- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLNE

Despite shrinking by US$140m in the past week, Clean Energy Fuels (NASDAQ:CLNE) shareholders are still up 149% over 1 year

It hasn't been the best quarter for Clean Energy Fuels Corp. (NASDAQ:CLNE) shareholders, since the share price has fallen 11% in that time. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 149% in that time. So it may be that the share price is simply cooling off after a strong rise. More important, going forward, is how the business itself is going.

Since the long term performance has been good but there's been a recent pullback of 8.1%, let's check if the fundamentals match the share price.

Check out our latest analysis for Clean Energy Fuels

Clean Energy Fuels wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Clean Energy Fuels actually shrunk its revenue over the last year, with a reduction of 34%. So we would not have expected the share price to rise 149%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. It's quite likely the revenue fall was already priced in, anyway.

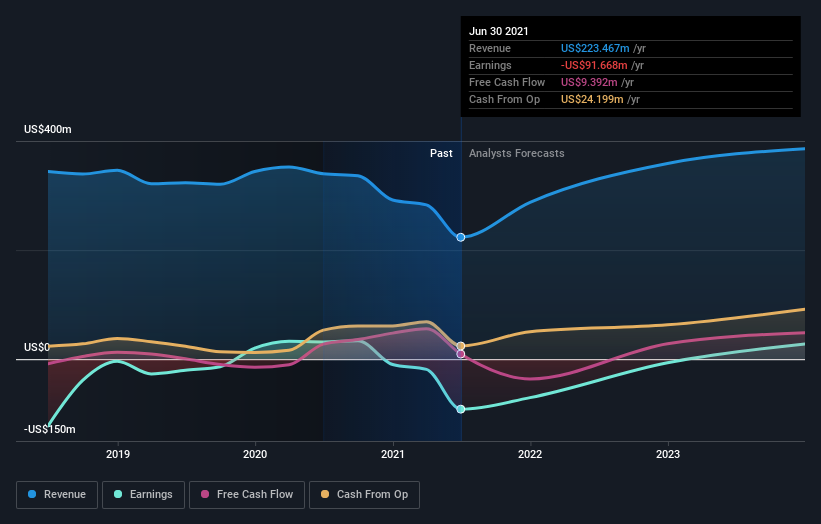

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Clean Energy Fuels will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Clean Energy Fuels shareholders have received a total shareholder return of 149% over one year. That gain is better than the annual TSR over five years, which is 11%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Clean Energy Fuels that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Clean Energy Fuels or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CLNE

Clean Energy Fuels

Offers natural gas as alternative fuels for vehicle fleets and related fueling solutions in the United States and Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives