- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

Will Weaker Q3 Results and Bold 2026 Guidance Change NESR's Growth Narrative?

Reviewed by Sasha Jovanovic

- On November 13, 2025, National Energy Services Reunited Corp. reported a year-over-year decline in third quarter sales to US$295.32 million and net income to US$17.74 million, while providing guidance that full year 2025 revenues are expected to be in line with 2024 and that 2026 could see the company reach a revenue run rate of approximately US$2 billion driven by its expanding contract base.

- Despite weaker recent results, the company's outlook for a record fourth quarter of 2025 tied to new contract start-ups highlights a shift from current performance challenges toward future growth expectations.

- We'll examine how management's confidence in achieving a US$2 billion revenue run rate in 2026 could influence the company's investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

National Energy Services Reunited Investment Narrative Recap

Shareholders in National Energy Services Reunited need confidence in the company’s ability to expand its contract base and achieve higher revenue run rates, even as recent third quarter results highlighted weaker earnings. The latest guidance, which played down 2025 growth but pointed to a potentially record fourth quarter and a US$2 billion run rate in 2026, may be reassuring for those focused on contract momentum, yet near-term results reinforce that delays or setbacks in key projects remain the largest risk to the investment case.

The most relevant recent announcement is the company’s November 13, 2025, earnings release and forward-looking guidance, which directly connects expected record fourth quarter revenues to the start-up of new contracts, placing project execution and timely contract rollouts at the center of both the upcoming catalyst and ongoing risk profile for NESR shareholders.

Yet, investors should be aware that even as future growth is emphasized by management, risks tied to concentrated customer exposure or contract delays in core markets remain potentially material if...

Read the full narrative on National Energy Services Reunited (it's free!)

National Energy Services Reunited's outlook forecasts $1.5 billion in revenue and $168.6 million in earnings by 2028. Achieving this would require 4.0% annual revenue growth and an earnings increase of $95.6 million from the current $73.0 million.

Uncover how National Energy Services Reunited's forecasts yield a $19.80 fair value, a 44% upside to its current price.

Exploring Other Perspectives

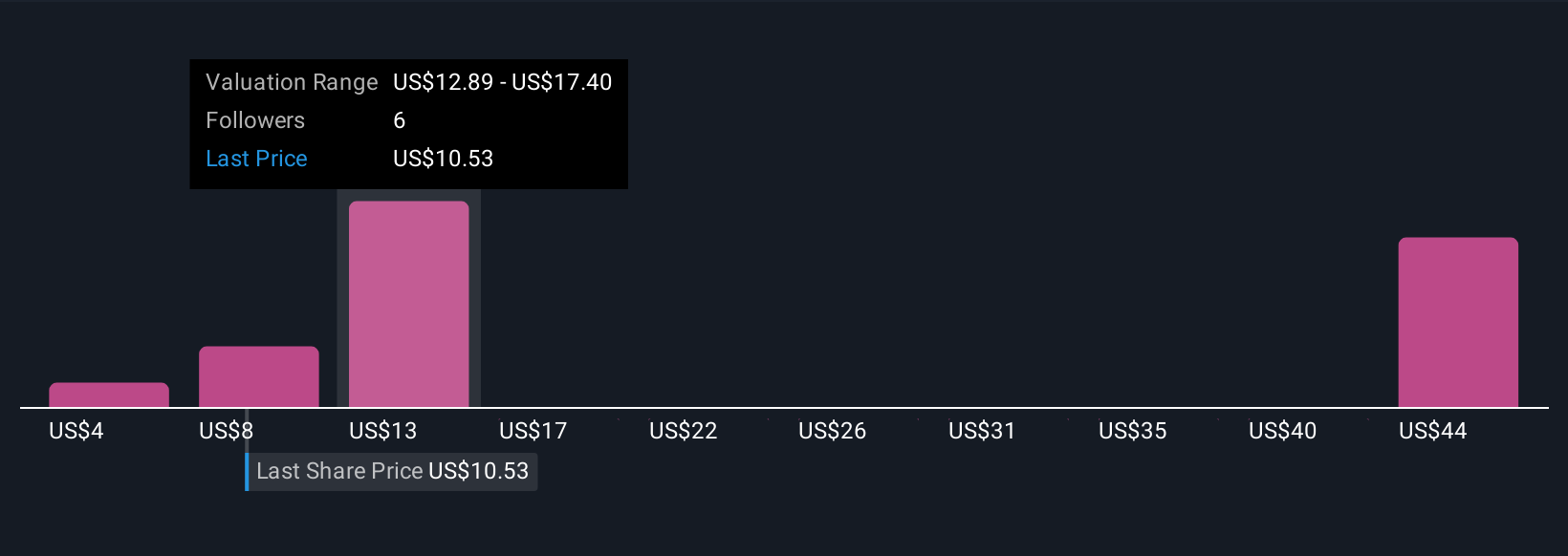

Seven fair value estimates from the Simply Wall St Community range widely, from US$3.87 to US$56.60 per share. While some see substantial upside, the company’s reliance on major contract execution underscores why opinions on NESR’s future performance can be so different, explore these viewpoints for a broader perspective.

Explore 7 other fair value estimates on National Energy Services Reunited - why the stock might be worth less than half the current price!

Build Your Own National Energy Services Reunited Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Energy Services Reunited research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free National Energy Services Reunited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Energy Services Reunited's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success