- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

Is the Saudi Aramco Multi-Billion Dollar Contract Transforming the NESR (NESR) Investment Case?

Reviewed by Sasha Jovanovic

- Saudi Aramco recently announced it has awarded National Energy Services Reunited a multi-billion dollar, five-year contract for completion services in the Jafurah and other unconventional gas fields in Saudi Arabia.

- This major contract cements NESR’s position as a key contributor to Saudi Arabia’s Vision 2030 energy diversification initiative and highlights the company’s operational depth in unconventional gas development.

- We’ll examine how this expanded partnership with Saudi Aramco may reshape NESR’s investment narrative, particularly in terms of its long-term growth outlook.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

National Energy Services Reunited Investment Narrative Recap

Shareholders in National Energy Services Reunited need to believe in the long-term expansion of unconventional oil and gas in the Middle East and North Africa, with Saudi Arabia as a major engine of growth. The newly awarded multi-billion dollar contract from Saudi Aramco directly addresses the key short-term catalyst, winning and executing large NOC tenders, while reducing the immediate risk of revenue volatility due to failed contract wins, though customer concentration remains a factor to watch.

Of recent company developments, NESR’s inclusion in several key indices earlier this year offered increased visibility and potential liquidity for its shares, but the Saudi Aramco contract win is far more relevant as a value driver, reinforcing the order backlog, and could help improve revenue predictability and financial confidence amid growth in unconventional gas activity.

However, despite the new contract, the concentrated exposure to large national oil customers means even short-term setbacks, such as payment delays or regional instability, could still present risks that investors should be aware of...

Read the full narrative on National Energy Services Reunited (it's free!)

National Energy Services Reunited's outlook calls for $1.5 billion in revenue and $168.6 million in earnings by 2028. This scenario assumes annual revenue growth of 4.0% and a $95.6 million increase in earnings from the current level of $73.0 million.

Uncover how National Energy Services Reunited's forecasts yield a $15.40 fair value, a 22% upside to its current price.

Exploring Other Perspectives

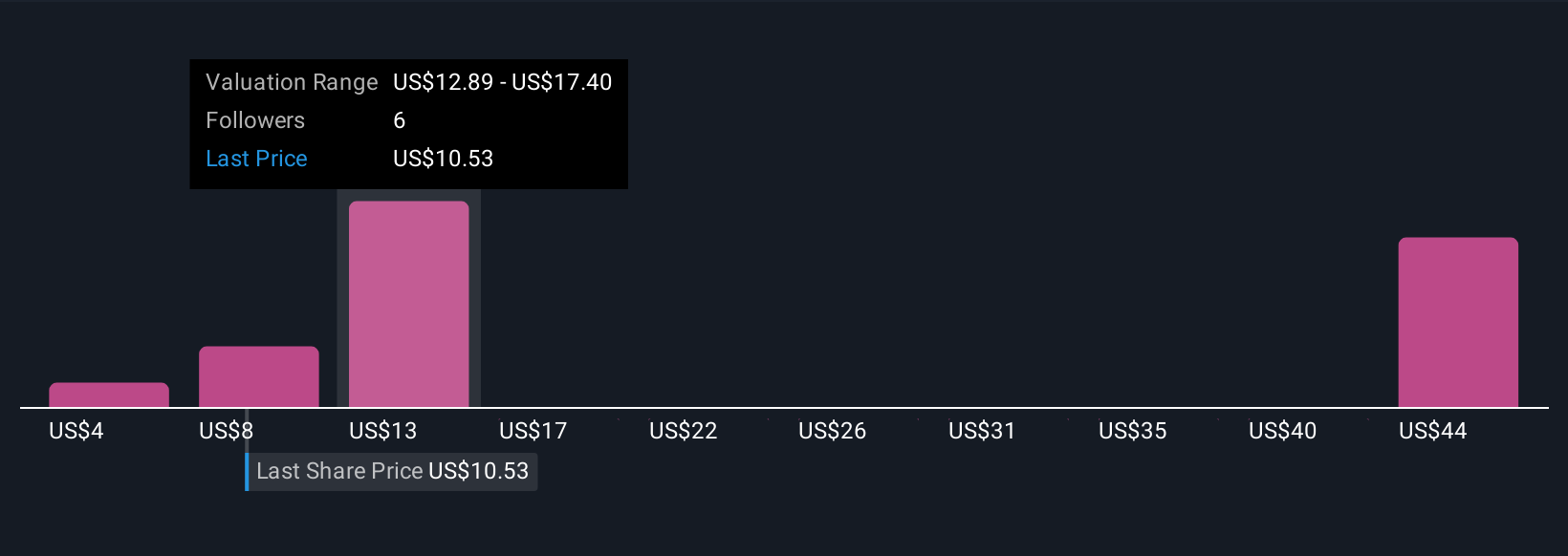

Simply Wall St Community members posted seven fair value estimates for NESR, ranging from US$3.87 to US$49.57. With broad optimism fueled by contract wins, you can see how opinions on long-term customer risk continue to shape the story and why many perspectives matter.

Explore 7 other fair value estimates on National Energy Services Reunited - why the stock might be worth over 3x more than the current price!

Build Your Own National Energy Services Reunited Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Energy Services Reunited research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free National Energy Services Reunited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Energy Services Reunited's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives