- United States

- /

- Oil and Gas

- /

- NasdaqGS:DMLP

Dorchester Minerals (DMLP): Assessing Valuation After Insider Buying and Leadership Changes at 52-Week Lows

Reviewed by Simply Wall St

Dorchester Minerals (DMLP) has drawn investor attention after several company insiders, including its CEO, CFO, and directors, purchased shares as the stock trades near its 52-week low. This activity comes during a period of leadership transition and sustained dividend payouts.

See our latest analysis for Dorchester Minerals.

Even with leadership changes and a string of insider buys, Dorchester Minerals’ share price has continued its downward drift. Its year-to-date share price return stands at -36.7%, with one-year total shareholder return at -29.4%. The long-term picture is more positive, however, with a 216.6% total return over five years. This suggests that while recent momentum has faded, patient investors have still been rewarded over the long haul.

If you're weighing your next move, now’s the perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With insider buying on the rise and shares hovering at multi-year lows, investors have to wonder if Dorchester Minerals is being overlooked in the market or if future growth concerns are already reflected in the price.

Price-to-Earnings of 19.8x: Is it justified?

With Dorchester Minerals' shares last closing at $21.95, the company is trading at a price-to-earnings (P/E) ratio of 19.8 times, placing it above the US Oil and Gas industry average of 13.4 times and slightly below its peer average of 27.9 times. This creates an opportunity for analysis as to why the market assigns this multiple and whether it is warranted given the company’s recent performance and prospects.

The P/E ratio measures how much investors are willing to pay today for a dollar of the company's earnings. In cyclical sectors like oil and gas, it can reflect both recent profits and expectations for future growth or stability. For Dorchester Minerals, a higher-than-industry P/E could indicate that investors expect steadier payouts or a stronger rebound going forward, even as recent returns trail the market and industry averages.

Dorchester’s P/E looks expensive compared to its broader industry peers but appears attractive when it is compared with its immediate peer group where the average is even higher. However, without further context from fair value analysis, it remains unclear whether the current multiple truly captures the company’s underlying prospects or if optimism is already reflected in the price.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 19.8x (OVERVALUED)

However, future growth concerns or sector volatility could undermine investor optimism. This highlights the need for ongoing risk assessment in such cyclical businesses.

Find out about the key risks to this Dorchester Minerals narrative.

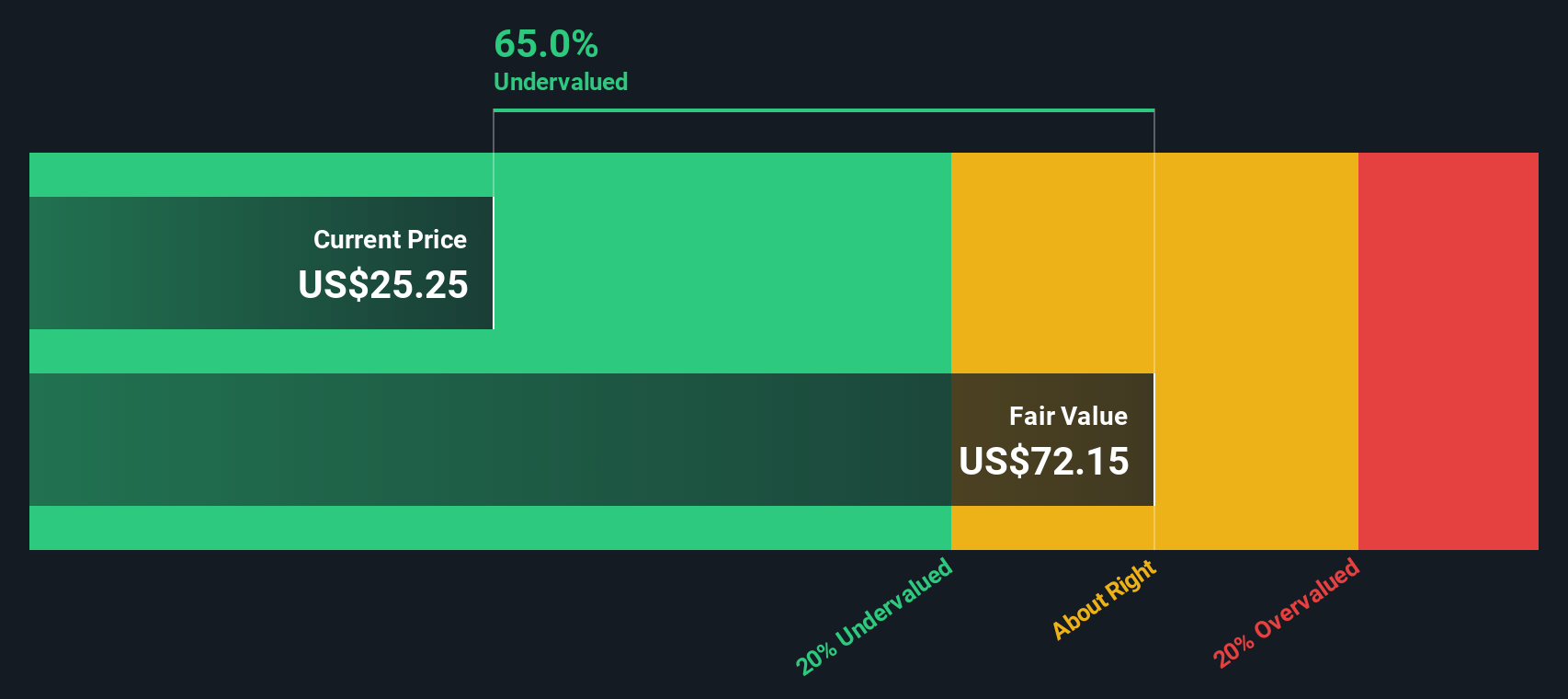

Another View: SWS DCF Model Suggests Undervaluation

While the price-to-earnings ratio presents Dorchester Minerals as overvalued compared to industry norms, the SWS DCF model offers a different perspective. According to our DCF analysis, shares are trading at approximately 67% below the estimated fair value of $67.09, indicating the possibility of upside if the market adjusts its valuation of the business.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dorchester Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dorchester Minerals Narrative

If you see things differently or want to dig deeper into the numbers, you can quickly craft your own story in just a few minutes. Do it your way

A great starting point for your Dorchester Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on other standout opportunities that could boost and diversify your portfolio. These unique stock ideas are just a click away on Simply Wall Street.

- Power up your returns and unlock hidden potential by reviewing these 914 undervalued stocks based on cash flows, which features remarkable value based on strong cash flows.

- Strengthen your passive income by exploring these 15 dividend stocks with yields > 3%, which offers robust yields above 3% for income-focused investors.

- Ride the next technological revolution by taking a close look at these 25 AI penny stocks, which are transforming industries with artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DMLP

Dorchester Minerals

Engages in the acquisition, ownership, and administration of royalty properties in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026