- United States

- /

- Oil and Gas

- /

- NasdaqGS:DMLP

Dorchester Minerals (DMLP): Assessing Value After Latest Q3 2025 Cash Distribution Announcement

Reviewed by Simply Wall St

Dorchester Minerals (DMLP) is giving investors something to watch with its newly announced third quarter 2025 cash distribution. The update details exactly how much unitholders can expect and specifies when payments will go out.

See our latest analysis for Dorchester Minerals.

This latest cash distribution comes as Dorchester Minerals’ share price sits at $25.31, reflecting a year-to-date price return of -27%. While the stock has seen a recent bounce, up 6.3% over the past week, momentum remains weak compared to prior years. The total shareholder return over three and five years still stands at 22% and a striking 319% respectively. The current performance suggests market sentiment is cautious, despite ongoing royalty income and distributions supporting the long-term case.

If the latest distribution has you weighing new opportunities, now is the perfect time to discover fast growing stocks with high insider ownership.

With the latest figures in hand and the distribution now public, the real question is whether Dorchester Minerals is now trading at a compelling value or if the market has already factored in expectations for future growth.

Price-to-Earnings of 15.4x: Is it justified?

At $25.31, Dorchester Minerals trades at a price-to-earnings (P/E) ratio of 15.4x, which is above the US Oil and Gas industry average P/E of 12.8x. This suggests the market values the company's earnings at a premium relative to many of its sector peers.

The P/E ratio reflects how much investors are willing to pay for each dollar of the company's earnings. For mature and income-generating businesses in energy, it often hints at market expectations around sustainability of profits, sector growth, and the reliability of future cash flows.

Despite recent earnings showing a decline and profit margins coming in lower than last year, Dorchester Minerals' current multiple implies some expectation of stability or special advantage. However, compared to the price-to-earnings ratio for its peer group at a 25.2x average, Dorchester actually appears attractively valued in a broader context, even though it is above the direct industry standard. No fair value ratio is available for a deeper benchmark, so the market may continue to reassess this premium as more earnings data becomes available.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 15.4x (ABOUT RIGHT)

However, sustained earnings pressure or a lack of growth catalysts could challenge Dorchester Minerals' valuation and test investor confidence in the coming quarters.

Find out about the key risks to this Dorchester Minerals narrative.

Another View: Discounted Cash Flow Puts DMLP in a Different Light

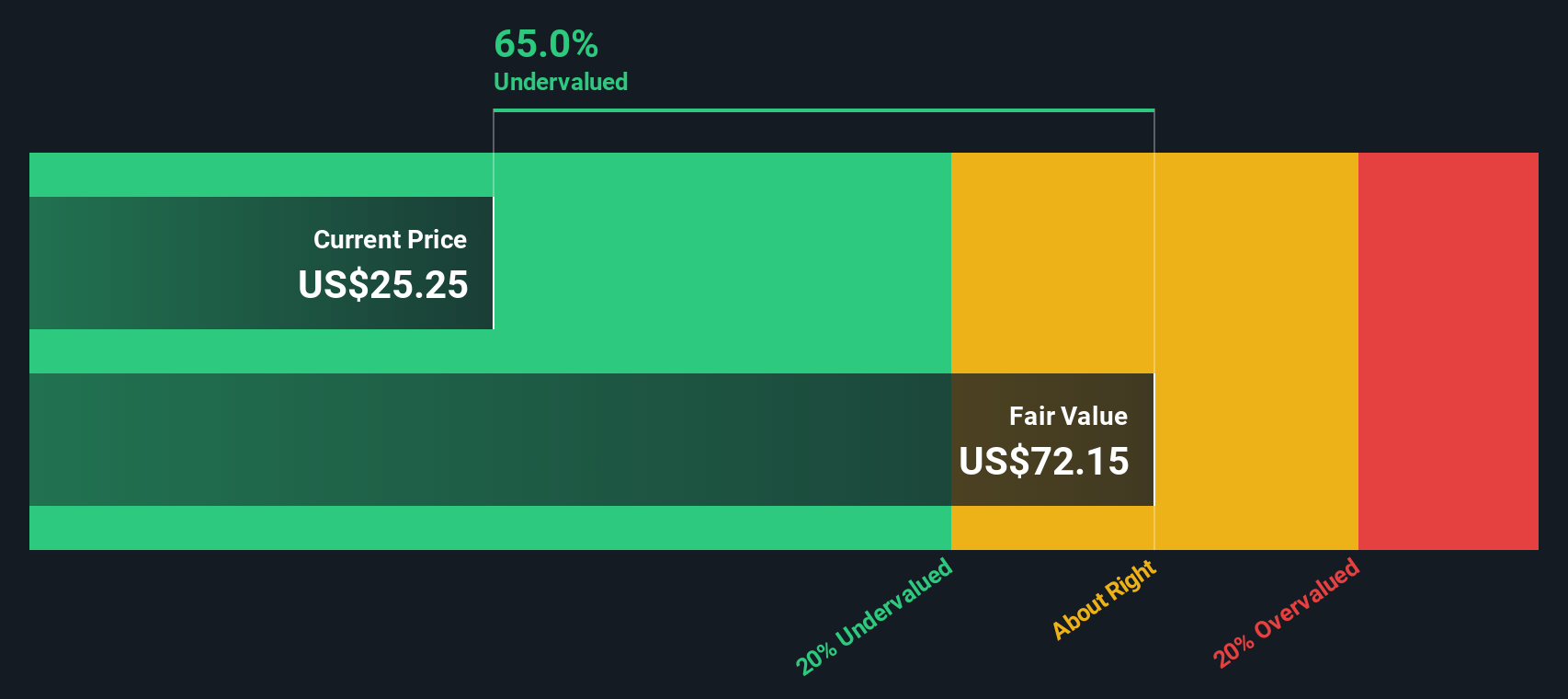

While the P/E ratio paints a picture of relative affordability among peers, our DCF model suggests Dorchester Minerals could be deeply undervalued. The SWS DCF model estimates a fair value of $72.15 per unit, which is nearly triple the current price. Is the market missing something here, or does it simply expect lower growth ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dorchester Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dorchester Minerals Narrative

If you see things differently or enjoy diving into your own research, you can lay out your own case for Dorchester Minerals in under three minutes, so why not Do it your way.

A great starting point for your Dorchester Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity pass you by. Expand your investing game and catch the next winners with dynamic strategies curated by Simply Wall Street's powerful tools:

- Tap into cash-generating potential and pursue steady returns by reviewing these 17 dividend stocks with yields > 3% with yields above 3%.

- Unlock tomorrow’s technological breakthroughs by seeking out companies pioneering artificial intelligence among these 27 AI penny stocks reshaping entire industries.

- Get ahead of the trend and position yourself early in innovation with these 28 quantum computing stocks, featuring businesses at the forefront of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DMLP

Dorchester Minerals

Engages in the acquisition, ownership, and administration of royalty properties in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives