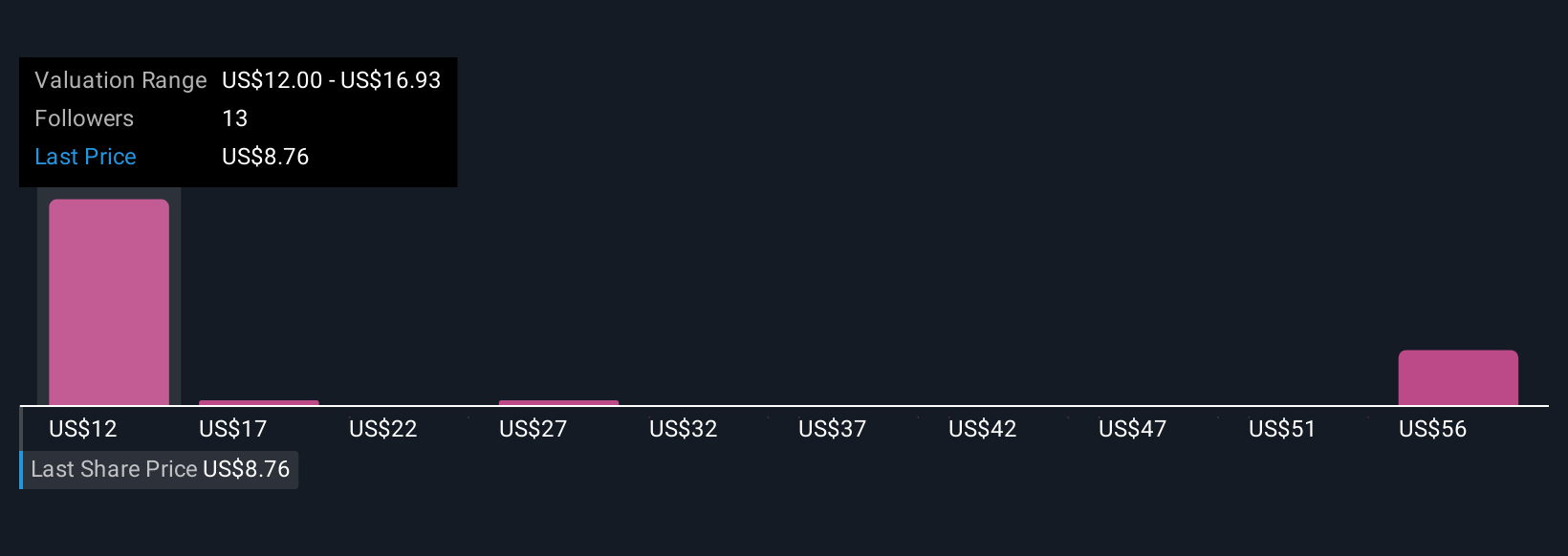

Five members of the Simply Wall St Community give fair value estimates for Crescent Energy ranging from US$12 to US$56.48 per share. With acquisition execution still a top risk, these varied opinions show just how differently market participants assess the company’s ability to generate sustainable value, explore these perspectives for a fuller picture.

Explore 5 other fair value estimates on Crescent Energy - why the stock might be worth just $12.00!

Build Your Own Crescent Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crescent Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crescent Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crescent Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives