- United States

- /

- Oil and Gas

- /

- NasdaqCM:NXXT

Market Still Lacking Some Conviction On EZFill Holdings Inc. (NASDAQ:EZFL)

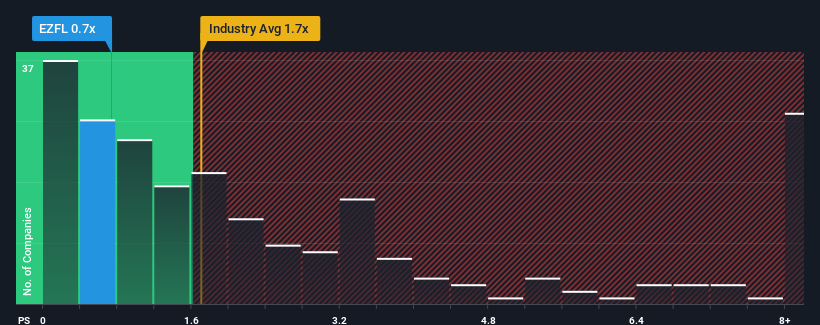

You may think that with a price-to-sales (or "P/S") ratio of 0.7x EZFill Holdings Inc. (NASDAQ:EZFL) is a stock worth checking out, seeing as almost half of all the Oil and Gas companies in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for EZFill Holdings

How Has EZFill Holdings Performed Recently?

Revenue has risen firmly for EZFill Holdings recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on EZFill Holdings will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For EZFill Holdings?

EZFill Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 9.2% shows it's noticeably more attractive.

With this in mind, we find it intriguing that EZFill Holdings' P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On EZFill Holdings' P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of EZFill Holdings revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for EZFill Holdings (2 make us uncomfortable) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if NextNRG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NXXT

Moderate risk with concerning outlook.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026