- United States

- /

- Oil and Gas

- /

- NasdaqCM:NXXT

A Piece Of The Puzzle Missing From EZFill Holdings Inc.'s (NASDAQ:EZFL) Share Price

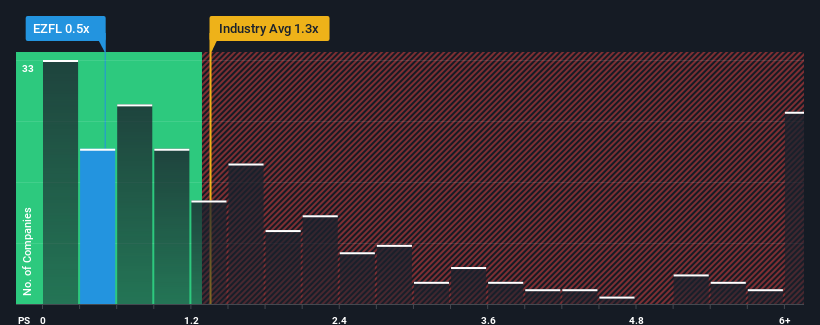

When close to half the companies operating in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") above 1.3x, you may consider EZFill Holdings Inc. (NASDAQ:EZFL) as an attractive investment with its 0.5x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for EZFill Holdings

What Does EZFill Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, EZFill Holdings has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on EZFill Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like EZFill Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 108%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 115%. That would be an excellent outcome when the industry is expected to decline by 8.8%.

With this in mind, we find it intriguing that EZFill Holdings' P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From EZFill Holdings' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into EZFill Holdings' analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 5 warning signs for EZFill Holdings you should be aware of, and 2 of them shouldn't be ignored.

If you're unsure about the strength of EZFill Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if NextNRG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NXXT

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives