- United States

- /

- Energy Services

- /

- NasdaqGS:PTEN

What Patterson-UTI Energy (PTEN)'s $1 Billion Buyback Completion Means For Shareholders

Reviewed by Sasha Jovanovic

- Patterson-UTI Energy recently reported third quarter 2025 earnings, showing sales of US$1,175.95 million and a net loss of US$36.4 million, alongside an update that it has repurchased 92,493,740 shares for a total of US$1,003.63 million under its ongoing buyback program announced in 2013.

- The company's multi-year buyback effort, representing more than one-third of its outstanding shares, highlights a significant long-term shareholder return initiative in a period marked by narrowed quarterly losses.

- Next, we'll explore how the completion of a US$1 billion buyback shapes Patterson-UTI Energy's current investment outlook and risk profile.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Patterson-UTI Energy Investment Narrative Recap

To be a shareholder in Patterson-UTI Energy right now, you need to believe that industry demand for high-spec drilling and completion technology will overcome the current softness in activity and pressure on margins. The recently completed US$1 billion share buyback and narrowed quarterly losses offer some reassurance, but they do not materially change the short-term outlook, where weak rig demand remains the most important catalyst and ongoing revenue declines are the biggest near-term risk.

The announcement of reduced third quarter losses, US$36.4 million versus a much larger loss last year, stands out against the backdrop of persistent revenue declines. This trend keeps the focus on how effectively the company can manage through uncertain customer demand, especially as the broader market continues to face volatility and peer competition in digital and automation offerings is intensifying.

Yet, even as Patterson-UTI has returned a significant portion of capital to shareholders, investors should also be alert to the challenge that...

Read the full narrative on Patterson-UTI Energy (it's free!)

Patterson-UTI Energy's outlook forecasts $4.8 billion in revenue and $337.4 million in earnings by 2028. This scenario assumes an annual revenue decline of 1.3% and a $1.44 billion increase in earnings from the current level of -$1.1 billion.

Uncover how Patterson-UTI Energy's forecasts yield a $7.16 fair value, a 12% upside to its current price.

Exploring Other Perspectives

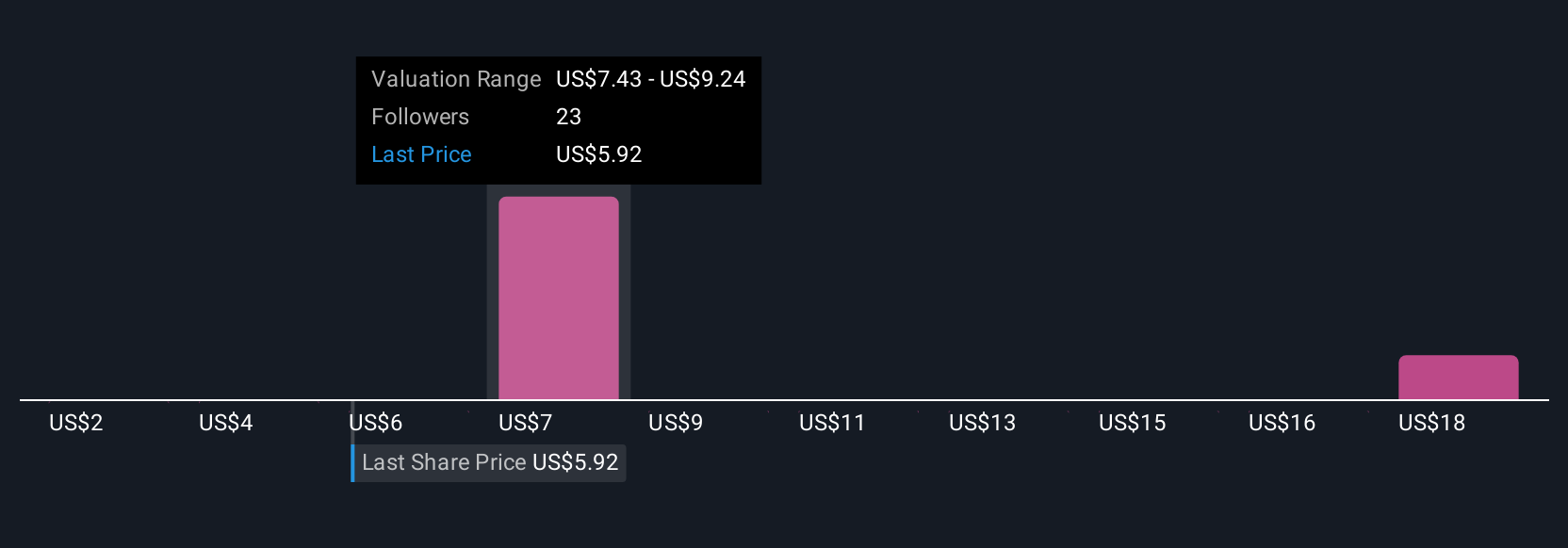

Four separate fair value estimates from the Simply Wall St Community range from US$2 to US$21.01 per share. With ongoing concerns about revenue declines and customer caution, you can see just how widely investor opinions can differ, explore several viewpoints to deepen your understanding.

Explore 4 other fair value estimates on Patterson-UTI Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Patterson-UTI Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patterson-UTI Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Patterson-UTI Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patterson-UTI Energy's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PTEN

Patterson-UTI Energy

Through its subsidiaries, provides drilling and completion services to oil and natural gas exploration and production companies in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives