- United States

- /

- Oil and Gas

- /

- NYSE:CNR

A Look at Core Natural Resources (CNR) Valuation Following Recent Share Price Climb

Reviewed by Simply Wall St

Core Natural Resources (CNR) shares recently caught investor attention following a steady climb over the past week, gaining 13% even as the stock remains down for the year. The move comes amid ongoing discussions about the company's value and growth prospects.

See our latest analysis for Core Natural Resources.

Even after this recent surge, Core Natural Resources' share price still shows a 17% decline for the year. However, momentum has picked up in the past week as perceptions of risk and growth potential shift. Investors weighing both the long three-year total shareholder return of nearly 60% and the more challenging 12-month stretch can see why the stock remains one to watch.

If the latest moves in CNR have you considering where momentum might surface next, now is a great time to broaden your investing lens and discover fast growing stocks with high insider ownership

With analysts seeing a notable discount to fair value and recent numbers signaling a potential turnaround, investors may wonder whether Core Natural Resources is an undervalued opportunity or if the market has already factored in the company's future growth prospects.

Most Popular Narrative: 21.3% Undervalued

With Core Natural Resources closing at $89.41 and the narrative consensus placing its fair value at $113.63, there is a substantial gap between current trading and expected worth. The stage is set for big moves, particularly as analyst expectations and recent buyback activity fuel investor debate.

Robust energy demand growth from domestic and emerging markets, most notably driven by increased power needs for AI/data centers and infrastructure expansion in Asia, are expected to create multi-year tailwinds for Core's coal products. This positions the company for sustained increases in contracted sales volumes and topline revenue.

Curious about what’s driving this ambitious fair value? The story features bold forecasts for revenue growth, future profit margins, and a striking shift in core earnings. Find out which blockbuster financial projections underpin these valuations. The real surprise is in the projected transformation and the numbers behind it.

Result: Fair Value of $113.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainty and growing ESG pressures could quickly challenge these optimistic assumptions if there is a shift in market or policy sentiment.

Find out about the key risks to this Core Natural Resources narrative.

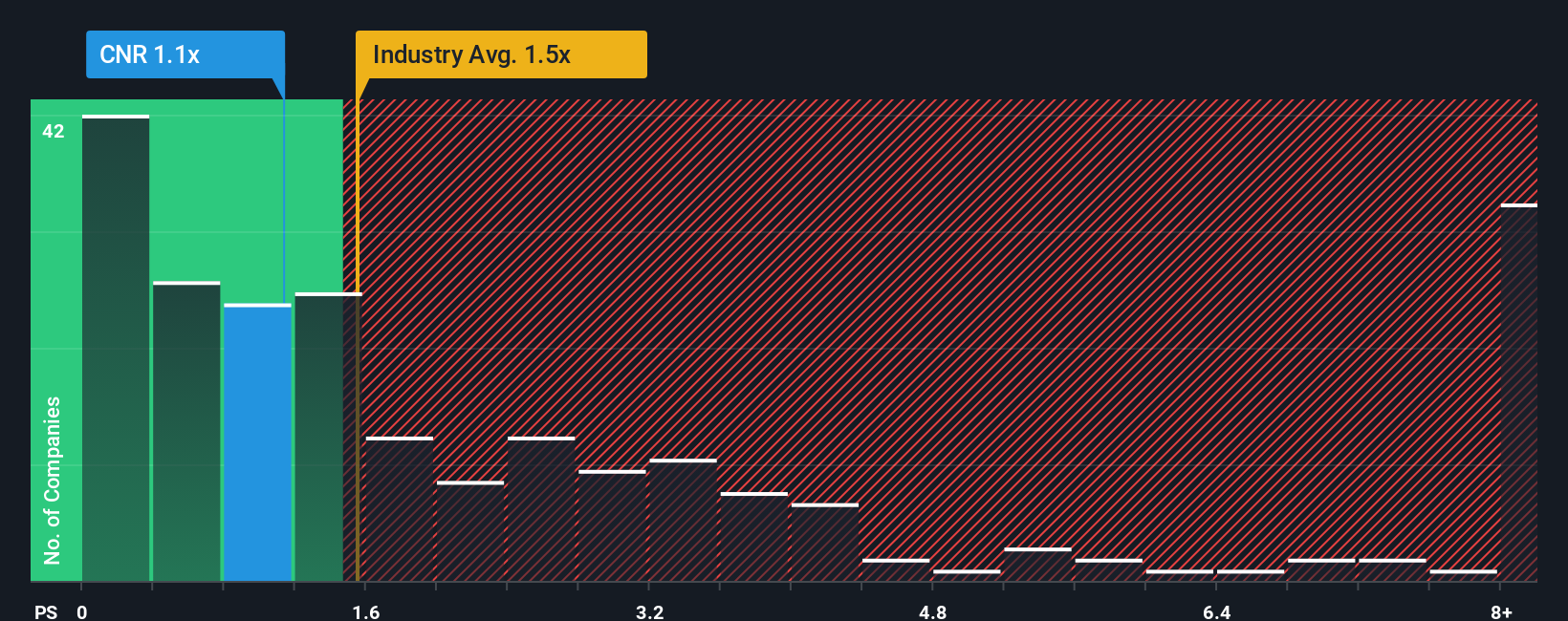

Another View: Comparing Multiples

Looking at Core Natural Resources through its price-to-sales ratio of 1.2x, the stock actually appears cheaper than its industry average of 1.5x and its peer average of 5.2x. However, when measured against its fair ratio of 0.8x, this suggests the market might still be pricing in some risk or growth expectations. Are investors getting real value, or is caution still warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Natural Resources Narrative

If you see things differently or want to dig into the numbers yourself, it's easy to shape your own perspective in just a few minutes, so why not Do it your way

A great starting point for your Core Natural Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons and catch unique opportunities before others do by using the right screener. Let these handpicked ideas give your investing journey a powerful edge.

- Uncover stocks offering robust income potential when you check out these 16 dividend stocks with yields > 3% and see which businesses deliver yields above 3%.

- Jump on the AI boom by using these 24 AI penny stocks to spot innovative companies driving tomorrow's most transformative technologies.

- Take advantage of attractive valuations with these 870 undervalued stocks based on cash flows to identify companies trading well below their intrinsic value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNR

Core Natural Resources

Produces, sells, and exports metallurgical and thermal coals in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives