- United States

- /

- Oil and Gas

- /

- NYSE:AMPY

Investors Don't See Light At End Of Amplify Energy Corp.'s (NYSE:AMPY) Tunnel And Push Stock Down 25%

The Amplify Energy Corp. (NYSE:AMPY) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

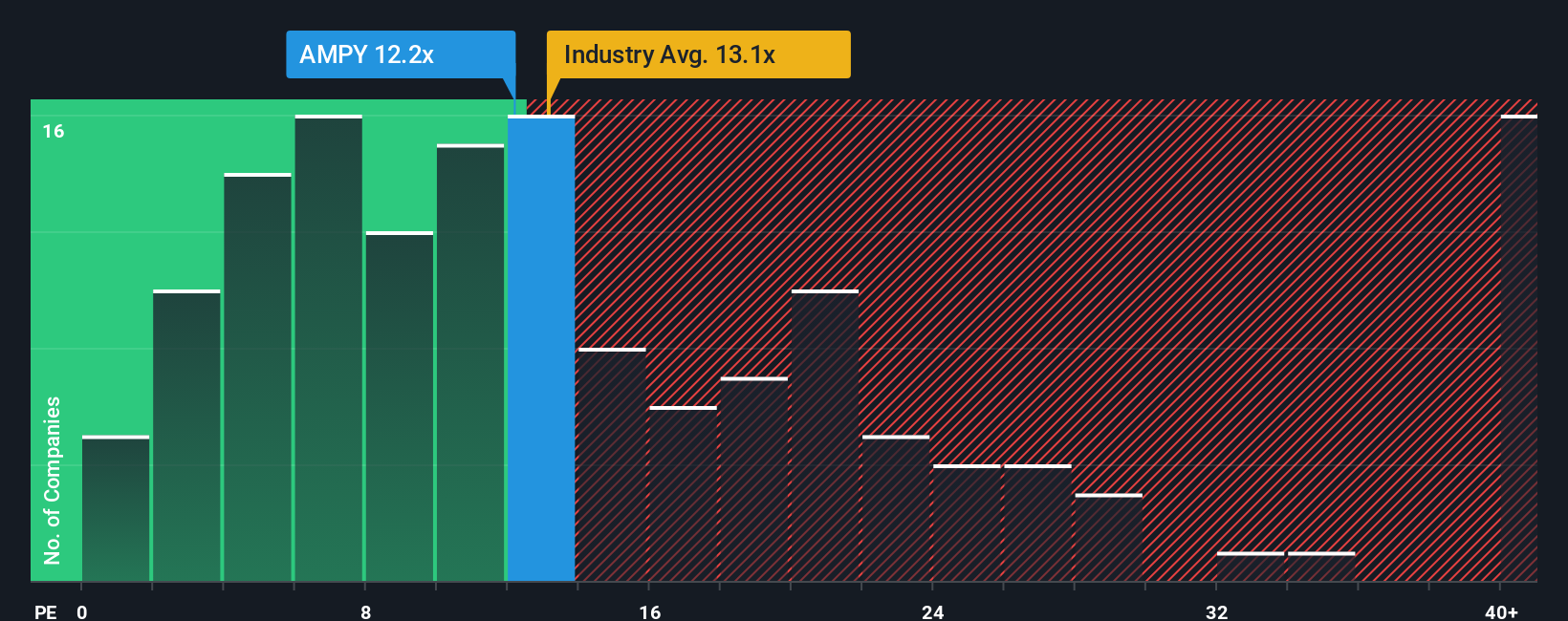

Since its price has dipped substantially, Amplify Energy's price-to-earnings (or "P/E") ratio of 12.2x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, Amplify Energy's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Amplify Energy

Is There Any Growth For Amplify Energy?

Amplify Energy's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 45%. Still, the latest three year period has seen an excellent 270% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 23% over the next year. Meanwhile, the broader market is forecast to expand by 15%, which paints a poor picture.

In light of this, it's understandable that Amplify Energy's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The softening of Amplify Energy's shares means its P/E is now sitting at a pretty low level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Amplify Energy maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 4 warning signs for Amplify Energy (1 doesn't sit too well with us!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Amplify Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMPY

Amplify Energy

Engages in the acquisition, development, exploitation, and production of oil and natural gas properties in the United States.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives