- United States

- /

- Energy Services

- /

- NYSE:AESI

Take Care Before Diving Into The Deep End On Atlas Energy Solutions Inc. (NYSE:AESI)

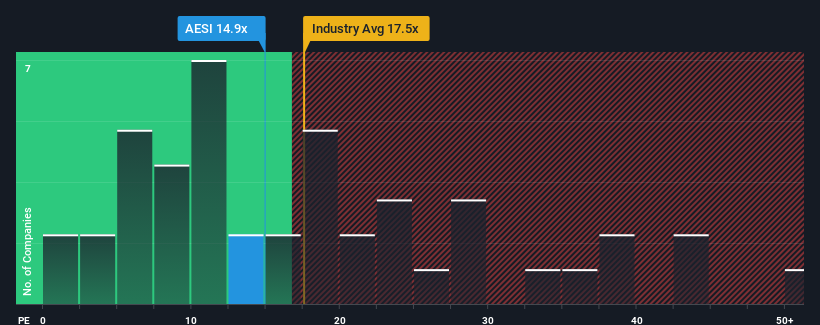

Atlas Energy Solutions Inc.'s (NYSE:AESI) price-to-earnings (or "P/E") ratio of 14.9x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 18x and even P/E's above 32x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Atlas Energy Solutions has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Atlas Energy Solutions

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Atlas Energy Solutions' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's bottom line. Even so, admirably EPS has lifted 110,073% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 27% per annum during the coming three years according to the nine analysts following the company. With the market only predicted to deliver 11% per annum, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Atlas Energy Solutions' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Atlas Energy Solutions' P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Atlas Energy Solutions currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Having said that, be aware Atlas Energy Solutions is showing 4 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AESI

Atlas Energy Solutions

Engages in the production, processing, and sale of mesh and sand used as a proppant during the well completion process in the Permian Basin of West Texas and New Mexico.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives