- United States

- /

- Oil and Gas

- /

- NasdaqGS:CHRD

Growing Analyst Consensus Might Change The Case For Investing In Chord Energy (CHRD)

Reviewed by Sasha Jovanovic

- On November 21, 2025, William Blair's Neal Dingmann initiated coverage of Chord Energy with an 'Outperform' rating, joining the broader market consensus from 19 brokerage firms with the same positive outlook.

- This new analyst endorsement reinforces a wave of optimism around Chord Energy, highlighting robust institutional support and increased confidence in the company's prospects.

- We will now explore how this growing analyst consensus could influence Chord Energy's investment outlook and future performance expectations.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Chord Energy Investment Narrative Recap

To be a Chord Energy shareholder, you typically have to believe in the company's ability to generate strong, sustainable free cash flow from its high-quality Williston Basin shale assets while managing operational risks unique to the region. The recent wave of analyst endorsements, including William Blair's 'Outperform' rating, may reinforce sentiment, but it does not materially alter the immediate importance of production guidance or mitigate the key risk of sustained high capital costs needed to offset natural declines in shale wells. Among recent announcements, Chord Energy’s decision to continue its share buyback program, repurchasing 1.37% of its total shares for US$83 million in the latest tranche, stands out. While this move supports near-term shareholder returns and signals management’s confidence, it must be considered alongside the persistent challenge of delivering on production targets and balancing capital allocation priorities. In contrast, one specific risk investors should be aware of is...

Read the full narrative on Chord Energy (it's free!)

Chord Energy's outlook anticipates $4.4 billion in revenue and $1.0 billion in earnings by 2028. This assumes a 4.3% annual revenue decline and a $734.3 million increase in earnings from the current $265.7 million.

Uncover how Chord Energy's forecasts yield a $128.59 fair value, a 40% upside to its current price.

Exploring Other Perspectives

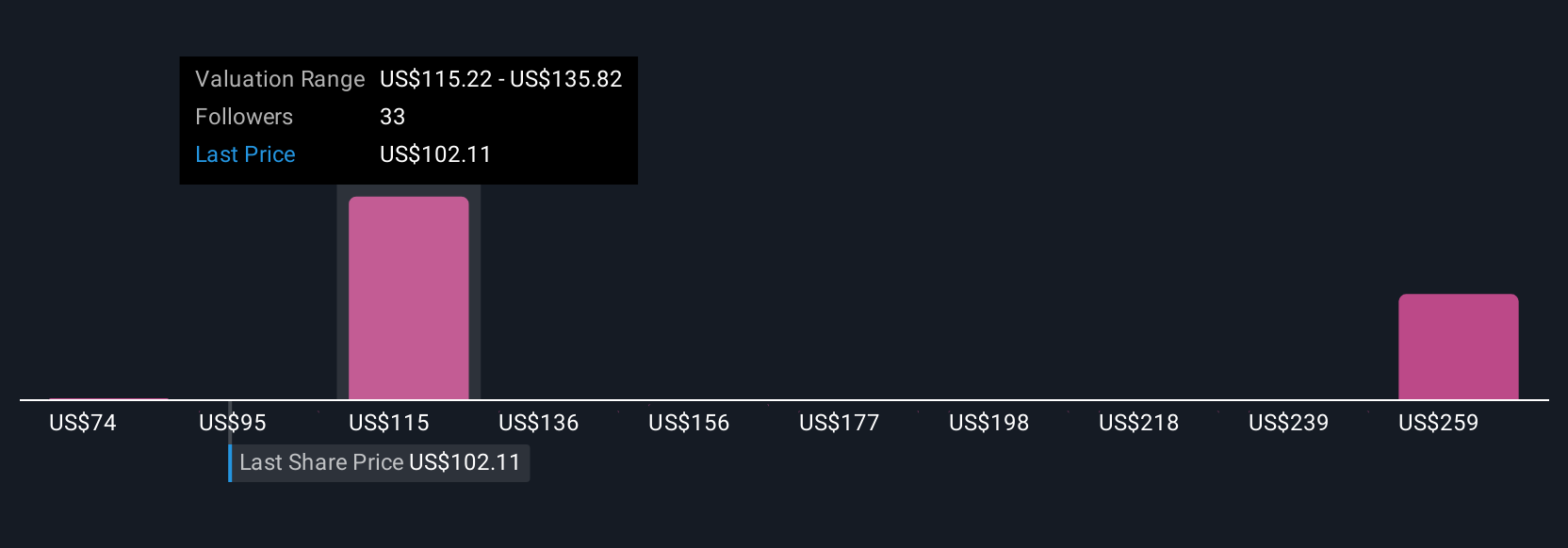

Fair value estimates from the Simply Wall St Community span from US$74 to US$486, across five private investor perspectives. While high analyst conviction remains, Chord’s concentrated Williston Basin operations could impact outcomes more than some expect, take the time to see how viewpoints diverge.

Explore 5 other fair value estimates on Chord Energy - why the stock might be worth 19% less than the current price!

Build Your Own Chord Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chord Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Chord Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chord Energy's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHRD

Chord Energy

Operates as an independent exploration and production company in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives