- United States

- /

- Oil and Gas

- /

- NasdaqCM:IMPP

Should Imperial Petroleum’s (IMPP) Preferred Dividend and Fleet Expansion Shift Investors’ Long-Term Outlook?

Reviewed by Simply Wall St

- Imperial Petroleum Inc. announced a dividend of US$0.546875 per share on its 8.75% Series A Cumulative Redeemable Perpetual Preferred Stock, payable on September 30, 2025, to holders of record as of September 25, 2025.

- This update follows the company's recent Q2 2025 results, which highlighted a major expansion of its shipping fleet from 12 to 19 vessels, signaling an increased commitment to growth and operational scale.

- We'll examine how the preferred dividend and fleet expansion could influence Imperial Petroleum’s long-term earnings outlook and capital allocation story.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Imperial Petroleum Investment Narrative Recap

To be a shareholder in Imperial Petroleum, you need to believe that the company's fleet expansion will translate into higher sustained earnings despite recent revenue and charter rate pressures. While this preferred dividend reaffirms the company's financial discipline and commitment to returning capital, it does not materially shift the biggest short-term catalyst, successful integration and employment of the new drybulk vessels, nor does it alleviate the core risk of exposure to volatile charter rates and weaker spot markets.

Among the latest announcements, the Q2 2025 results stand out, as they confirmed a dramatic jump in the vessel count from 12 to 19, underscoring Imperial’s ambitions for scale. This sets the stage for improved revenue potential if market demand holds, yet also amplifies near-term exposure to drybulk market swings, particularly because new ships are on short-term contracts.

However, if freight rates soften further, investors should be aware that...

Read the full narrative on Imperial Petroleum (it's free!)

Imperial Petroleum's outlook forecasts $407.7 million in revenue and $177.8 million in earnings by 2028. This implies a 47.3% annual revenue growth rate and a $143.8 million increase in earnings from the current $34.0 million.

Uncover how Imperial Petroleum's forecasts yield a $6.00 fair value, a 30% upside to its current price.

Exploring Other Perspectives

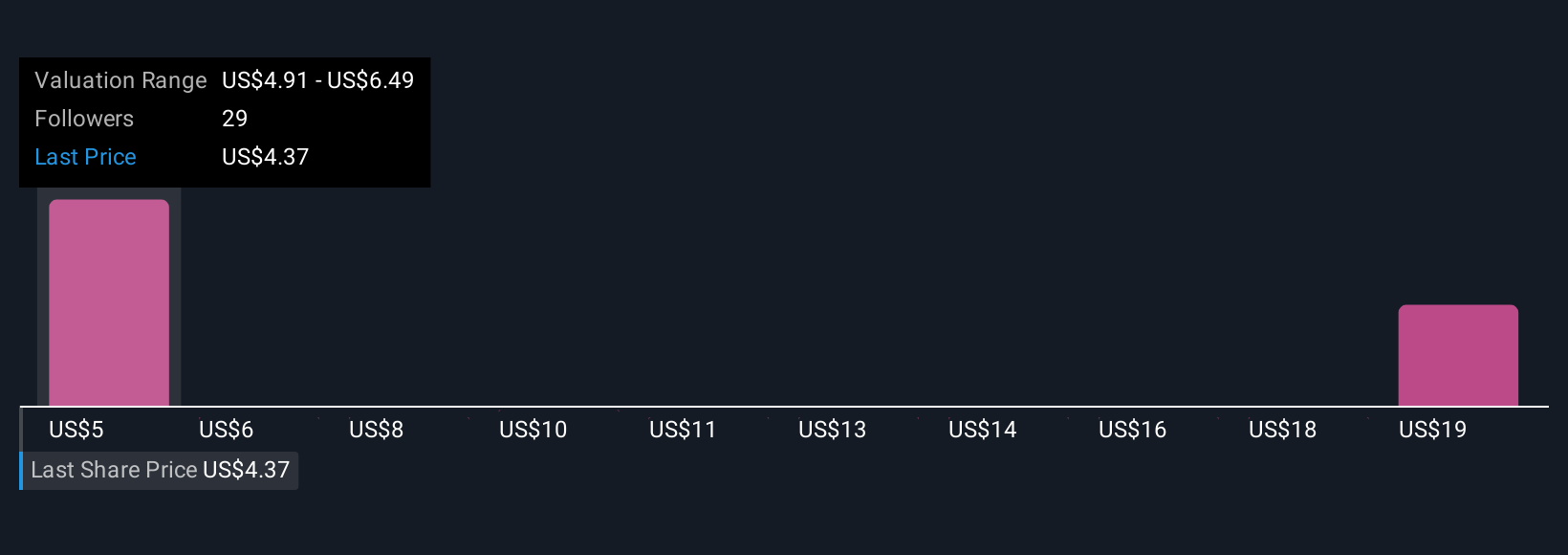

Four Simply Wall St Community members estimate Imperial Petroleum's fair value from just US$4.91 up to US$19.95 per share. With such a broad spread of outlooks, the recent rapid fleet expansion and charter mix will likely remain central to discussions about earnings stability and future returns, so consider how these differences might shape your own view.

Explore 4 other fair value estimates on Imperial Petroleum - why the stock might be worth just $4.91!

Build Your Own Imperial Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Imperial Petroleum research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Imperial Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Imperial Petroleum's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IMPP

Flawless balance sheet and undervalued.

Market Insights

Community Narratives