- United States

- /

- Oil and Gas

- /

- NYSE:BTU

Easy Come, Easy Go: How Peabody Energy (NYSE:BTU) Shareholders Got Unlucky And Saw 88% Of Their Cash Evaporate

It's nice to see the Peabody Energy Corporation (NYSE:BTU) share price up 21% in a week. But that doesn't change the fact that the returns over the last year have been stomach churning. To wit, the stock has dropped 88% over the last year. It's not uncommon to see a bounce after a drop like that. The bigger issue is whether the company can sustain the momentum in the long term.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Peabody Energy

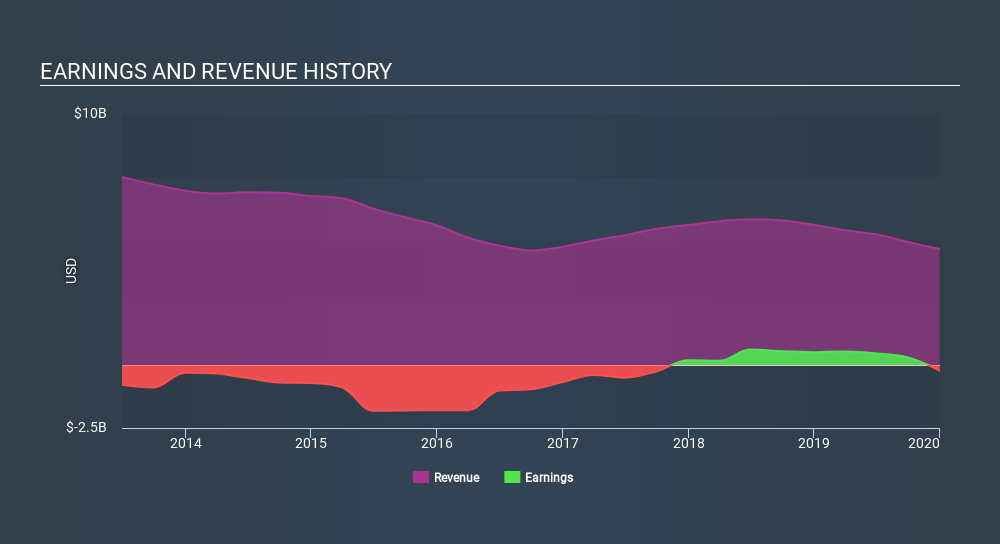

Because Peabody Energy made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Peabody Energy's revenue didn't grow at all in the last year. In fact, it fell 17%. That's not what investors generally want to see. The share price fall of 88% in a year tells the story. Holders should not lose the lesson: loss making companies should grow revenue. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Peabody Energy shareholders are down 88% for the year, falling short of the market return. Meanwhile, the broader market slid about 13%, likely weighing on the stock. The three-year loss of 49% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Peabody Energy that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:BTU

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives