- United States

- /

- Oil and Gas

- /

- NYSE:CRGY

Crescent Energy (CRGY): $38.5M One-Off Loss Pressures Margins, Challenging Earnings Growth Narrative

Reviewed by Simply Wall St

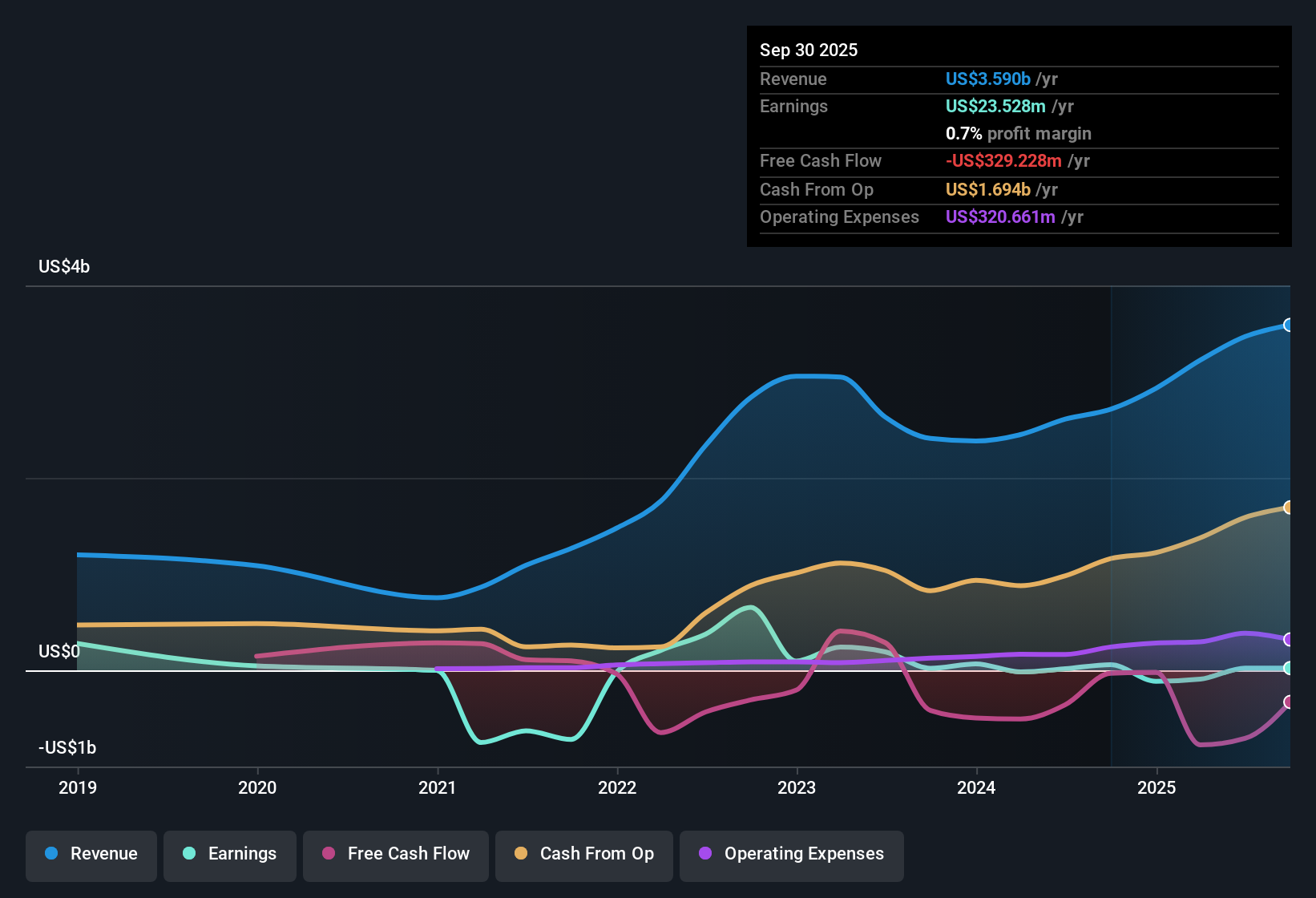

Crescent Energy (CRGY) is forecasting exceptionally strong earnings growth of 58% per year, leaving the US market’s 16% growth prediction far behind. However, revenue is only expected to rise at 8.9% annually, trailing the broader market’s 10.5% pace. Net profit margin has dropped to 0.7% from 2.2% last year after a one-off $38.5 million loss took a bite out of profitability. The numbers set up a compelling mix of robust future earnings potential, offset by real concerns about recent margin compression and valuation headwinds.

See our full analysis for Crescent Energy.Next, we’ll compare the latest results with the widely followed narratives at Simply Wall St to see which angles are being confirmed and where the story might be shifting.

See what the community is saying about Crescent Energy

Profit Margins Projected for Turnaround

- Analysts expect net profit margin to climb from today’s slim 0.7% to 12.8% within three years, an aggressive leap coming off this year’s sharp margin squeeze and $38.5 million in non-recurring losses.

- Analysts’ consensus view highlights a bullish mix of disciplined financial management and operational efficiency, contending these will drive margin improvement. However, the abrupt margin compression now means the path to those gains could remain volatile.

- Shareholders are counting on proven cost controls and expanded reserves to unlock better profitability than the market currently prices in.

- Bulls lean on Crescent’s strong balance sheet and strategy of targeted acquisitions as evidence margins could rebound, despite short-term pressures.

- For a deeper dive into how operational discipline could power a turnaround, see the full consensus take on what’s next for Crescent Energy. 📊 Read the full Crescent Energy Consensus Narrative.

Acquisition-Driven Growth Faces Integration Hurdles

- With analysts projecting the number of shares outstanding to rise 7.0% annually for three years as acquisitions fuel scale, Crescent’s expansion strategy is pushing hard on size while also stretching integration bandwidth.

- Consensus narrative calls out a delicate balancing act, where aggressive moves to broaden the production base and tap high-potential basins can rapidly enhance reserves and cash flow. Yet integration pitfalls and underperformance from acquired assets could threaten margins.

- Expanding in prolific regions like the Uinta and Eagle Ford basins brings both scale advantages and the risk of regulatory or environmental setbacks unique to each geography.

- Analysts note that recurring “market dislocation” events and the hunt for accretive deals keep strategic risk high, especially if commodity price cycles turn against the company.

Share Price Discount Contrasts High PE Ratio

- Despite a current share price of $8.08, trading at a 43% discount to the analyst price target of $14.27, Crescent Energy’s PE ratio sits at an ultra-high 90.6x today. This tops the US Oil and Gas peer group’s 12.6x and makes valuation a complex puzzle for investors.

- Consensus narrative flags the tension between bullish expectations for earnings growth and the reality of a stock that screens expensive on traditional multiples. This underlines that only a dramatic expansion in future profits can justify today’s valuation.

- If Crescent delivers on forecasts, the future PE could compress to around 9.0x. However, this hinges on meeting aggressive targets for revenue and margin improvement.

- Until then, persistent discounting by the market may reflect doubts about recurring one-off losses or the high capital intensity baked into the company’s growth plans.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Crescent Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something the market may be missing? Take just a few minutes to craft your own take and shape the discussion. Do it your way.

A great starting point for your Crescent Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Crescent Energy’s soaring earnings forecasts are undermined by volatile profit margins, repeated one-off losses, and a valuation that appears expensive compared to industry peers.

If you want less volatility and more predictable results, use stable growth stocks screener (2073 results) to find companies that consistently deliver steady earnings and revenue regardless of market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRGY

Crescent Energy

An energy company, engages in the exploration and production of crude oil, natural gas, and natural gas liquids in the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives