Stock Analysis

- United States

- /

- Energy Services

- /

- NYSE:CLB

Why We're Not Concerned About Core Laboratories Inc.'s (NYSE:CLB) Share Price

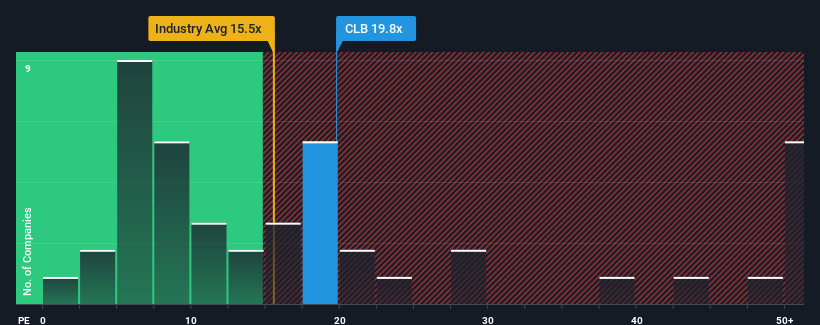

Core Laboratories Inc.'s (NYSE:CLB) price-to-earnings (or "P/E") ratio of 19.8x might make it look like a sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Core Laboratories has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Core Laboratories

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Core Laboratories' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 87% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 32% per annum during the coming three years according to the eight analysts following the company. With the market only predicted to deliver 11% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Core Laboratories' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Core Laboratories maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Core Laboratories, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Core Laboratories is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NYSE:CLB

Core Laboratories

Core Laboratories Inc. provides reservoir description and production enhancement services and products to the oil and gas industry in the United States, and internationally.

Proven track record with adequate balance sheet.