- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

Expand Energy (EXE): Valuation Check After EPS Beat and Post‑Merger Operational Upside

Reviewed by Simply Wall St

Expand Energy (EXE) just released a standout earnings update, with adjusted EPS jumping sharply year over year on stronger oil, gas, and NGL sales, plus sizable contributions from marketing and derivatives.

See our latest analysis for Expand Energy.

Even after this blowout quarter, the stock has cooled off recently, with a 30 day share price return of minus 8.1 percent. However, a 1 year total shareholder return of 17.2 percent still signals that momentum is building over the longer run.

If this kind of earnings surprise has you rethinking your energy exposure, it could be a good moment to scan other aerospace and defense stocks for resilient, cash generative plays.

With analysts still calling EXE a strong buy and the stock trading at a sizable discount to target and intrinsic value, is this a rare mispricing in plain sight, or is the market already baking in future growth?

Most Popular Narrative: 18.9% Undervalued

With Expand Energy closing at $107.74, the most widely followed narrative argues that fair value sits meaningfully higher, setting up a compelling upside case.

Enhanced merger synergies now being realized above initial expectations are generating hundreds of millions in additional annual free cash flow, which improves both net margins and available capital for shareholder returns.

The company's strong balance sheet and accelerating net debt reduction enable substantial flexibility for capital returns, dividends, share buybacks and defensive power in volatile markets, supporting higher and less volatile EPS over the long term.

Want to see how robust cash generation, widening margins and future earnings power are stitched together into that higher fair value story? The full narrative reveals the exact growth, profitability and valuation bridge that turns today’s price gap into a potential rerating roadmap.

Result: Fair Value of $132.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if decarbonization policies tighten faster than expected and basin productivity disappoints, which would pressure both long term volumes and margins.

Find out about the key risks to this Expand Energy narrative.

Another Lens on Value

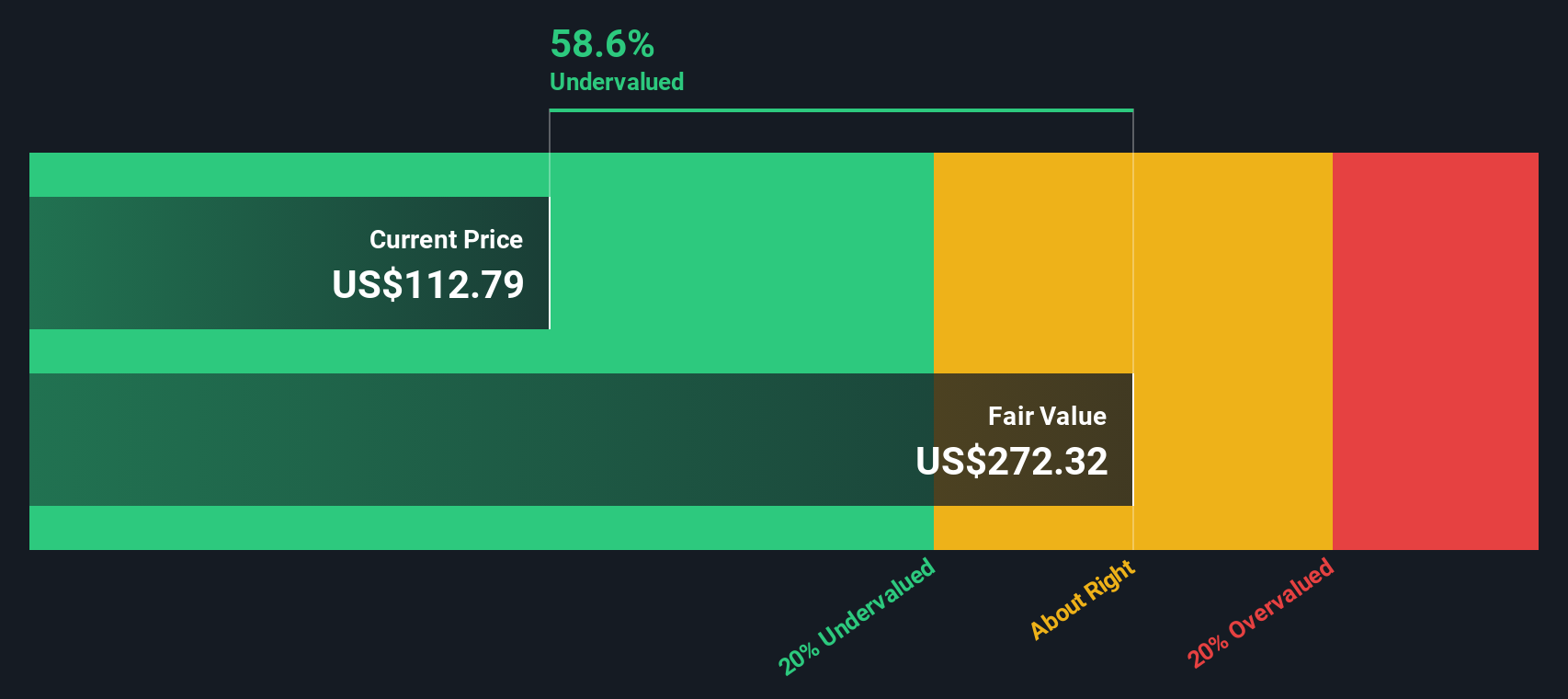

Our SWS DCF model paints a far more optimistic picture, putting fair value near $275.67, which is roughly 60.9 percent above today’s price and far higher than the narrative fair value. Is this a genuine disconnect, or a sign that assumptions are too rosy?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Expand Energy Narrative

If you see the story differently or want to validate the assumptions yourself, you can quickly craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Expand Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore focused stock lists built from real fundamentals, not hype, so your research time is used more effectively.

- Capture early growth stories by scanning these 3608 penny stocks with strong financials that already pair small share prices with credible financial strength and momentum.

- Position ahead of the next tech wave by reviewing these 24 AI penny stocks targeting applications in automation, data intelligence, and machine learning.

- Seek steadier portfolio income by selecting from these 13 dividend stocks with yields > 3% that aim to balance yield with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion