- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAGP

A Fresh Look at Plains GP Holdings (PAGP) Valuation After $750M Debt Raise and Earnings Miss

Reviewed by Simply Wall St

Plains GP Holdings (PAGP) grabbed attention this week after two big developments: a $750 million senior notes offering and third-quarter earnings that landed shy of expectations. Investors are weighing the impact of new financing against the company’s recent results.

See our latest analysis for Plains GP Holdings.

Plains GP Holdings’ recent $750 million debt raise combined with mixed quarterly results has put the spotlight back on its resilience and growth path. While short-term price action showed a swift 5.7% jump over the past month, momentum has lagged over the last quarter. Still, the stock’s impressive 71.7% total return over three years reinforces long-term confidence in its business model.

If these kinds of moves have you wondering what’s next in the market, now’s the perfect moment to discover fast growing stocks with high insider ownership

With a recent capital raise and mixed earnings, investors are left asking the crucial question: Is Plains GP Holdings trading below its intrinsic value after the latest moves, or is the market already pricing in future growth?

Most Popular Narrative: 13.4% Undervalued

Based on the most widely followed narrative, Plains GP Holdings’ estimated fair value sits above its current share price. This suggests the stock’s upside potential remains underappreciated even after recent developments.

Increased capital allocation toward Permian Basin initiatives, including new lease connects, terminal expansions, and incremental pipeline interests like BridgeTex, directly leverages Plains' dominant footprint in the fastest-growing, lowest-cost U.S. oil field. This positions the company to capitalize on sustained high throughput volumes and resilient earnings as U.S. energy demand persists.

Curious what bold assumptions are fueling this narrative’s premium valuation? The secret mix involves future earnings targets, expanding margins, and a strikingly ambitious profit multiple. Dive in to see which financial leaps drive this enticing upside.

Result: Fair Value of $20.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in global energy demand or stricter regulations could threaten Plains GP Holdings’ growth story. These factors could potentially challenge the optimistic outlook investors have priced in.

Find out about the key risks to this Plains GP Holdings narrative.

Another View: Looking at Price Ratios

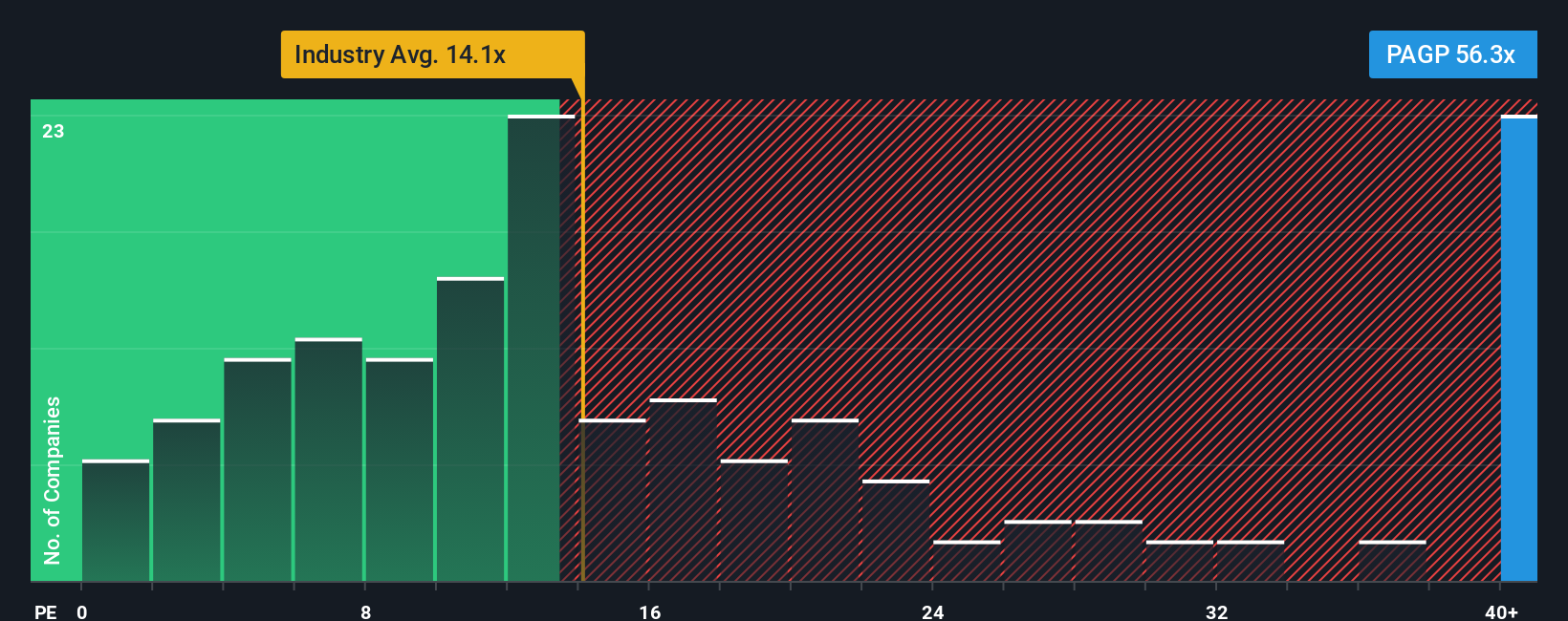

Switching to a price-to-earnings ratio lens reveals a more cautious story. Plains GP Holdings trades at 57x earnings, which outpaces both its peer average of 25.8x and the industry at 13.9x. This also exceeds the fair ratio of 28x, suggesting the stock is priced for high expectations. Is there more risk built in than investors realize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plains GP Holdings Narrative

If you think there’s another angle, or prefer crafting your own story from the latest numbers, you can shape a fresh perspective in just a few minutes: Do it your way

A great starting point for your Plains GP Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Don’t just focus on one winner when the market is full of unique growth stories. Give your portfolio an edge by searching for fresh ideas using these proven stock lists:

- Accelerate your potential returns by scanning for these 887 undervalued stocks based on cash flows, which features companies trading below their intrinsic value right now.

- Uncover passive income opportunities as you browse these 16 dividend stocks with yields > 3%, offering yields above 3 percent and ideal for investors seeking steady cash flow.

- Catch big trends in emerging healthcare technology with these 32 healthcare AI stocks, featuring companies at the forefront of AI-driven medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAGP

Plains GP Holdings

Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives