- United States

- /

- Oil and Gas

- /

- NYSE:CNR

Can CNR's Dividend and Buyback Moves Offset Profit Pressure Amid Rising Sales?

Reviewed by Sasha Jovanovic

- Core Natural Resources reported third quarter 2025 results with sales increasing to US$1.00 billion, but net income fell sharply to US$31.6 million, alongside updated full-year sales guidance, a dividend declaration, and details on its ongoing share repurchase program.

- Despite significant revenue growth, the company experienced a meaningful reduction in profitability and posted a net loss over the nine-month period, highlighting operational pressures amid robust sales and continued shareholder returns.

- We'll take a closer look at how Core's earnings decline and sales momentum affect its investment outlook and future expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Core Natural Resources Investment Narrative Recap

Shareholders in Core Natural Resources have had to believe in the company’s ability to leverage a rebound in energy infrastructure and volume growth, while managing the inherent risks of market volatility and ongoing regulatory headwinds facing fossil producers. The third quarter’s sharp net income decline, despite robust sales, puts the spotlight on margin pressure, but doesn’t materially shift the key near-term catalyst: sustained operational recovery at critical mining assets, especially Leer South, or the central risk, cost control and execution during volatile market cycles.

Among recent announcements, the updated full-year sales guidance stands out, now targeting between 83.4 million and 87.8 million tons sold in 2025. This provides investors with a tangible milestone tied directly to revenue momentum, reinforcing short-term optimism but reminding us that execution on volume targets is crucial to supporting cash flows and future earnings amid margin uncertainty.

By contrast, investors should also keep in mind the increased sensitivity of Core’s profitability to disruptions or delays at its largest mining operations...

Read the full narrative on Core Natural Resources (it's free!)

Core Natural Resources' narrative projects $5.1 billion revenue and $920.4 million earnings by 2028. This requires 15.9% yearly revenue growth and a $899.8 million earnings increase from $20.6 million today.

Uncover how Core Natural Resources' forecasts yield a $113.62 fair value, a 30% upside to its current price.

Exploring Other Perspectives

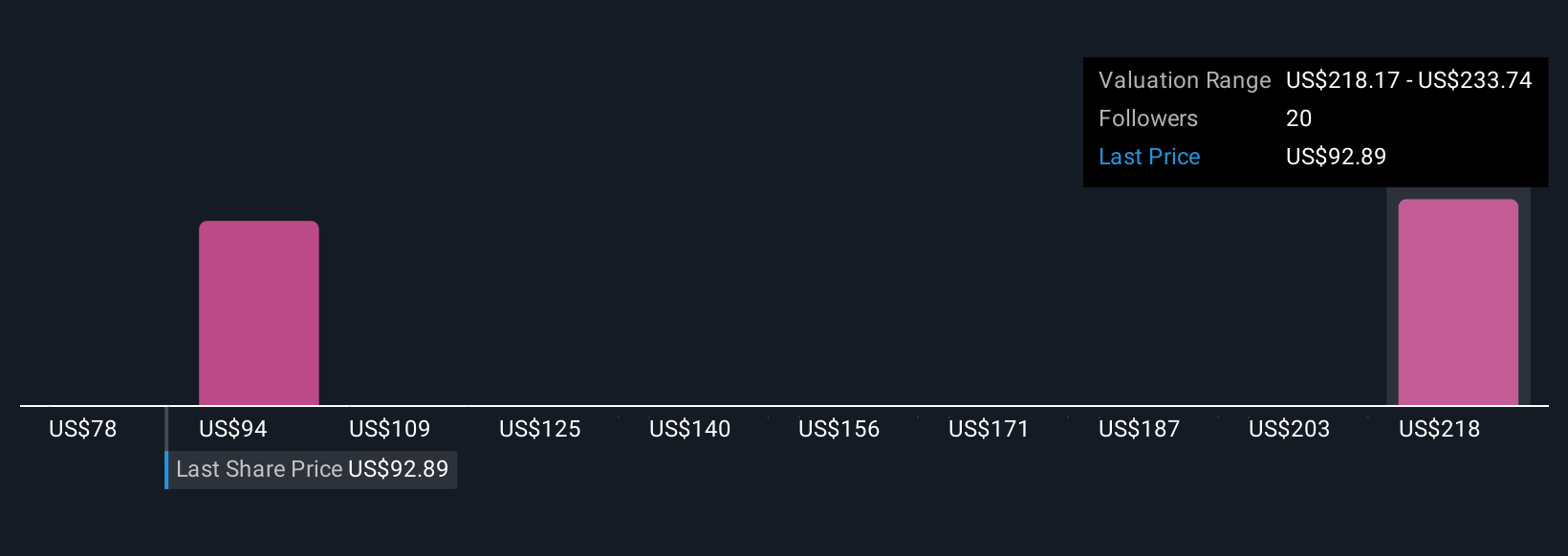

Simply Wall St Community members’ fair value estimates for Core Natural Resources range from US$110 to US$282.70, based on 3 independent models. While opinions vary widely, the company’s margin pressures and recent profit volatility raise important questions about longer-term earnings stability and resilience; explore several viewpoints to fully understand the differing rationales.

Explore 3 other fair value estimates on Core Natural Resources - why the stock might be worth over 3x more than the current price!

Build Your Own Core Natural Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Core Natural Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Core Natural Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Core Natural Resources' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNR

Core Natural Resources

Produces, sells, and exports metallurgical and thermal coals in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives