- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLMT

Calumet, Inc. (NASDAQ:CLMT) Soars 43% But It's A Story Of Risk Vs Reward

Calumet, Inc. (NASDAQ:CLMT) shareholders would be excited to see that the share price has had a great month, posting a 43% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 3.0% isn't as impressive.

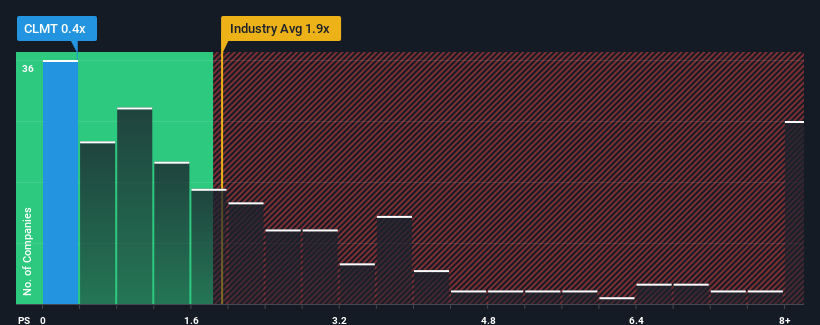

In spite of the firm bounce in price, Calumet may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Oil and Gas industry in the United States have P/S ratios greater than 1.9x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Calumet

What Does Calumet's Recent Performance Look Like?

Recent times have been pleasing for Calumet as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Calumet's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Calumet's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 69% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Looking ahead now, revenue is anticipated to climb by 2.5% per year during the coming three years according to the five analysts following the company. That's shaping up to be similar to the 0.6% per year growth forecast for the broader industry.

With this information, we find it odd that Calumet is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Calumet's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Calumet currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Calumet, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CLMT

Calumet

Manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives