- United States

- /

- Oil and Gas

- /

- NYSE:CNX

Has the Recent Jump in Gas Demand Forecasts Changed the Outlook for CNX Resources in 2025?

Reviewed by Bailey Pemberton

- If you’ve ever wondered whether CNX Resources is a bargain or priced for perfection, you’re not alone. Figuring that out is where smart investing starts.

- Despite a tough year with the stock down 8.3% over the last 12 months, short-term performance is turning around, up 7.1% just this week.

- Recent news has focused on increased natural gas demand forecasts and shifting analyst sentiment, which are fueling renewed interest in energy stocks like CNX. Momentum from policy changes around domestic energy production has also powered recent share price moves.

- On our six-point valuation check, CNX Resources lands a 3 out of 6. This suggests a split between value and caution. Here is a breakdown of what goes into this score and an exploration of classic valuation methods, followed by an even more insightful way to judge fair value at the end of this article.

Find out why CNX Resources's -8.3% return over the last year is lagging behind its peers.

Approach 1: CNX Resources Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model aims to estimate a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors assess whether the current stock price accurately reflects CNX Resources’ potential.

According to the latest figures, CNX Resources generated Free Cash Flow of $373.3 million in the last twelve months. Analysts provide up to five years of forward estimates. Beyond that, Simply Wall St extrapolates cash flows out to ten years. By 2028, Free Cash Flow is projected to reach $780 million. Over the next decade, projections continue to grow, albeit at a more moderate pace, with the expectation of annual increases supported by industry trends and company performance.

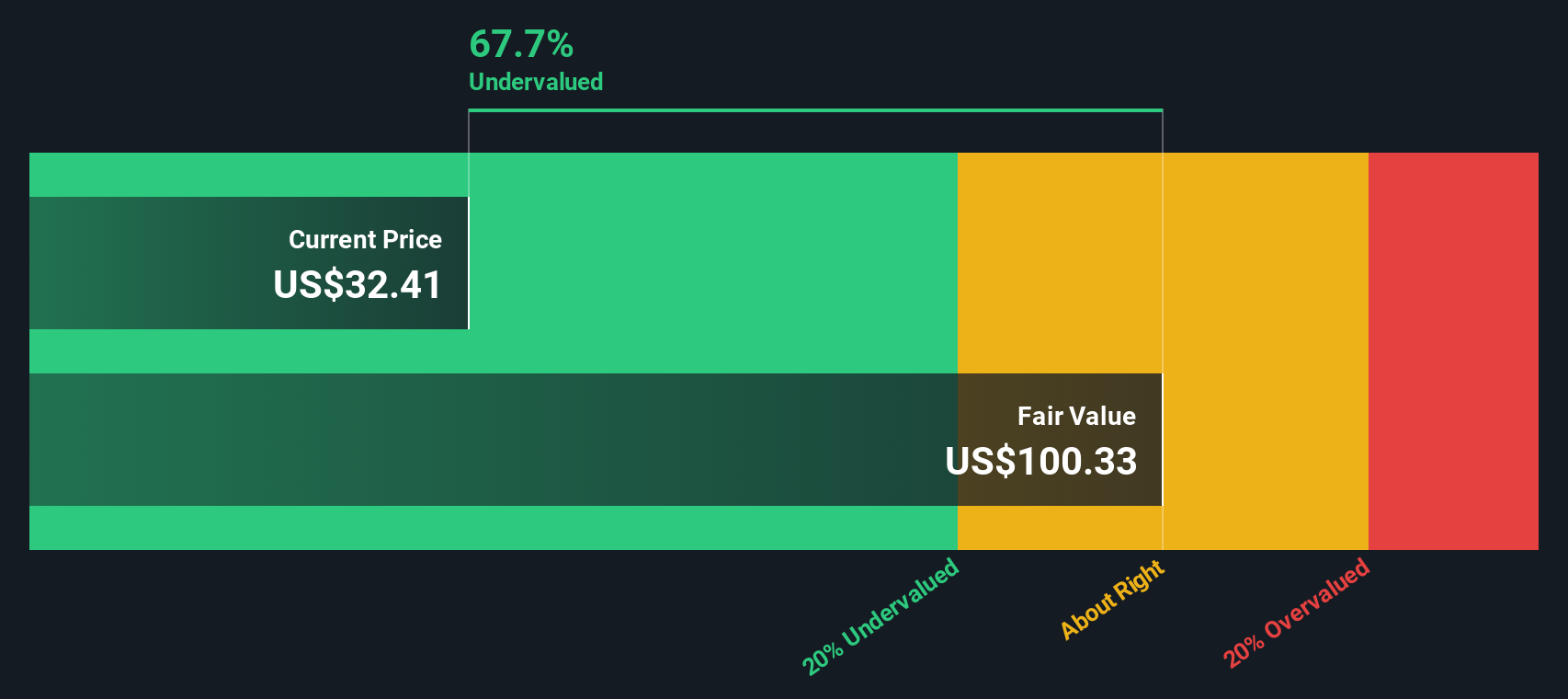

Using the 2 Stage Free Cash Flow to Equity model and discounting all future cash flows to present value, the DCF analysis assigns CNX Resources an intrinsic value of $119.25 per share. Based on this method, the stock is currently trading at a 71.5% discount to its calculated intrinsic value, indicating a significant undervaluation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CNX Resources is undervalued by 71.5%. Track this in your watchlist or portfolio, or discover 845 more undervalued stocks based on cash flows.

Approach 2: CNX Resources Price vs Earnings

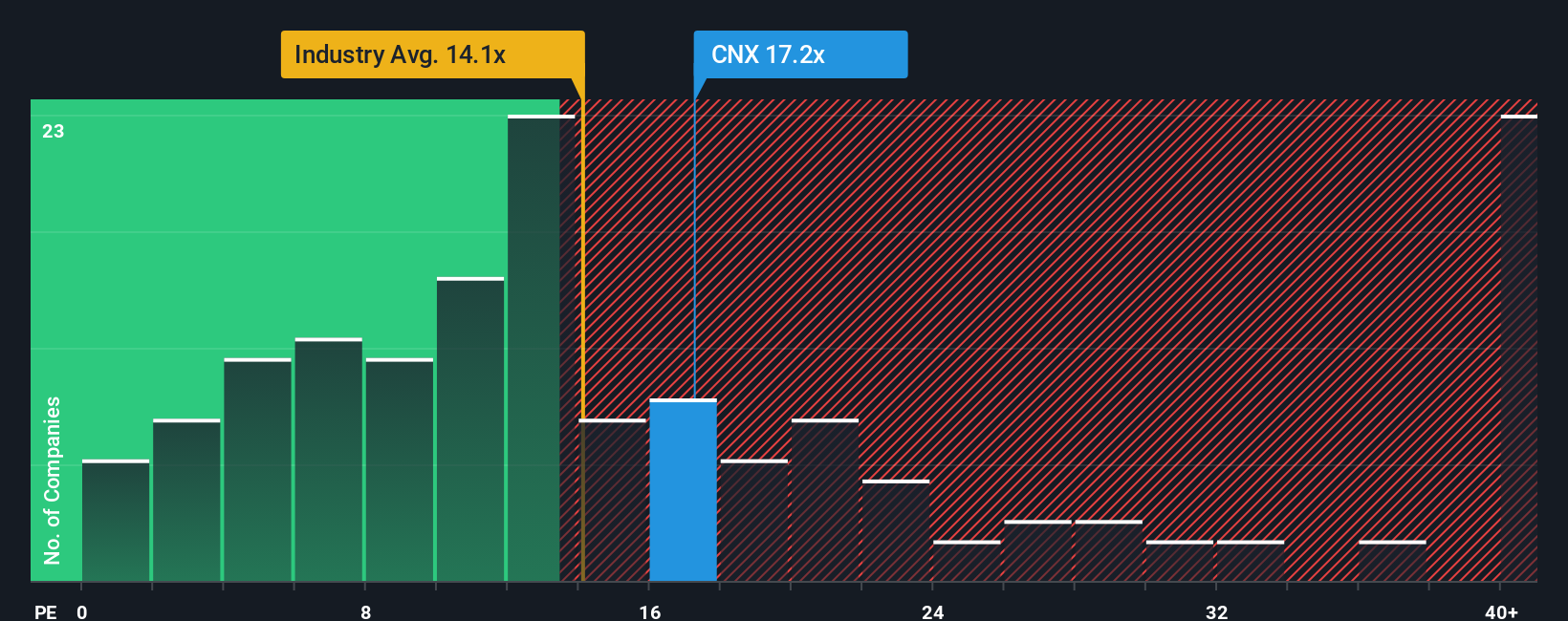

The Price-to-Earnings (PE) ratio is a well-established metric for valuing profitable companies, as it directly ties a company's market value to its earnings. For investors, PE helps frame what the market is willing to pay today for a dollar of CNX Resources’ earnings, making it a standard way to compare businesses within the same sector.

While the PE ratio offers a quick snapshot, its interpretation depends on several factors. Higher growth companies generally command higher PE ratios, as future earnings are expected to increase. Conversely, firms with more risk or uncertain prospects tend to trade at lower PE multiples. Therefore, context matters because both growth expectations and company-specific risk should shape what counts as a “fair” PE.

CNX Resources is trading at a PE ratio of 15.7x. This sits above the Oil and Gas industry average of 12.8x, and higher than the average PE of its closest peers at 13.0x. However, Simply Wall St’s proprietary “Fair Ratio” for CNX Resources is 20.5x. The Fair Ratio is a more nuanced benchmark that reflects not just comparable company multiples, but also CNX’s specific earnings growth, profit margins, risk profile, industry positioning, and market capitalization. By accounting for these factors, the Fair Ratio goes further than a simple industry or peer comparison and offers a more tailored assessment of what investors should reasonably pay for CNX’s earnings.

Since CNX’s actual PE of 15.7x is well below the calculated Fair Ratio of 20.5x, this methodology points to its shares being undervalued by the market.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CNX Resources Narrative

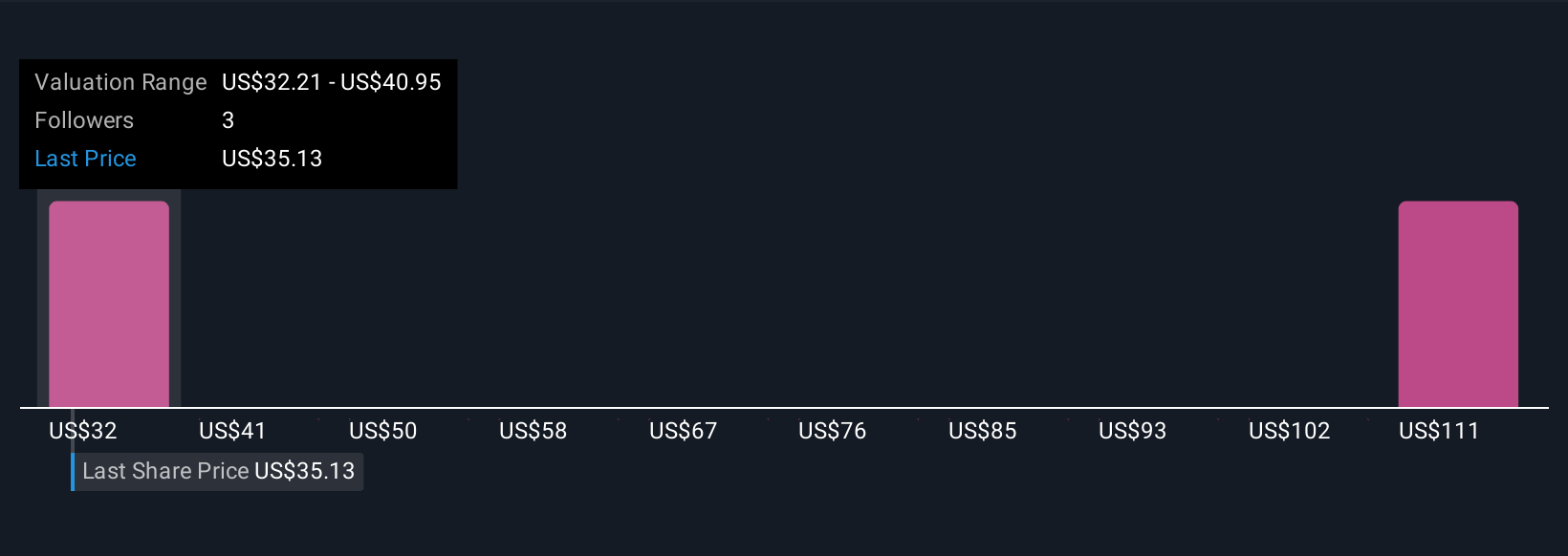

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, your perspective grounded in real-world trends, that connects what’s happening at CNX Resources to your financial outlook and a justified fair value. Instead of just focusing on traditional valuation ratios, Narratives help you see the big picture by linking your business insights with how you think future revenues, margins, and earnings will evolve.

Narratives are easy to create and use on Simply Wall St’s Community page, where millions of investors share and refine their viewpoints. By building your Narrative, you can instantly compare your calculated Fair Value with the current share price, helping guide decisions to buy, hold, or sell. What’s more, your Narrative is dynamic, and when new developments like earnings, news, or policy changes hit, your assumptions and fair value update automatically.

With CNX Resources, for example, some investors project aggressive growth in data-driven natural gas demand and environmental markets, resulting in a Fair Value as high as $41.0, while others are more cautious about policy risks and future margin uncertainty, assigning a Bearish Fair Value of $24.0. Narratives let you make investment calls grounded in your own story and expectations, not just consensus.

Do you think there's more to the story for CNX Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives