- United States

- /

- Oil and Gas

- /

- NasdaqGS:GLNG

Golar LNG (NasdaqGS:GLNG) Valuation Spotlight After Securing 20-Year Charter for Argentina FLNG Expansion

Reviewed by Simply Wall St

Golar LNG (NasdaqGS:GLNG) confirmed that all conditions for its 20-year FLNG charter agreement with Southern Energy are now met. This development paves the way for offshore operations in Argentina beginning in 2028.

See our latest analysis for Golar LNG.

After upbeat news about the long-term charter, Golar LNG's shares saw renewed investor interest, with the stock rallying earlier in the week. While the year-to-date share price return is still down by 7.3%, the company’s 1-year total shareholder return of nearly 14% and a remarkable 471% total return over five years suggest that long-term momentum remains firmly in Golar’s corner. This is bolstered by optimism surrounding its growth prospects and recent dealmaking.

If you’re keen to find other names with the potential to outpace the market, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

With strong returns and a bullish long-term outlook following its major charter announcement, the question for investors is whether Golar LNG is still attractively priced or if recent optimism has already been factored in by the market.

Most Popular Narrative: 20.5% Undervalued

Despite Golar LNG’s latest close of $40.65, the narrative’s fair value estimate sits much higher and points to a significant potential upside if assumptions hold. This gap makes the underlying projections worth a closer look.

The company has secured long-term (20-year) charters for its existing FLNG units, providing $17 billion in contracted EBITDA backlog and 20 years of cash flow visibility. This is expected to drive a significant (4x) increase in EBITDA and contracted free cash flow by 2028, suggesting the market may be undervaluing its forward earnings stability and revenue growth.

Curious about what is driving this bold valuation? One major assumption involves a future profit margin typically reserved for high-growth innovators, paired with a dramatic shift in future earnings power. Want to see which financial leap the narrative is banking on? Uncover the full story behind these headline numbers in the complete narrative.

Result: Fair Value of $51.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the outlook could change if demand for floating LNG softens or if regulatory and project execution risks begin to weigh on future returns.

Find out about the key risks to this Golar LNG narrative.

Another View: Market Ratios Show Caution

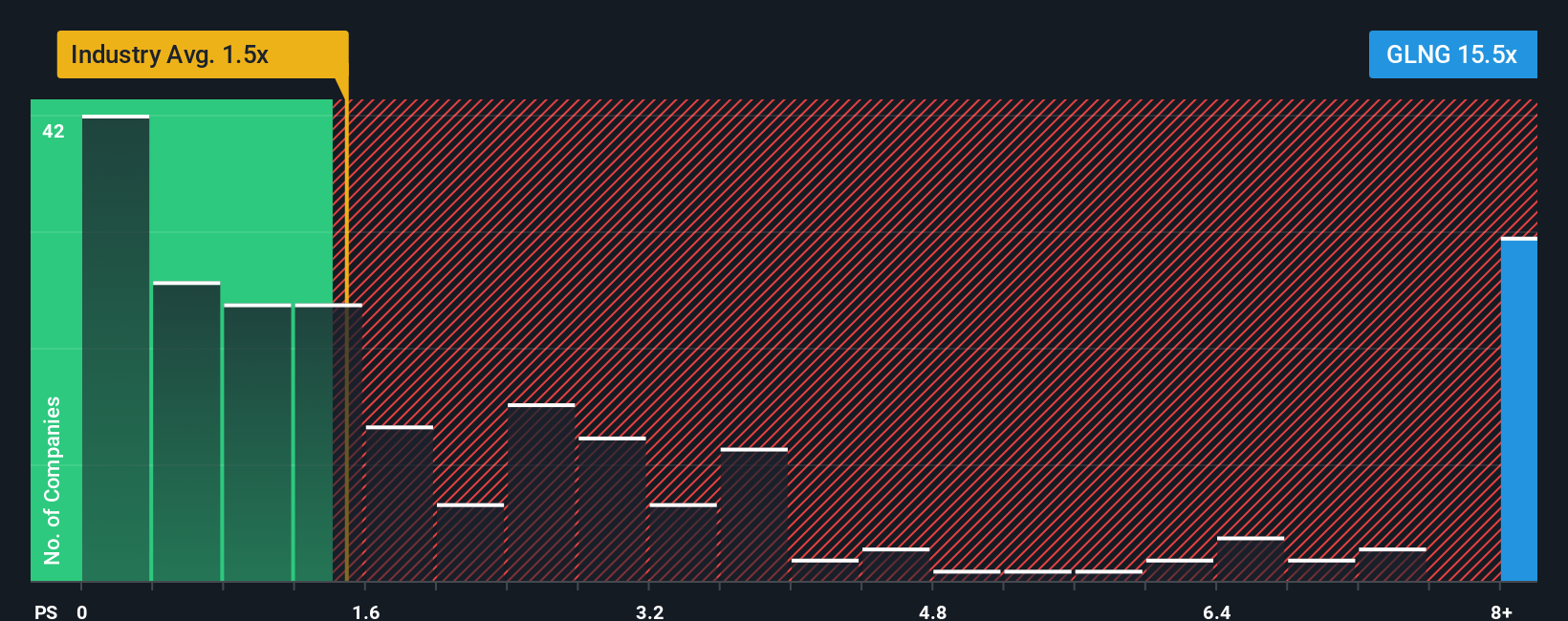

While the growth story and fair value scenario look promising, Golar LNG trades at a strikingly high price-to-sales ratio of 15.5x. This is much steeper than the US Oil and Gas industry average of 1.5x, the peer average of 2.2x, and its fair ratio, estimated at 1.8x. This gap suggests the market is pricing in a lot of expected growth already, exposing investors to the risk that reality might not live up to such optimistic assumptions. Is this premium a sign of clear market leadership, or does it leave little room for disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Golar LNG Narrative

If you see the story differently or want to dive into the numbers firsthand, you can shape your own view with just a few clicks. Do it your way

A great starting point for your Golar LNG research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize this moment to put your money to work where it matters. Step up your investing strategy and don't let smarter opportunities pass you by.

- Uncover the potential for reliable passive income by exploring these 21 dividend stocks with yields > 3%, which offers attractive yields above 3 percent in the current market.

- Capitalize on the AI trend by staying ahead of the curve with these 26 AI penny stocks, making an impact across multiple sectors.

- Capture value that others may be missing by targeting these 855 undervalued stocks based on cash flows, which is positioned for future growth based on resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLNG

Golar LNG

Designs, converts, owns, and operates marine infrastructure for the liquefaction of natural gas.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives