- United States

- /

- Oil and Gas

- /

- NasdaqGS:NFE

New Fortress Energy Inc.'s (NASDAQ:NFE) Shares Not Telling The Full Story

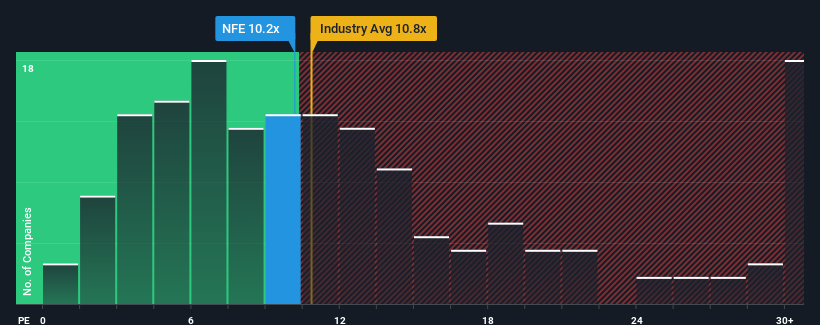

With a price-to-earnings (or "P/E") ratio of 10.2x New Fortress Energy Inc. (NASDAQ:NFE) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 32x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

New Fortress Energy certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for New Fortress Energy

What Are Growth Metrics Telling Us About The Low P/E?

New Fortress Energy's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 333%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 32% per year over the next three years. With the market only predicted to deliver 10% per year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that New Fortress Energy's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From New Fortress Energy's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that New Fortress Energy currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for New Fortress Energy (2 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if New Fortress Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NFE

New Fortress Energy

Operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026