Stock Analysis

- United States

- /

- Oil and Gas

- /

- NYSE:CIVI

Bonanza Creek Energy (NYSE:BCEI) Has A Somewhat Strained Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk'. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Bonanza Creek Energy, Inc. (NYSE:BCEI) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Bonanza Creek Energy

What Is Bonanza Creek Energy's Net Debt?

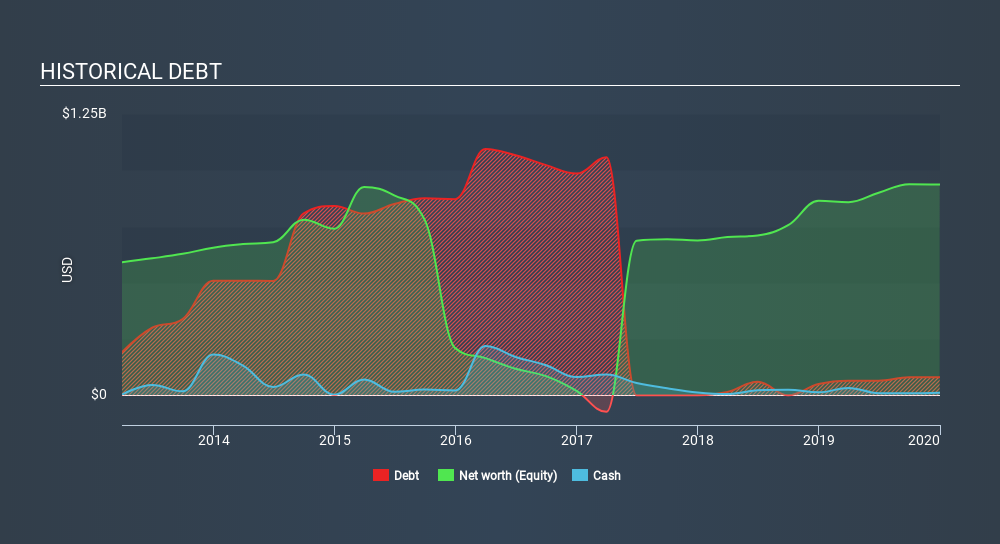

As you can see below, at the end of December 2019, Bonanza Creek Energy had US$80.0m of debt, up from US$50.0m a year ago. Click the image for more detail. On the flip side, it has US$11.0m in cash leading to net debt of about US$69.0m.

How Strong Is Bonanza Creek Energy's Balance Sheet?

We can see from the most recent balance sheet that Bonanza Creek Energy had liabilities of US$104.7m falling due within a year, and liabilities of US$164.9m due beyond that. Offsetting these obligations, it had cash of US$11.0m as well as receivables valued at US$81.9m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$176.8m.

Bonanza Creek Energy has a market capitalization of US$320.5m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Bonanza Creek Energy's net debt is only 0.44 times its EBITDA. And its EBIT easily covers its interest expense, being 26.5 times the size. So we're pretty relaxed about its super-conservative use of debt. It is just as well that Bonanza Creek Energy's load is not too heavy, because its EBIT was down 49% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Bonanza Creek Energy's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last two years, Bonanza Creek Energy saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

On the face of it, Bonanza Creek Energy's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Bonanza Creek Energy stock a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Bonanza Creek Energy you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CIVI

Civitas Resources

An exploration and production company, focuses on the acquisition, development, and production of oil and natural gas in the Rocky Mountain region, primarily in the Field of the Denver-Julesburg Basin of Colorado.

Very undervalued average dividend payer.