- United States

- /

- Energy Services

- /

- NasdaqGS:GIFI

Read This Before Selling Gulf Island Fabrication, Inc. (NASDAQ:GIFI) Shares

It is not uncommon to see companies perform well in the years after insiders buy shares. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in Gulf Island Fabrication, Inc. (NASDAQ:GIFI).

What Is Insider Buying?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

We don't think shareholders should simply follow insider transactions. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

See our latest analysis for Gulf Island Fabrication

Gulf Island Fabrication Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when President Richard Heo bought US$157k worth of shares at a price of US$3.96 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being US$3.17). It's very possible they regret the purchase, but it's more likely they are bullish about the company. To us, it's very important to consider the price insiders pay for shares. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

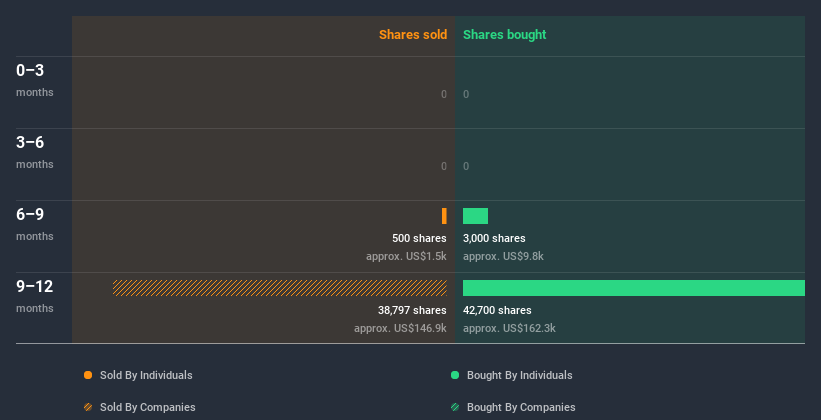

Happily, we note that in the last year insiders paid US$178k for 45.70k shares. But insiders sold 500.00 shares worth US$1.5k. In the last twelve months there was more buying than selling by Gulf Island Fabrication insiders. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Gulf Island Fabrication is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Our data suggests Gulf Island Fabrication insiders own 4.7% of the company, worth about US$2.3m. We prefer to see high levels of insider ownership.

What Might The Insider Transactions At Gulf Island Fabrication Tell Us?

The fact that there have been no Gulf Island Fabrication insider transactions recently certainly doesn't bother us. However, our analysis of transactions over the last year is heartening. While we have no worries about the insider transactions, we'd be more comfortable if they owned more Gulf Island Fabrication stock. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Our analysis shows 2 warning signs for Gulf Island Fabrication (1 is potentially serious!) and we strongly recommend you look at these before investing.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you decide to trade Gulf Island Fabrication, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:GIFI

Gulf Island Fabrication

Operates as a fabricator of steel structures and modules in the United States.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success