- United States

- /

- Energy Services

- /

- NYSE:AESI

Will Atlas Energy Solutions’ (AESI) Interim Logistics Leadership Test Its Growth Strategy or Reinforce Management Depth?

Reviewed by Sasha Jovanovic

- On October 21, 2025, Atlas Energy Solutions announced that Chris Scholla, EVP & President of Sand and Logistics, departed from the company, with CEO John Turner assuming interim leadership of sand and logistics operations during the search for a successor.

- This leadership transition comes at a pivotal moment for Atlas, as sand and logistics represent key operational segments supporting the company’s growth and diversification strategy.

- We'll review how this unexpected change in sand and logistics leadership may influence Atlas Energy Solutions' long-term investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Atlas Energy Solutions Investment Narrative Recap

To be a shareholder in Atlas Energy Solutions, one must believe in the company's ability to capitalize on its integrated sand and logistics platform, while riding any future recovery in Permian Basin activity and maintaining operational discipline. The recent departure of the EVP & President of Sand and Logistics is unlikely to materially disrupt Atlas’s most important short-term catalyst, potential margin gains from tighter in-basin sand supply, but it may amplify execution risks in a volatile market where demand uncertainty remains the biggest concern.

Of recent announcements, the upcoming Q3 2025 earnings report, scheduled for November 3, stands out as the most relevant. Investors will be closely watching for updates on sand and logistics performance as well as management’s comments on operational continuity and customer activity precisely because these segments are exposed to shifting market dynamics and leadership transitions that may affect asset utilization and margins.

By contrast, one risk investors should be aware of involves the impact of persistent end-market volatility, which may yet influence...

Read the full narrative on Atlas Energy Solutions (it's free!)

Atlas Energy Solutions' forecast calls for $1.2 billion in revenue and $148.5 million in earnings by 2028. This assumes a 2.2% annual revenue growth rate and a $134.5 million increase in earnings from the current $14.0 million.

Uncover how Atlas Energy Solutions' forecasts yield a $13.68 fair value, a 11% upside to its current price.

Exploring Other Perspectives

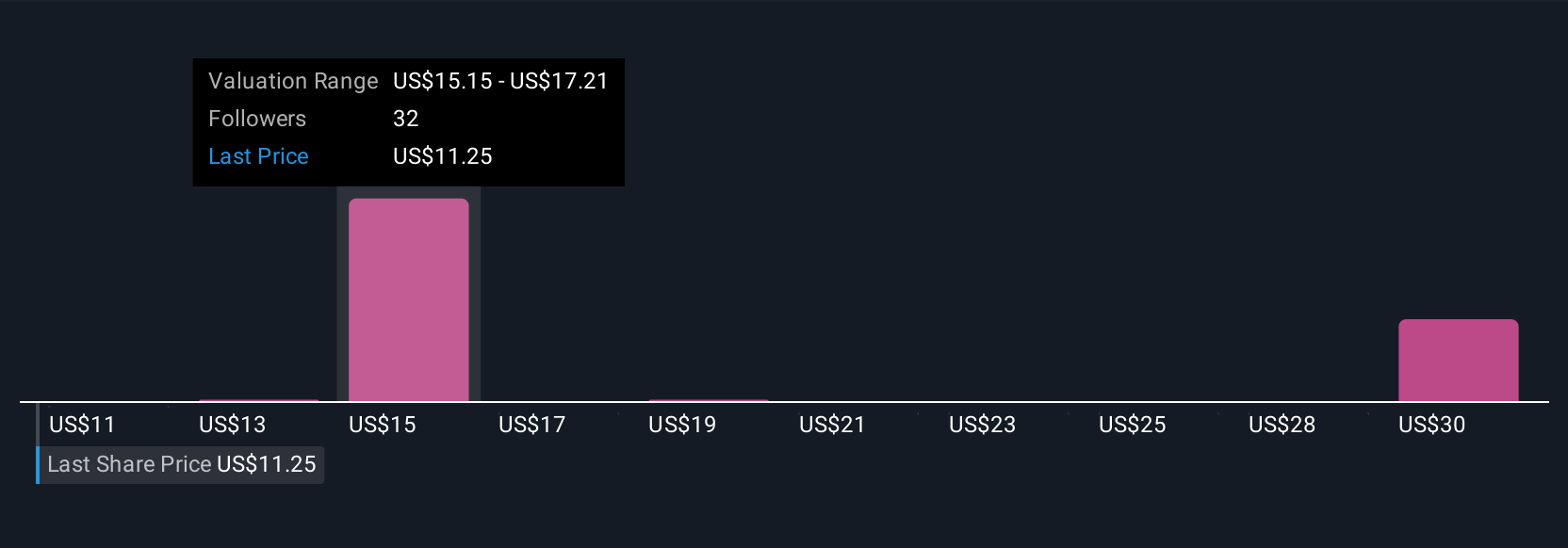

Simply Wall St Community valuations for Atlas Energy Solutions range from US$10 to US$29.63, with eight individual views represented. While broad optimism exists for significant future earnings growth, customers’ pauses in the Permian Basin could expose the stock to extended periods of market weakness.

Explore 8 other fair value estimates on Atlas Energy Solutions - why the stock might be worth 19% less than the current price!

Build Your Own Atlas Energy Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlas Energy Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Atlas Energy Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlas Energy Solutions' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AESI

Atlas Energy Solutions

Engages in the production, processing, and sale of mesh and sand used as a proppant during the well completion process in the Permian Basin of West Texas and New Mexico.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives