- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

A Look at Expand Energy (EXE) Valuation After Strong Q3 Profits and Upbeat Production Outlook

Reviewed by Simply Wall St

Expand Energy (EXE) announced stronger-than-expected Q3 2025 profits, credited to higher production levels and supportive commodity prices. The company also shared an upbeat outlook for future gas output and outlined plans to lower capital spending.

See our latest analysis for Expand Energy.

Expand Energy’s upbeat production guidance and strong Q3 profits have clearly caught investors’ attention, with the share price jumping nearly 16% over the past month alone and up over 25% in the last 90 days. Taking a longer view, the company’s one-year total shareholder return sits at more than 28%, pointing to building momentum even as some fundamentals remain under scrutiny.

If Expand’s rally has you exploring fresh opportunities in the energy sector, now is a great time to discover fast growing stocks with high insider ownership

With shares near record highs and analysts divided on the company’s prospects, the key question now is whether Expand Energy remains undervalued or if the recent rally already reflects all its future growth potential.

Most Popular Narrative: 7% Undervalued

Compared to its last close of $119.46, Expand Energy's most followed narrative sees fair value at $128.78. This suggests the strong rally may still be leaving money on the table for bullish investors willing to trust aggressive growth forecasts.

Major, recurring operational efficiencies and rapid well productivity gains, driven by advanced digitalization and AI integration, are resulting in reduced drilling/completion costs and increasing net margins. These improvements are expected to compound over time and directly benefit future earnings.

How sustainable are these margin-boosting breakthroughs? The key drivers behind this momentum are aggressive cost-slashing tech upgrades and bold assumptions for efficiency. Do these projections withstand scrutiny? See what makes this narrative tick and which optimistic numbers set the stage for a potential re-rating.

Result: Fair Value of $128.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, long-term policy shifts toward decarbonization and tightening emissions regulations could curb demand growth and put pressure on Expand Energy’s margins.

Find out about the key risks to this Expand Energy narrative.

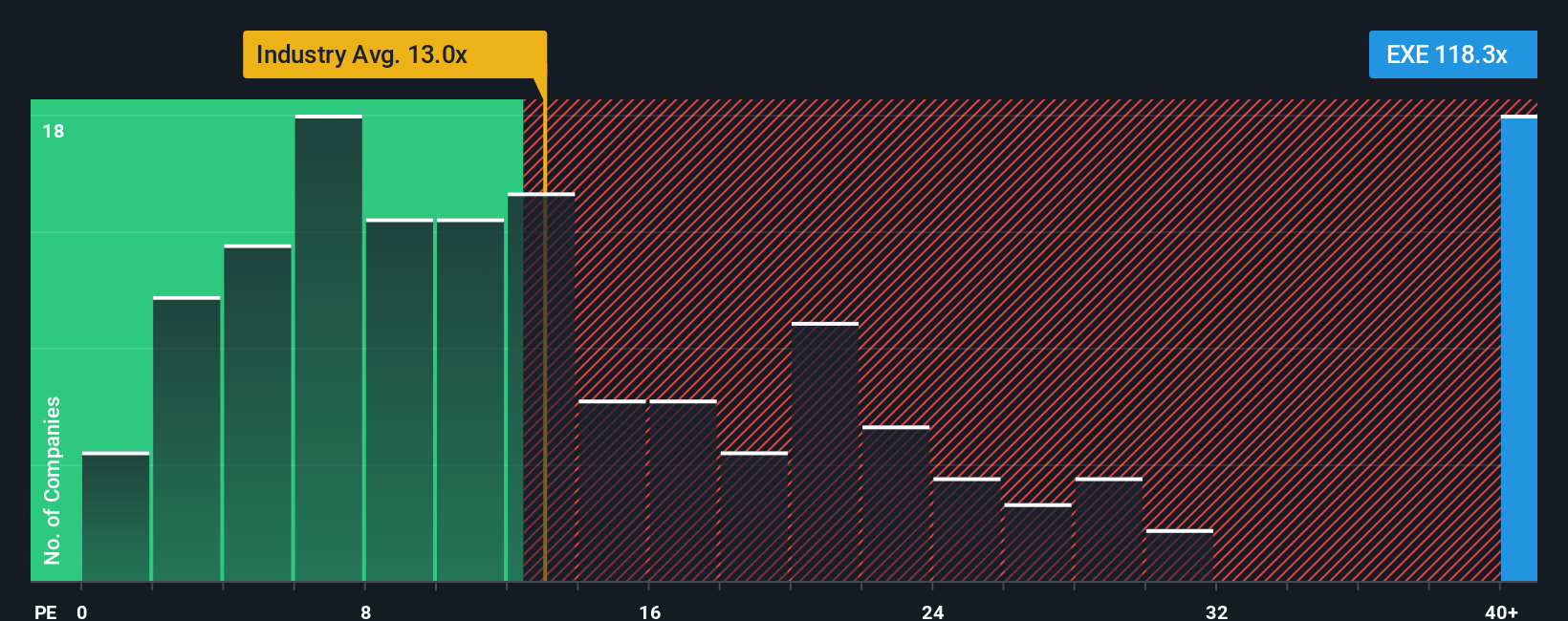

Another View: What About Multiples?

Looking at Expand Energy's valuation through its price-to-earnings ratio raises a different perspective. The company trades at 32.8 times earnings, which is notably higher than its industry peers at 14.1x and the fair ratio of 23.1x. This suggests the market expects ongoing strong growth or sees little room for missteps. Is this pricing too rich, or just right for the risk-reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Expand Energy Narrative

If you want to challenge the consensus or follow your own path, the tools are there to build your personal view in just minutes, so why not Do it your way?

A great starting point for your Expand Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one angle. Use your edge, stay ahead of market trends, and get direct access to opportunities others might overlook before they heat up.

- Target consistent passive income by checking out these 14 dividend stocks with yields > 3%, which offers yields above 3% to strengthen your portfolio's cash flow potential.

- Catch the next big wave in artificial intelligence and accelerate your strategy with these 27 AI penny stocks, which show promise in transformative tech sectors.

- Capitalize on market mispricings and look for value by reviewing these 876 undervalued stocks based on cash flows that could be flying under the radar right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives