- United States

- /

- Oil and Gas

- /

- NYSE:BKV

How BKV's New East Texas CCS Project With a Major Partner Has Changed Its Investment Story

Reviewed by Simply Wall St

- BKV Corporation recently executed an agreement with a major midstream energy company to develop a new carbon capture and sequestration project at an existing East Texas natural gas processing facility, expanding upon prior collaborations in the region.

- This development both broadens BKV’s CCS portfolio and underlines the company’s growing focus on sustainable energy solutions alongside recognition for excellence in customer service.

- We’ll explore how the expansion of BKV’s carbon capture initiatives is shaping the company’s broader investment narrative.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is BKV's Investment Narrative?

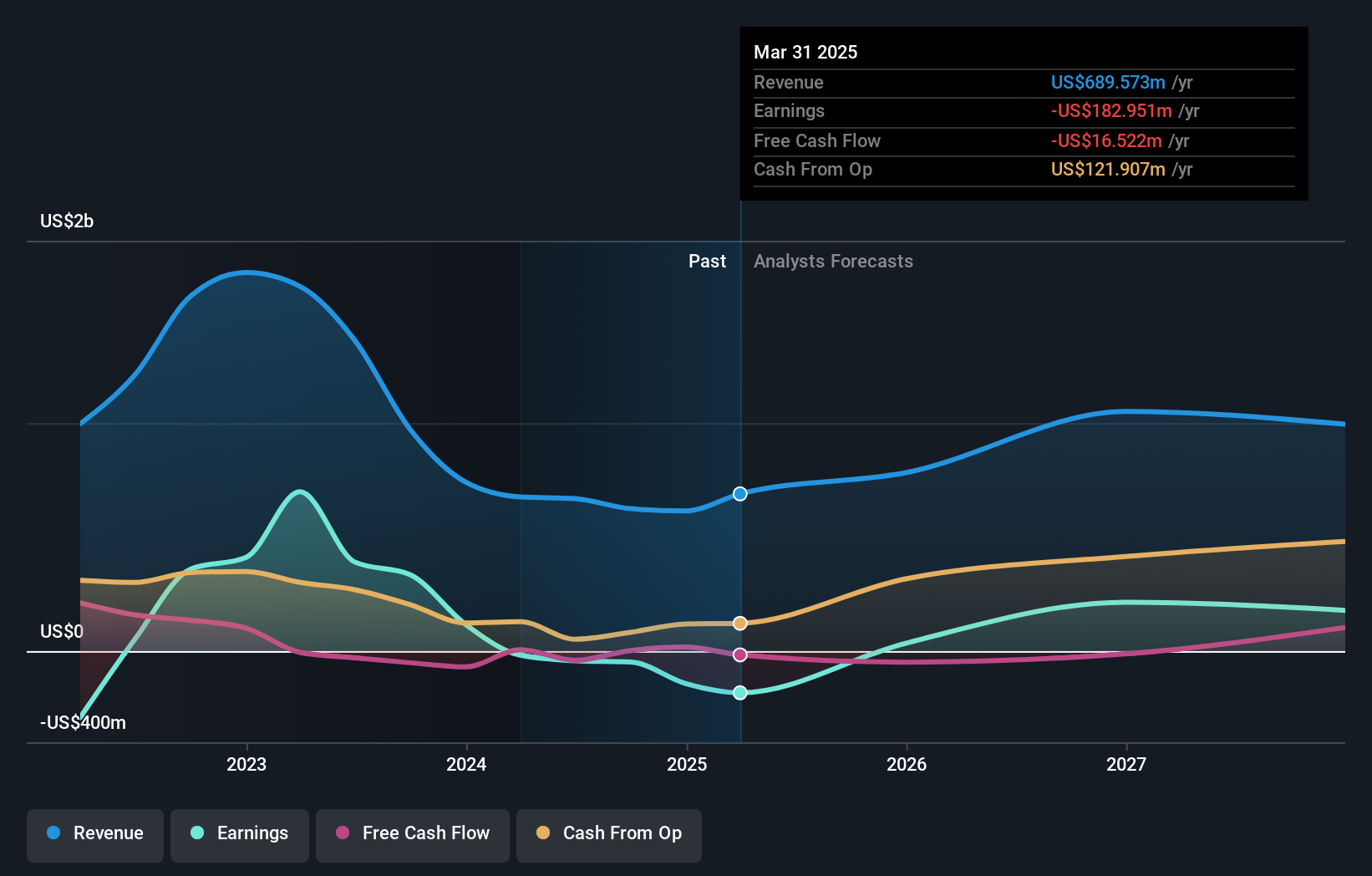

To be a shareholder in BKV right now, you need to see the company as a long-term bet on carbon capture and sustainable energy, amid ongoing financial losses and recent market headwinds. The newly announced CCS project in East Texas fits directly into BKV’s emerging theme of building a broader carbon capture, utilization and sequestration (CCUS) portfolio, this matters because expanding operational projects may support future revenue growth and signal a shift toward a more mature, diversified energy model. The project, while not an immediate fix, does represent incremental progress on the company’s primary catalyst: turning innovative CCS initiatives into operational and, eventually, financial success. However, with continued net losses, weak share price performance this year, and recent index removals still in play, risks around unprofitability, execution delays, and uncertain market sentiment remain front and center. The news adds credibility to BKV’s ambitions but doesn’t materially change the current risk profile or speed up short-term catalysts just yet.

But with index removals and ongoing losses, there’s a risk you should keep in mind.

Exploring Other Perspectives

Explore 2 other fair value estimates on BKV - why the stock might be worth as much as 46% more than the current price!

Build Your Own BKV Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BKV research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free BKV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BKV's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BKV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKV

BKV

Produces and sells natural gas in the Barnett Shale in the Fort Worth Basin of Texas and in the Marcellus Shale in the Appalachian Basin of Northeast Pennsylvania.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives