- United States

- /

- Energy Services

- /

- NasdaqCM:PFIE

Should You Be Adding Profire Energy (NASDAQ:PFIE) To Your Watchlist Today?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Profire Energy (NASDAQ:PFIE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Profire Energy with the means to add long-term value to shareholders.

Check out our latest analysis for Profire Energy

Profire Energy's Improving Profits

Profire Energy has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Profire Energy's EPS skyrocketed from US$0.13 to US$0.20, in just one year; a result that's bound to bring a smile to shareholders. That's a commendable gain of 63%.

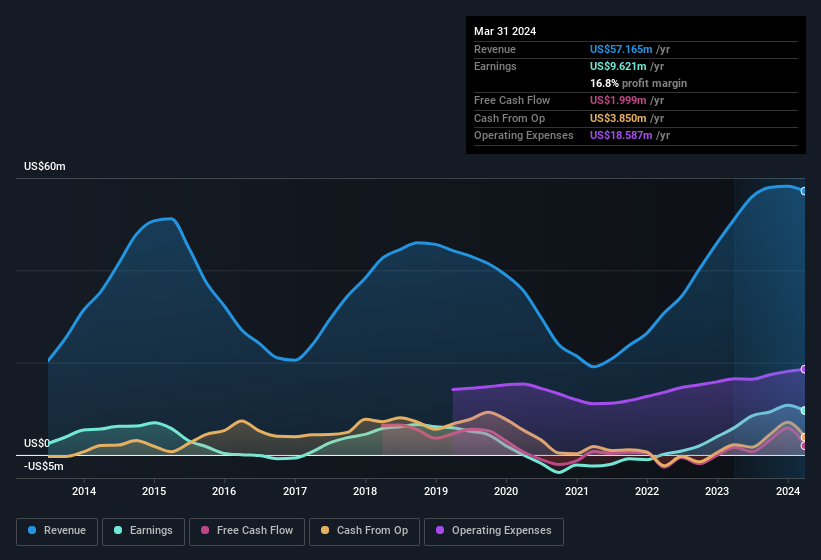

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Profire Energy shareholders is that EBIT margins have grown from 15% to 18% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Profire Energy is no giant, with a market capitalisation of US$67m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Profire Energy Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Profire Energy shares, in the last year. With that in mind, it's heartening that Ryan Oviatt, the Co-CEO, Co-President of the company, paid US$12k for shares at around US$1.43 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Profire Energy.

Along with the insider buying, another encouraging sign for Profire Energy is that insiders, as a group, have a considerable shareholding. To be specific, they have US$17m worth of shares. This considerable investment should help drive long-term value in the business. As a percentage, this totals to 25% of the shares on issue for the business, an appreciable amount considering the market cap.

Does Profire Energy Deserve A Spot On Your Watchlist?

For growth investors, Profire Energy's raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. So it's fair to say that this stock may well deserve a spot on your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Profire Energy (of which 1 makes us a bit uncomfortable!) you should know about.

Keen growth investors love to see insider activity. Thankfully, Profire Energy isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PFIE

Profire Energy

A technology company, engages in the engineering and design of burner, and combustion management systems and solutions for natural and forced draft applications in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives