- United States

- /

- Oil and Gas

- /

- NasdaqGS:NFE

Could New Fortress Energy's (NFE) UK Restructuring Plans Reveal Its Evolving Approach to Financial Stability?

Reviewed by Sasha Jovanovic

- In the past week, New Fortress Energy was reported to be considering a restructuring of its UK operations as an alternative to filing for Chapter 11 bankruptcy, according to Bloomberg News. This approach highlights the company's preference to address financial or operational challenges without entering formal bankruptcy proceedings, potentially affecting its business strategy in the UK.

- The proposed restructuring of UK operations could signal a shift in how New Fortress Energy manages financial stability, business continuity, and market presence in a key region.

- We'll now explore how the option to restructure UK operations rather than pursue bankruptcy could influence New Fortress Energy's investment outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

New Fortress Energy Investment Narrative Recap

To be a shareholder in New Fortress Energy, you need to believe in the company’s ability to expand and improve operational efficiency, especially as large new assets like the Brazil power plant come online and long-term contracts drive revenue. The recent UK restructuring news does not materially alter the most immediate catalyst, the commercial launch of the CELBA 2 Power Plant in Brazil, or the core risk, which remains execution and financial discipline during geographic and operational expansion.

The announcement of the CELBA 2 Power Plant achieving first fire in Brazil stands out, given its potential to strengthen New Fortress Energy’s earnings base soon. With commercial operations targeted later this year, this project could become central to supporting revenue growth, even as the company addresses ongoing financial and operational concerns in other markets.

By contrast, the company’s high reliance on capital-intensive projects and timely refinancing is a risk investors should be aware of, especially if...

Read the full narrative on New Fortress Energy (it's free!)

New Fortress Energy's outlook anticipates $3.8 billion in revenue and $557.9 million in earnings by 2028. This scenario assumes a 23.2% annual revenue growth rate and an earnings turnaround of $1.56 billion, up from current earnings of -$1.0 billion.

Uncover how New Fortress Energy's forecasts yield a $4.30 fair value, a 226% upside to its current price.

Exploring Other Perspectives

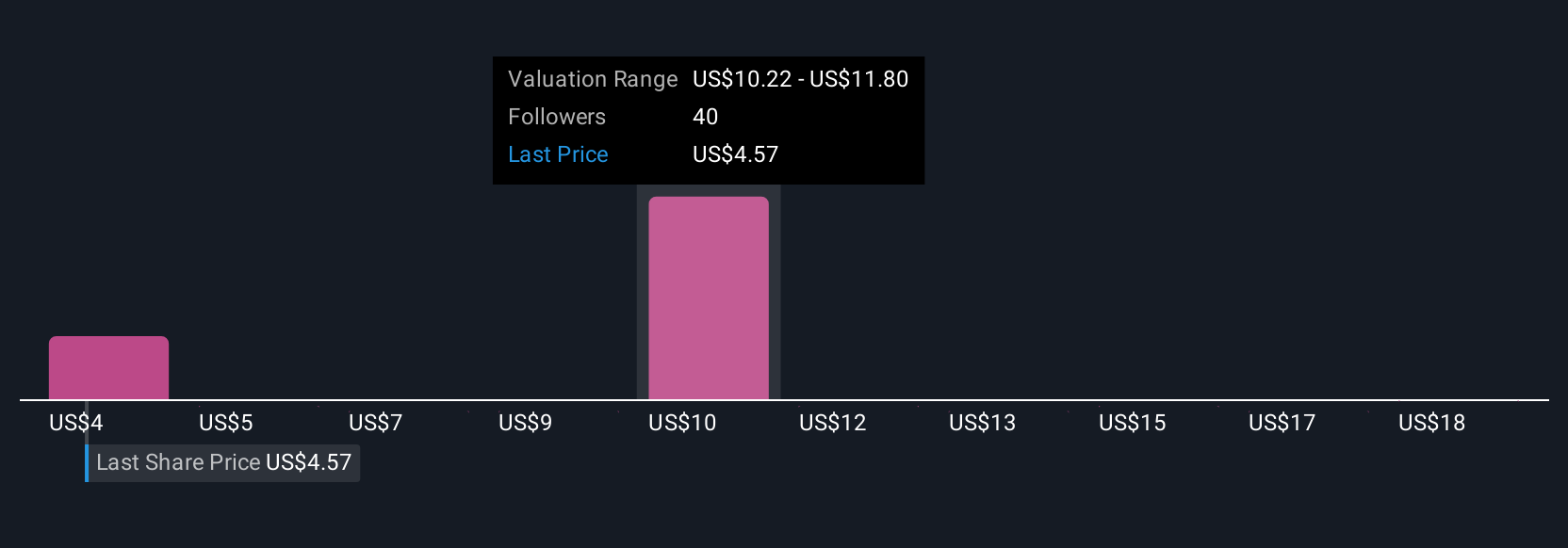

Seven members of the Simply Wall St Community estimate New Fortress Energy’s fair value from as low as US$0.09 up to US$12.51 per share. Adding the persistent risk of execution challenges in new markets, it’s clear opinions vary widely, so be sure to check alternative viewpoints before making your own assessment.

Explore 7 other fair value estimates on New Fortress Energy - why the stock might be worth over 9x more than the current price!

Build Your Own New Fortress Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Fortress Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free New Fortress Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Fortress Energy's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Fortress Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NFE

New Fortress Energy

Operates as an integrated gas-to-power energy infrastructure company that provides energy and development services to end-users worldwide.

Fair value with very low risk.

Similar Companies

Market Insights

Community Narratives