- United States

- /

- Oil and Gas

- /

- OTCPK:VTNR.Q

Market Cool On Vertex Energy, Inc.'s (NASDAQ:VTNR) Revenues Pushing Shares 26% Lower

The Vertex Energy, Inc. (NASDAQ:VTNR) share price has fared very poorly over the last month, falling by a substantial 26%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

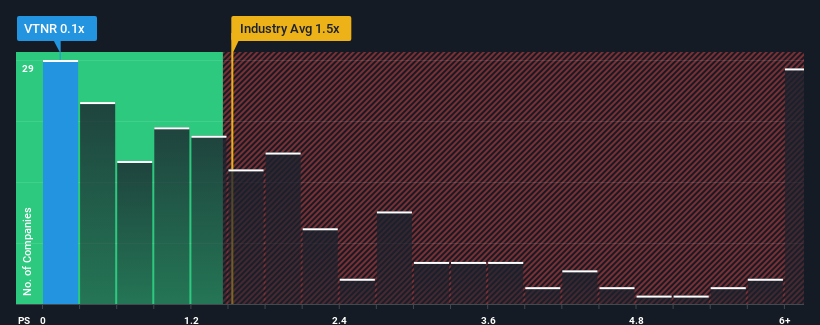

Since its price has dipped substantially, given about half the companies operating in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") above 1.5x, you may consider Vertex Energy as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Vertex Energy

What Does Vertex Energy's P/S Mean For Shareholders?

Vertex Energy certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Vertex Energy's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Vertex Energy?

In order to justify its P/S ratio, Vertex Energy would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth will show minor resilience over the next three years growing only by 4.0% per annum. While this isn't a particularly impressive figure, it should be noted that the the industry is expected to decline by 3.2% per year.

With this in consideration, we find it intriguing that Vertex Energy's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Vertex Energy's recently weak share price has pulled its P/S back below other Oil and Gas companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Vertex Energy's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Vertex Energy is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Vertex Energy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:VTNR.Q

Vertex Energy

An energy transition company, that focuses on the production and distribution of conventional and alternative fuels.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives