- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAGP

Will Plains GP Holdings' (PAGP) Higher Profit on Lower Sales Shift Its Long-Term Narrative?

Reviewed by Sasha Jovanovic

- Plains GP Holdings, L.P. recently reported third quarter results, showing US$11.58 billion in sales and net income of US$83 million, both for the period ended September 30, 2025.

- Despite a decrease in sales compared to a year ago, the company's net income and earnings per share rose significantly, reflecting improved profitability.

- We'll explore how this higher net income, achieved even as sales declined, may influence Plains GP Holdings' long-term investment outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Plains GP Holdings Investment Narrative Recap

To be a shareholder in Plains GP Holdings, you need confidence in the company's ability to deliver resilient and growing earnings from its pure-play crude oil midstream operations, particularly as it increases exposure to the Permian Basin and fee-based contracts. The recent earnings beat, rising net income and EPS despite lower sales, bolsters the most important short-term catalyst of improved profitability, while risks tied to demand for North American crude and exposure to contract renegotiation remain; however, current news shows no material impact to these core drivers.

Among recent corporate moves, the Q3 2025 dividend announcement stands out given its relevance to earnings quality and capital allocation. With the quarterly distribution holding steady at US$0.38 per Class A share, Plains continues to signal confidence in its cash flow generation, although this payout needs to be monitored in context of free cash flow constraints from future capital spending and debt service.

By contrast, investors should also be aware of how future contract renegotiations could impact Plains’ earnings predictability and...

Read the full narrative on Plains GP Holdings (it's free!)

Plains GP Holdings' outlook anticipates $49.0 billion in revenue and $417.5 million in earnings by 2028. This requires a 0.9% annual revenue decline and a $445.5 million increase in earnings from the current level of -$28.0 million.

Uncover how Plains GP Holdings' forecasts yield a $20.62 fair value, a 15% upside to its current price.

Exploring Other Perspectives

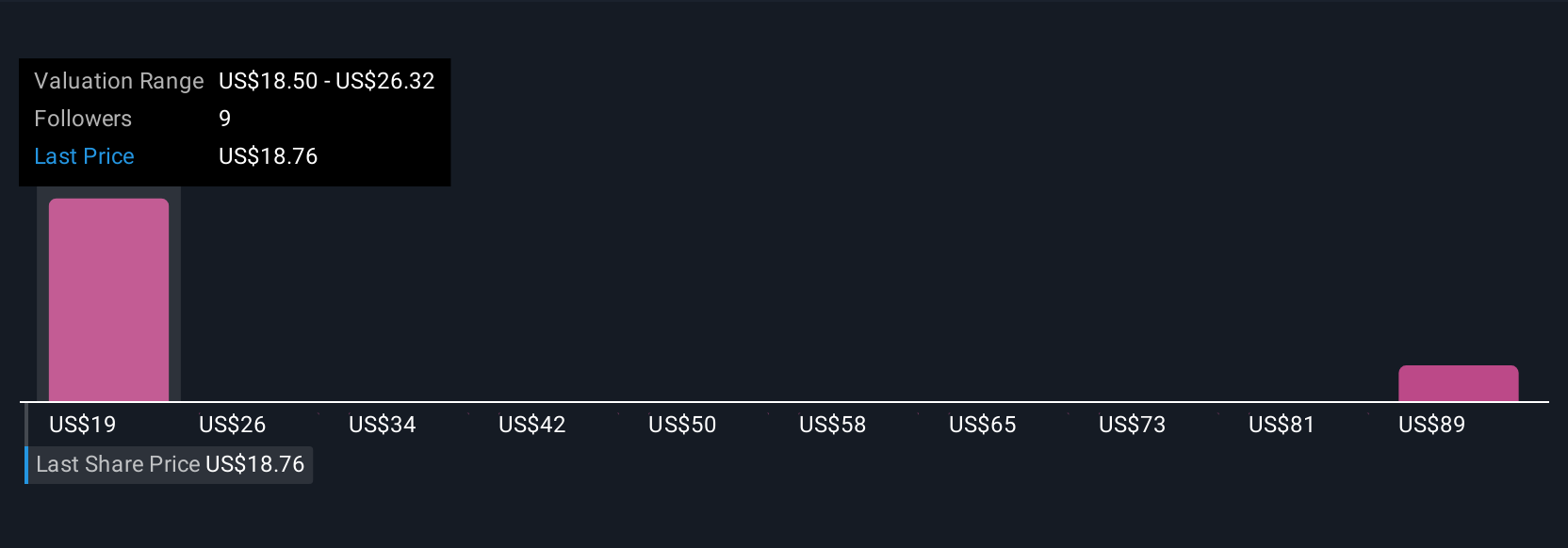

Simply Wall St Community fair value estimates for Plains range from US$17.50 to US$112.38 across 7 analyses. These differing views highlight how contract roll-offs and renegotiations could have big implications for revenue stability and growth, so it’s important to weigh a spectrum of opinions as you assess your outlook.

Explore 7 other fair value estimates on Plains GP Holdings - why the stock might be worth over 6x more than the current price!

Build Your Own Plains GP Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Plains GP Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Plains GP Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Plains GP Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAGP

Plains GP Holdings

Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives