- United States

- /

- Oil and Gas

- /

- NasdaqGS:DMLP

Dorchester Minerals (DMLP): Revisiting Valuation Following Q3 Earnings Drop and Nasdaq Compliance Concerns

Reviewed by Simply Wall St

Dorchester Minerals (DMLP) just went through a tough quarter, reporting a sharp drop in both revenue and net income. The company also lost a key audit committee member, which put its Nasdaq compliance in jeopardy.

See our latest analysis for Dorchester Minerals.

Dorchester Minerals’ share price has faced heavy pressure this year, with a 31.9% drop year-to-date, largely reflecting investor concerns after both disappointing Q3 numbers and the audit committee shakeup. While the unit price is off sharply, long-term holders are still well ahead, with a total shareholder return of 276% over the past five years. Momentum is fading for now, but the company’s long-run performance remains a bright spot in the energy sector.

If you’re weighing your next move beyond Dorchester’s recent turbulence, now is a perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With such a sharp drop in key metrics and recent leadership changes, is Dorchester Minerals trading at a bargain price, or are investors right to question whether future growth is already factored in?

Price-to-Earnings of 21.3x: Is it justified?

With Dorchester Minerals currently trading at a price-to-earnings (P/E) ratio of 21.3x, the stock appears more expensive than its industry peers, raising important questions about valuation. As of the last close, shares finished at $23.61, and investors may wonder if this premium is backed by the fundamentals or market optimism.

The P/E ratio measures how much investors are willing to pay for each dollar of earnings. In sectors like oil and gas, where earnings can be volatile, this metric helps gauge whether the market is pricing in growth, stability, or risk. For Dorchester Minerals, the current ratio suggests the market has either high expectations for future recovery or is overlooking recent profit declines.

Compared to the U.S. oil and gas industry average P/E of 14.3x, Dorchester's valuation stands out as notably higher. This means investors are paying a significant premium over sector norms, possibly attributing added value to the company's longer-term track record or unique business structure. However, this elevated multiple is less attractive when earnings have contracted in the latest period, making the premium harder to justify without a visible growth catalyst.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 21.3x (OVERVALUED)

However, sustained profit declines or further leadership instability could quickly undermine expectations and put continued pressure on the valuation premium of Dorchester Minerals.

Find out about the key risks to this Dorchester Minerals narrative.

Another View: What Does Our DCF Model Say?

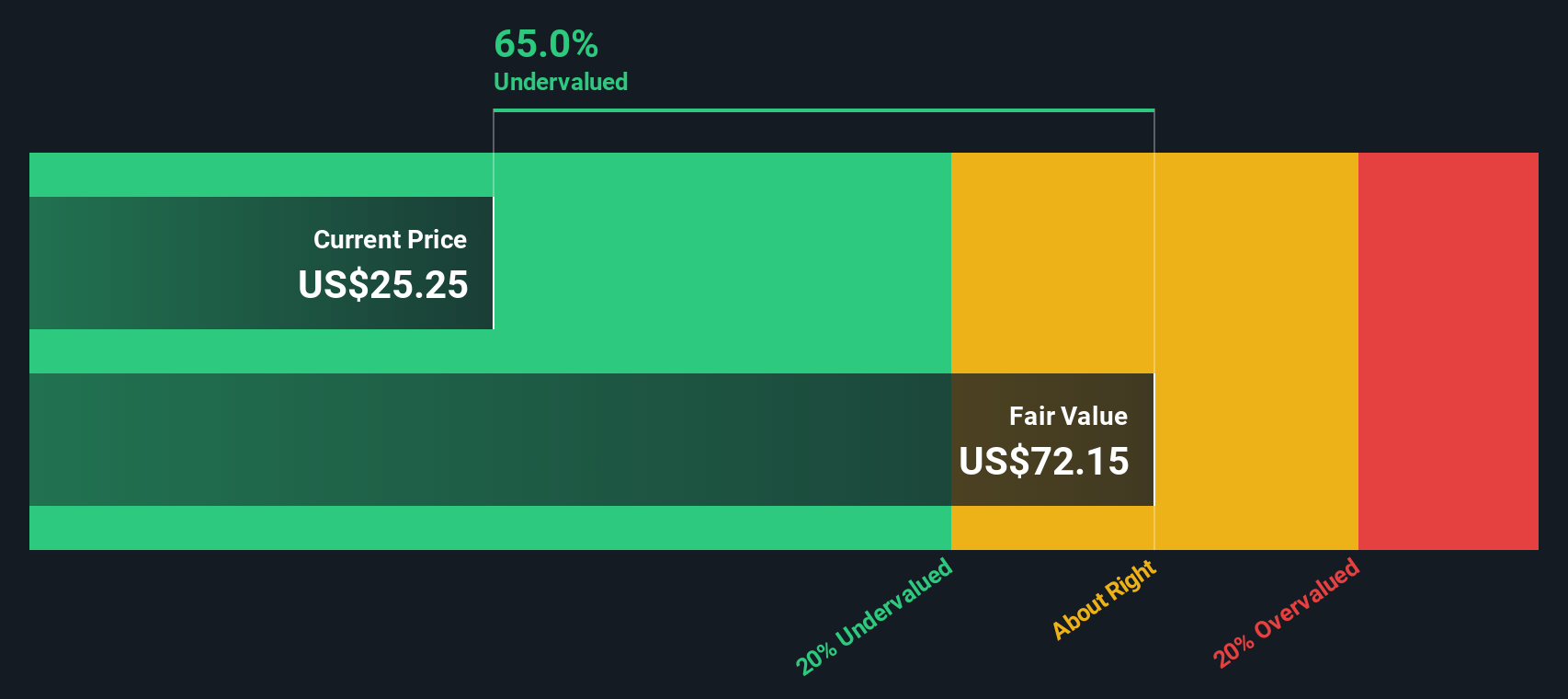

While Dorchester Minerals appears expensive based on its price-to-earnings ratio, our SWS DCF model offers a markedly different perspective. According to this method, DMLP is undervalued, trading at a 64.8% discount to our fair value estimate of $67.09. This wide gap suggests the market might be underappreciating Dorchester’s future cash flows. Could this be a deep value opportunity, or does it signal risks that multiples alone cannot reveal?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dorchester Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dorchester Minerals Narrative

If you see things differently or want to dig deeper into Dorchester Minerals’ story, try assembling your own view in just a few minutes. Do it your way.

A great starting point for your Dorchester Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your next investing move count by tapping into fresh opportunities. Don’t let a great prospect slip away while you’re focused on just one stock.

- Unlock the growth potential of tomorrow’s market leaders when you browse these 879 undervalued stocks based on cash flows, packed with companies trading below their fair value.

- Access high-yield opportunities and supercharge your income strategy by checking out these 16 dividend stocks with yields > 3%, offering stocks with standout dividend potential.

- Stay ahead of the megatrend sweeping the market by searching these 25 AI penny stocks for innovative businesses trailblazing the artificial intelligence revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DMLP

Dorchester Minerals

Engages in the acquisition, ownership, and administration of royalty properties in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives