- United States

- /

- Oil and Gas

- /

- NYSE:BTU

Will Peabody Energy's (BTU) New Board Appointments Shift Its Strategy in a Changing Industry?

Reviewed by Sasha Jovanovic

- Peabody Energy recently appointed Georganne Hodges and Clayton Walker to its Board of Directors, effective November 19, 2025, adding extensive leadership experience from the energy and mining sectors.

- Their combined backgrounds in finance, operations, and international project development could reflect a Board focus on operational excellence and governance at a time of industry transition.

- Now, let's explore how the addition of two highly experienced board members could influence Peabody's investment outlook and future direction.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Peabody Energy Investment Narrative Recap

To be a shareholder in Peabody Energy, you need to believe that coal remains a vital contributor to the global energy mix in the near term, driven by recent US policy support, growing domestic power demand, and disciplined international coal markets. The appointments of Georganne Hodges and Clayton Walker to the board bring deep operational and financial expertise, but this news does not materially change the most significant short-term catalyst, tight US coal supply-demand, nor does it address the ongoing secular risk from global decarbonization efforts that could shrink Peabody’s addressable market.

Among recent announcements, Peabody’s affirmation of quarterly dividends at US$0.075 per share stands out, signaling a commitment to returning value to shareholders despite a recent net loss and declining revenues. This reinforces the importance of near-term cash flow and reliable demand, even as the industry’s long-term outlook faces structural headwinds and evolving investor priorities.

However, if global momentum for renewables accelerates, investors should be aware that…

Read the full narrative on Peabody Energy (it's free!)

Peabody Energy is projected to reach $4.9 billion in revenue and $468.2 million in earnings by 2028. This requires 6.4% annual revenue growth and an increase in earnings of $327 million from the current level of $140.9 million.

Uncover how Peabody Energy's forecasts yield a $34.47 fair value, a 33% upside to its current price.

Exploring Other Perspectives

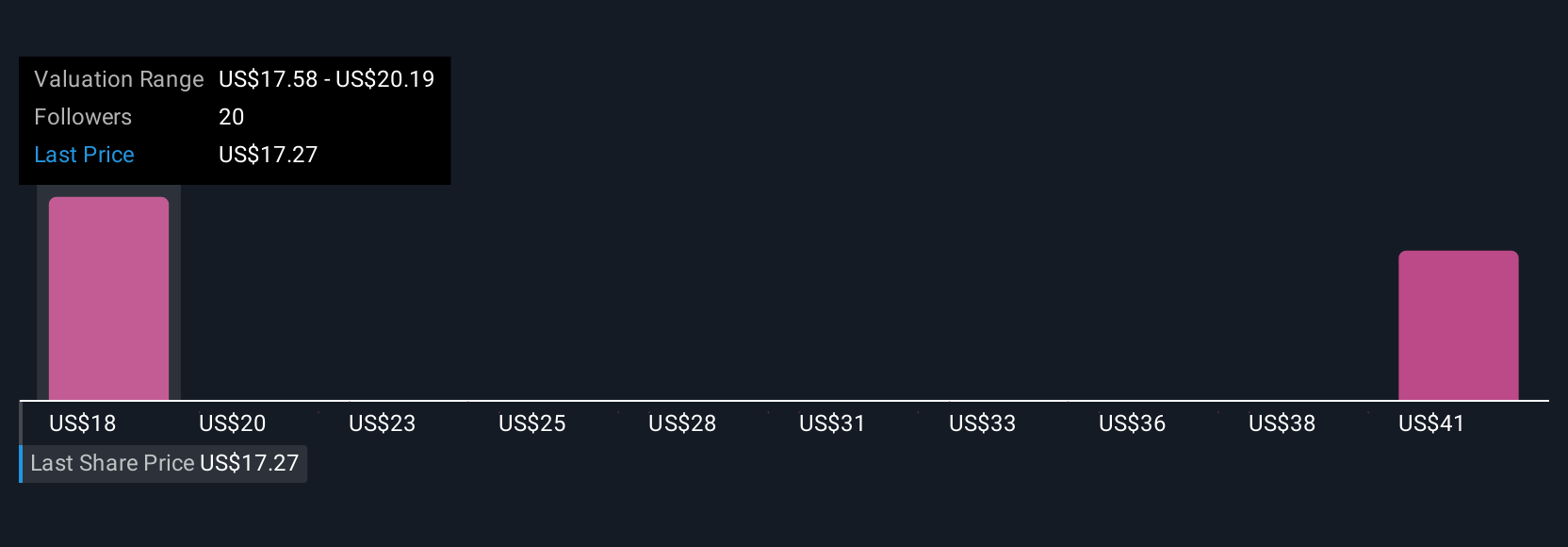

Five members of the Simply Wall St Community give fair value estimates for Peabody Energy ranging from US$24.00 to US$86.10 per share. With these diverse views in mind, consider how persistent regulatory and environmental risks could limit future earnings potential and influence long-term value. Explore several alternative viewpoints for a more complete picture.

Explore 5 other fair value estimates on Peabody Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Peabody Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peabody Energy research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Peabody Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peabody Energy's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BTU

Undervalued with adequate balance sheet.

Market Insights

Community Narratives